Nokia 2006 Annual Report Download - page 150

Download and view the complete annual report

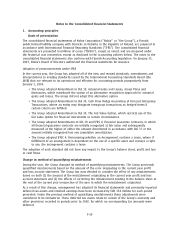

Please find page 150 of the 2006 Nokia annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.Notes to the Consolidated Financial Statements (Continued)

1. Accounting principles (Continued)

estimated reliably, it is probable that the economic benefits associated with the contract will flow to

the Group and the stage of contract completion can be measured reliably. When the Group is not

able to meet those conditions, the policy is to recognize revenues only equal to costs incurred to

date, to the extent that such costs are expected to be recovered.

Completion is measured by reference to cost incurred to date as a percentage of estimated total

project costs, the costtocost method.

The percentage of completion method relies on estimates of total expected contract revenue and

costs, as well as dependable measurement of the progress made towards completing a particular

project. Recognized revenues and profits are subject to revisions during the project in the event that

the assumptions regarding the overall project outcome are revised. The cumulative impact of a

revision in estimates is recorded in the period such revisions become likely and estimable. Losses on

projects in progress are recognized in the period they become probable and estimable.

The Group’s customer contracts may include the provision of separately identifiable components of a

single transaction, for example the construction of a network solution and subsequent network

maintenance services or postcontract customer support on software solutions. Accordingly, for these

arrangements, revenue recognition requires proper identification of the components of the

transaction and evaluation of their commercial effect in order to reflect the substance of the

transaction. If the components are considered separable, revenue is allocated across the identifiable

components based upon relative fair values.

All the Group’s material revenue streams are recorded according to the above policies.

Shipping and handling costs

The costs of shipping and distributing products are included in cost of sales.

Research and development

Research and development costs are expensed as they are incurred, except for certain development

costs, which are capitalized when it is probable that a development project will generate future

economic benefits, and certain criteria, including commercial and technological feasibility, have been

met. Capitalized development costs, comprising direct labor and related overhead, are amortized on

a systematic basis over their expected useful lives between two and five years.

Capitalized development costs are subject to regular assessments of recoverability based on

anticipated future revenues, including the impact of changes in technology. Unamortized capitalized

development costs determined to be in excess of their recoverable amounts are expensed

immediately.

Other intangible assets

Expenditures on acquired patents, trademarks and licenses are capitalized and amortized using the

straightline method over their useful lives, generally 3 to 5 years, but not exceeding 20 years.

Where an indication of impairment exists, the carrying amount of any intangible asset is assessed

and written down to its recoverable amount. Costs of software licenses associated with internaluse

software are capitalized. These costs are included within other intangible assets and are amortized

over a period not to exceed three years.

F15