Nokia 2006 Annual Report Download - page 53

Download and view the complete annual report

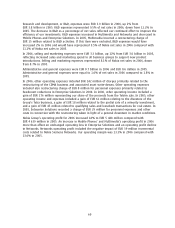

Please find page 53 of the 2006 Nokia annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.quality costs. Networks profitability is also impacted by the pricing environment, product mix and

regional mix.

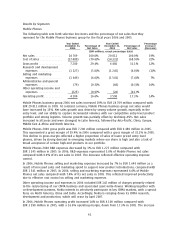

In an effort to drive our share and accelerate consolidation of the market we have prioritized

seeking share gains at established operators. However, these actions have resulted in lower margins

or losses initially. In the last few years, we have also prioritized Networks’ sales into the emerging

markets. Networks net sales in the primarily emerging markets of AsiaPacific, Latin America and

Middle East & Africa grew from 28% in 2004 to 42% in 2006 of Networks total net sales. In India, for

example, over the last two years our estimated market share has increased from the single digits to

close to 30% in 2006. During the same two year period, Europe was down from 43% to 36% of

Networks total net sales. Emerging markets, initially and in general, carry lower than average gross

margins for Networks. In addition to growth in emerging markets, Networks’ services business

including services related software, which also carries a lower gross margin than equipment sales,

continued to grow in 2006.

We believe the current and continuing dynamics in the infrastructure market provide further

validation for the creation of Nokia Siemens Networks. This merger is designed to provide the new

company with needed scale and a more competitive convergence portfolio, and we believe it will

further spur industry consolidation. The scale advantages of the merger, coupled with the significant

restructure program planned, are expected to deliver margin benefits leading to improved

profitability. See ‘‘Item 4.B Business Overview—Nokia Siemens Networks’’ for a more detailed

discussion on Nokia Siemens Networks.

Efficiency of operating expense is also an important driver for Networks profitability. For 2006 and

2005, the research and development, or R&D, expenses represented approximately 16% and 18%,

respectively, of Networks net sales. We did not reach our target to lower our Networks R&D

expenses/net sales ratio to 14% by the end of 2006. In 2006, the sales and marketing costs related

to Networks were EUR 544 million compared with EUR 475 million in 2005. In an effort to continue

to improve our efficiency, Nokia targets an improvement in the ratio of overall Nokia gross margin

to R&D expenses and an improvement in the ratio of overall Nokia gross margin to sales and

marketing expenses in 2007, compared to 2006.

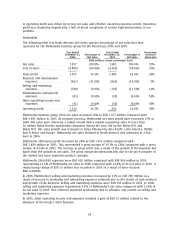

Nokia medium term financial targets

In November 2006, Nokia set a target of Nokialevel operating margin of 15% during the next one to

two years. This target revised the one to two year 17% operating margin target Nokia set in

December 2005, primarily due to Nokia’s increased exposure to the infrastructure market following

the expected start of operations of Nokia Siemens Networks. In November 2006, Nokia also set a

Nokia’s device (Mobile Phones and Multimedia combined) operating margin target of 17% during the

next one to two years. This target revised the one to two year 17%18% device operating margin

target Nokia set in December 2005.

Subsequent Event

In June 2006, Nokia and Siemens A.G. (‘‘Siemens’’) announced plans to form Nokia Siemens Networks

that will combine Nokia’s networks business and Siemens’ carrierrelated operations for fixed and

mobile networks in a new company owned by Nokia and Siemens. Nokia and Siemens will each own

approximately 50% of Nokia Siemens Networks. However, Nokia will effectively control Nokia

Siemens Networks as it has the ability to appoint key officers and the majority of the members of its

Board of Directors. Accordingly, Nokia will consolidate Nokia Siemens Networks.

Nokia Siemens Networks operating margin target is 10% plus during the next one to two years as

from the start of operations. Nokia Siemens Networks aims to achieve a double digit operating

margin within its first 12 months of operations, before restructuring charges.

Nokia Siemens Networks is expected to start its operations around the end of March 2007 subject to

the satisfaction or waiver of the conditions to the merger, including achievement of agreement

52