Nokia 2006 Annual Report Download - page 186

Download and view the complete annual report

Please find page 186 of the 2006 Nokia annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Notes to the Consolidated Financial Statements (Continued)

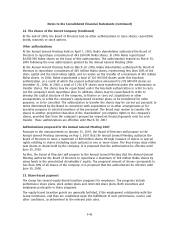

30. Earnings per share

2005 2004

2006 As revised As revised

Numerator (EURm)

Basic/Diluted:

Profit attributable to equity holders of the parent ******** 4 306 3 616 3 192

Denominator (000’s Shares)

Basic:

Weighted average shares ****************************** 4 062 833 4 365 547 4 593 196

Effect of dilutive securities:

stock options, restricted shares and performance shares 23 696 5 692 7 141

Diluted:

Adjusted weighted average shares and assumed

conversions **************************************** 4 086 529 4 371 239 4 600 337

Under IAS 33, basic earnings per share is computed using the weighted average number of shares

outstanding during the period. Diluted earnings per share is computed using the weighted average

number of shares outstanding during the period plus the dilutive effect of stock options, restricted

shares and performance shares outstanding during the period.

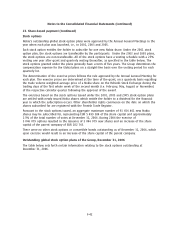

31. Commitments and contingencies

2006 2005

EURm EURm

Collateral for our own commitments

Property under mortgages ****************************************************** 18 18

Assets pledged **************************************************************** 27 10

Contingent liabilities on behalf of Group companies

Other guarantees ************************************************************** 358 276

Collateral given on behalf of other companies

Securities pledged(1)************************************************************ ——

Contingent liabilities on behalf of other companies

Financial guarantees on behalf of third parties(1) ********************************** 23 —

Other guarantees ************************************************************** 22

Financing commitments

Customer finance commitments(1)************************************************ 164 13

Venture fund commitments(2) *************************************************** 208 230

(1) See also note 37 b).

(2) See also note 37 a).

The amounts above represent the maximum principal amount of commitments and contingencies.

Property under mortgages given as collateral for our own commitments include mortgages given to

the Finnish National Board of Customs as a general indemnity of EUR 18 million in 2006 (EUR

18 million in 2005).

Assets pledged for the Group’s own commitments include availableforsale investments of

EUR 10 million in 2006 (EUR 10 million of availableforsale investments in 2005).

Other guarantees include guarantees of Nokia’s performance of EUR 316 million in 2006

(EUR 234 million in 2005). EUR 259 million (EUR 182 million in 2005) of these guarantees are

provided to certain Networks’ customers in the form of bank guarantees, standby letters of credit

F51