Nokia 2006 Annual Report Download - page 211

Download and view the complete annual report

Please find page 211 of the 2006 Nokia annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Notes to the Consolidated Financial Statements (Continued)

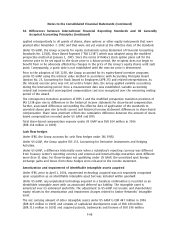

38. Differences between International Financial Reporting Standards and US Generally

Accepted Accounting Principles (Continued)

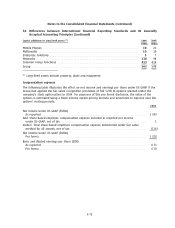

The Accumulated Benefit Obligation at December 31, 2006 for the domestic plans was

EUR 901 million (EUR 776 million in 2005) and for the foreign plans EUR 492 million (EUR 443 million

in 2005).

The measurement date used to measure the fair value of plan assets and the projected benefit

obligation is December 31. Weighted average assumptions used in calculation of pension obligations

are as follows:

2006 2005

Domestic Foreign Domestic Foreign

%%%%

Discount rate for determining present values ************** 4.60 4.78 4.20 4.55

Expected long term rate of return on plan assets *********** 4.60 5.50 4.44 5.49

Annual rate of increase in future compensation levels******* 3.50 3.59 3.50 3.91

Pension increases*************************************** 2.00 2.69 2.00 2.55

The Group also contributes to multiemployer plans, insured plans and defined contribution plans.

Such contributions were approximately EUR 198 million, EUR 206 million and EUR 192 million in

2006, 2005 and 2004, respectively, including premiums associated with pooled benefits.

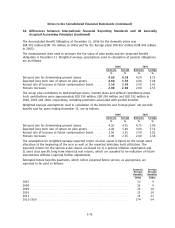

Weighted average assumptions used in calculation of the Domestic and Foreign plans’ net periodic

benefit cost for years ending December 31, are as follows:

2006 2005

Domestic Foreign Domestic Foreign

%%%%

Discount rate for determining present values ************** 4.20 4.55 4.75 5.00

Expected long term rate of return on plan assets *********** 4.44 5.49 5.00 5.31

Annual rate of increase in future compensation levels******* 3.50 3.91 3.50 3.82

Pension increases*************************************** 2.00 2.55 2.00 2.38

The assumption for weighted average expected return on plan assets is based on the target asset

allocation at the beginning of the year as well as the expected deviation limit utilization. The

expected returns for the various asset classes are based on 1) a general inflation expectation and

2) asset class specific longterm historical real returns, which are assumed to be indicative of future

expectations without requiring further adjustments.

Estimated future benefits payments, which reflect expected future service, as appropriate, are

expected to be paid as follows:

Domestic Foreign

Pension Pension

Benefits Benefits

EURm EURm

2007 ******************************************************************** 12 9

2008 ******************************************************************** 16 9

2009 ******************************************************************** 20 10

2010 ******************************************************************** 23 10

2011 ******************************************************************** 26 11

20122016 *************************************************************** 174 64

F76