Nokia 2006 Annual Report Download - page 208

Download and view the complete annual report

Please find page 208 of the 2006 Nokia annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Notes to the Consolidated Financial Statements (Continued)

38. Differences between International Financial Reporting Standards and US Generally

Accepted Accounting Principles (Continued)

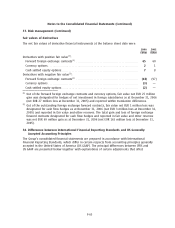

Deferred taxes

Under IFRS, the presentation of deferred taxes differs from the methodology set forth in US GAAP. For

purposes of US GAAP, deferred tax assets and liabilities must either be classified as current or non

current based on the classification of the related nontax asset or liability for financial reporting. This

table presents the IFRS deferred tax assets and liabilities according to the presentation prescribed by

FAS 109, Accounting for Income Taxes under US GAAP.

2006 2005

EURm EURm

Current assets:

Intercompany profit in inventory*********************************************** 34 49

Warranty provision *********************************************************** 68 74

Other provisions ************************************************************* 96 28

Tax losses carried forward***************************************************** —6

Other temporary differences *************************************************** 115 191

313 348

Noncurrent assets:

Tax losses carried forward***************************************************** 48 26

Warranty provision *********************************************************** 66 77

Other provisions ************************************************************* 157 252

Depreciation differences and untaxed reserves*********************************** 104 85

Fair value gains/losses ******************************************************** —43

Other temporary differences *************************************************** 128 40

503 523

Deferred tax assets ************************************************************* 816 871

Less: valuation allowance ******************************************************* (7) (25)

Total deferred tax assets ******************************************************** 809 846

Current deferred tax liabilities************************************************* (27) (26)

Noncurrent deferred tax liabilities:

Depreciation differences and untaxed reserves*********************************** (14) (13)

Fair value gains/losses ******************************************************** (16) —

Undistributed earnings******************************************************** (65) (68)

Other temporary differences *************************************************** (83) (44)

(178) (125)

Total deferred tax liabilities ***************************************************** (205) (151)

Net deferred tax asset ********************************************************** 604 695

F73