Nokia 2006 Annual Report Download - page 91

Download and view the complete annual report

Please find page 91 of the 2006 Nokia annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

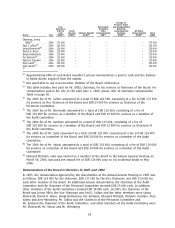

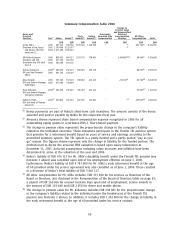

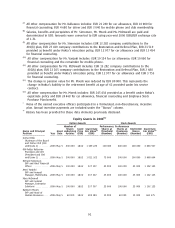

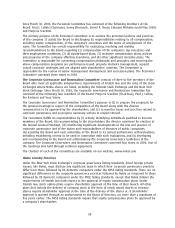

Summary Compensation Table 2006

Change in

Pension Value

and Nonqualified

Name and NonEquity Deferred

Principal Stock Option Incentive Plan Compensation All Other

Position Year** Salary Bonus(1) Awards(2) Awards(2) Compensation Earnings Compensation Total

EUR EUR EUR EUR EUR EUR EUR EUR

Jorma Ollila************* 2006 609 524 643 942 5 105 118 1 220 610

*(3)

662 764

(5)

8 241 955

Chairman of the Board 2005 1 500 000 3 212 037

(4)

and former CEO (CEO 2004 1 475 238 1 936 221

until June 1)**********

OlliPekka Kallasvuo ***** 2006 898 413 664 227 1 529 732 578 465

*

1 496 883

(3)(6)

38 960

(7)

5 206 680

President and CEO ******* 2005 623 524 947 742

(President and COO until

June 1) **************

2004 584 000 454 150

Richard Simonson ******* 2006

(8)

460 070 292 673 958 993 194 119

*

84 652

(9)

1 990 507

EVP and Chief Financial

Officer****************

2005 461 526 634 516

Anssi Vanjoki *********** 2006 505 343 353 674 938 582 222 213

*

215 143

(3)

29 394

(10)

2 264 349

EVP and General Manager,

Multimedia ***********

2005 476 000 718 896

Mary McDowell********** 2006

(8)

466 676 249 625 786 783 213 412

*

45 806

(11)

1 762 302

EVP and General Manager,

Enterprise Solutions ***

Hallstein Moerk ********* 2006

(8)

390 854 205 516 652 530 123 802

* (12)

269 902

(13)

1 642 603

EVP and Head of Human

Resources ************

(1) Bonus payments are part of Nokia’s shortterm cash incentives. The amount consists of the bonus

awarded and paid or payable by Nokia for the respective fiscal year.

(2) Amounts shown represent share based compensation expense recognized in 2006 for all

outstanding equity grants in accordance IFRS 2, Sharebased payment.

(3) The change in pension value represents the proportionate change in the company’s liability

related to the individual executive. These executives participate in the Finnish TEL pension system

that provides for a retirement benefit based on years of service and earnings according to the

prescribed statutory system. The TEL system is a partly funded and a partly pooled ‘‘pay as you

go’’ system. The figures shown represent only the change in liability for the funded portion. The

method used to derive the actuarial IFRS valuation is based upon salary information at

December 31, 2005. Actuarial assumptions including salary increases and inflation have been

determined to arrive at the valuation at the year end 2006.

(4) Nokia’s liability of EUR 676 117 for Mr. Ollila’s disability benefit under the Finnish TEL pension (see

footnote 3 above) was cancelled upon end of his employment effective on June 1, 2006.

Furthermore, Nokia’s liability of EUR 4 787 000 for Mr. Ollila’s early retirement benefit at the age

of 60 provided under his service agreement was also cancelled as of June 1, 2006. These resulted

in a decrease of Nokia’s total liability of EUR 5 463 117.

(5) All other compensation for Mr. Ollila includes: EUR 375 000 for his services as Chairman of the

Board or Directors, also disclosed in the Remuneration of the Board of Directors table on page 85;

a payout of EUR 166 666 for unused vacation days upon end of employment; service awards in

the amount of EUR 119 048 and EUR 2 050 for driver and mobile phone.

(6) The change in pension value for Mr. Kallasvuo includes EUR 194 883 for the proportionate change

in the company’s liability related to the individual under the funded part of the Finnish TEL

pension (see footnote 3 above). In addition, it includes EUR 1 302 000 for the change in liability in

the early retirement benefit at the age of 60 provided under his service contract.

90