Nokia 2006 Annual Report Download - page 201

Download and view the complete annual report

Please find page 201 of the 2006 Nokia annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Notes to the Consolidated Financial Statements (Continued)

38. Differences between International Financial Reporting Standards and US Generally

Accepted Accounting Principles (Continued)

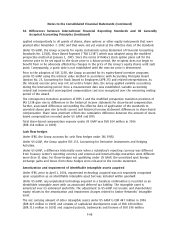

Change in method of quantifying misstatements

As discussed in Note 1, the Group changed its method of quantifying misstatements. As a result of

this change management has adjusted its financial statements. Previously reported deferred tax

assets have been increased by EUR 154 million, previously reported goodwill has been decreased by

EUR 90 million and previously reported retained earnings have been increased by EUR 64 million for

each period presented. Under the previous method of quantifying misstatements these adjustments

were considered to be immaterial. The deferred tax asset adjustment relates to certain of the

Group’s warranty and other provisions recorded in periods prior to 2002, for which no corresponding

tax amounts were deferred. The goodwill adjustment relates to an item that was not separately

recognized by the Group from the date of acquisition.

Pensions

Under IFRS, pension assets, defined benefit pension liabilities and pension expense are actuarially

determined in a similar manner to US GAAP. To the extent that the benefits related to transition

adjustments and plan amendments are already vested immediately following the introduction of, or

changes to, a defined benefit plan, the Group recognizes past service cost immediately under IFRS. If

the benefits have not vested, the related past service cost is recognized as expense over the average

period until the benefits become vested. Under US GAAP, transition adjustments and prior service

cost related to plan amendments are generally recognized over the remaining service period of

active employees.

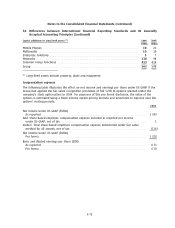

In addition, prior to December 31, 2006, US GAAP required recognition of an additional minimum

pension liability when the accumulated benefit obligation (ABO) exceeded the fair value of the plan

assets and this amount was not covered by the liability recognized in the balance sheet. An

intangible asset was recognized to the extent of unrecognized prior service cost with the excess of

the additional minimum liability over unrecognized prior service cost recognized in other

comprehensive income. The calculation of the ABO is based on approach two as described in EITF 88

1, Determination of Vested Benefit Obligation for a Defined Benefit Pension Plan, under which the

actuarial present value is based on the date of separation from service.

At December 31, 2006, in accordance with the transition provisions of FAS 158, Employers’

Accounting for Defined Benefit Pension and Other Postretirement Plans, the Group made an

adjustment net of tax to accumulated other comprehensive income to record unrecognized actuarial

losses, unrecognized prior service costs and unamortized transition assets and to eliminate the

additional minimum liability. The following table presents the impact of the adoption of FAS 158 on

total shareholders’ equity under US GAAP at December 31, 2006:

2006

EURm

Total shareholders’ equity under US GAAP before adoption of FAS 158 ******************** 12 274

Adoption of FAS 158 **************************************************************** (222)

Deferred tax *********************************************************************** 60

Total shareholders’ equity under US GAAP after adoption of FAS 158 ********************** 12 112

F66