Nokia 2006 Annual Report Download - page 175

Download and view the complete annual report

Please find page 175 of the 2006 Nokia annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.Notes to the Consolidated Financial Statements (Continued)

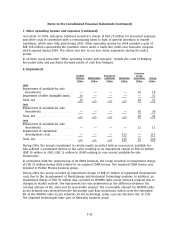

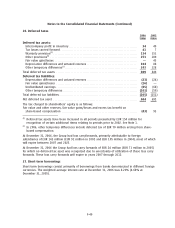

21. Fair value and other reserves (Continued)

the process used to calculate the reserve balance, separate disclosure of the transfers of gains and

losses to and from the reserve would be impractical.

All of the net fair value gains or losses recorded in the hedging reserve at December 31, 2006 on

open forward foreign exchange contracts which hedge anticipated future foreign currency sales or

purchases are transferred from the Hedging Reserve to the profit and loss account when the

forecasted foreign currency cash flows occur, at various dates up to approximately 1 year from the

balance sheet date.

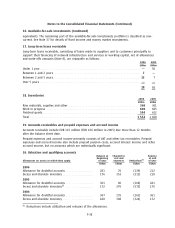

22. The shares of the Parent Company

Nokia shares and shareholders

Shares and share capital

Nokia has one class of shares. Each Nokia share entitles the holder to one (1) vote at General

Meetings of Nokia. The par value of the share is EUR 0.06.

The minimum share capital stipulated in the Articles of Association is EUR 170 million and the

maximum share capital EUR 680 million. The share capital may be increased or reduced within these

limits without amending the Articles of Association.

On December 31, 2006, the share capital of Nokia Corporation was EUR 245 702 557.14 and the total

number of shares issued was 4 095 042 619.

On December 31, 2006, the total number of shares included 129 312 226 shares owned by Group

companies with an aggregate par value of EUR 7 758 733.56 representing approximately 3.2% of the

share capital and the total voting rights.

Pursuant to the announcement on January 25, 2007, the Board of Directors will propose for

shareholders’ approval at the Annual General Meeting convening on May 3, 2007 that the Articles of

Association be amended to the effect that the provisions on minimum and maximum share capital

as well as on the par value of a share be removed.

Authorizations

Authorization to increase the share capital

The Board of Directors had been authorized by Nokia shareholders at the Annual General Meeting

held on April 7, 2005 to decide on an increase of the share capital by a maximum of EUR 53 160 000

offering a maximum of 886 000 000 new shares. In 2006, the Board of Directors did not increase the

share capital on the basis of this authorization. The authorization expired on March 30, 2006

following the new authorization granted by the Annual General Meeting 2006.

At the Annual General Meeting held on March 30, 2006 Nokia shareholders authorized the Board of

Directors to decide on an increase of the share capital by a maximum of EUR 48 540 000 within one

year from the resolution of the Annual General Meeting. The increase of the share capital may

consist of one or more issues offering a maximum of 809 000 000 new shares with a par value of

EUR 0.06 each. The share capital may be increased in deviation from the shareholders’ preemptive

rights for share subscription provided that from the company’s perspective important financial

grounds exist such as financing or carrying out of an acquisition or another arrangement or granting

incentives to selected members of the personnel. In 2006, the Board of Directors did not increase the

share capital on the basis of this authorization. The authorization is effective until March 30, 2007.

F40