Nokia 2006 Annual Report Download - page 196

Download and view the complete annual report

Please find page 196 of the 2006 Nokia annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.-

1

1 -

2

2 -

3

3 -

4

4 -

5

5 -

6

6 -

7

7 -

8

8 -

9

9 -

10

10 -

11

11 -

12

12 -

13

13 -

14

14 -

15

15 -

16

16 -

17

17 -

18

18 -

19

19 -

20

20 -

21

21 -

22

22 -

23

23 -

24

24 -

25

25 -

26

26 -

27

27 -

28

28 -

29

29 -

30

30 -

31

31 -

32

32 -

33

33 -

34

34 -

35

35 -

36

36 -

37

37 -

38

38 -

39

39 -

40

40 -

41

41 -

42

42 -

43

43 -

44

44 -

45

45 -

46

46 -

47

47 -

48

48 -

49

49 -

50

50 -

51

51 -

52

52 -

53

53 -

54

54 -

55

55 -

56

56 -

57

57 -

58

58 -

59

59 -

60

60 -

61

61 -

62

62 -

63

63 -

64

64 -

65

65 -

66

66 -

67

67 -

68

68 -

69

69 -

70

70 -

71

71 -

72

72 -

73

73 -

74

74 -

75

75 -

76

76 -

77

77 -

78

78 -

79

79 -

80

80 -

81

81 -

82

82 -

83

83 -

84

84 -

85

85 -

86

86 -

87

87 -

88

88 -

89

89 -

90

90 -

91

91 -

92

92 -

93

93 -

94

94 -

95

95 -

96

96 -

97

97 -

98

98 -

99

99 -

100

100 -

101

101 -

102

102 -

103

103 -

104

104 -

105

105 -

106

106 -

107

107 -

108

108 -

109

109 -

110

110 -

111

111 -

112

112 -

113

113 -

114

114 -

115

115 -

116

116 -

117

117 -

118

118 -

119

119 -

120

120 -

121

121 -

122

122 -

123

123 -

124

124 -

125

125 -

126

126 -

127

127 -

128

128 -

129

129 -

130

130 -

131

131 -

132

132 -

133

133 -

134

134 -

135

135 -

136

136 -

137

137 -

138

138 -

139

139 -

140

140 -

141

141 -

142

142 -

143

143 -

144

144 -

145

145 -

146

146 -

147

147 -

148

148 -

149

149 -

150

150 -

151

151 -

152

152 -

153

153 -

154

154 -

155

155 -

156

156 -

157

157 -

158

158 -

159

159 -

160

160 -

161

161 -

162

162 -

163

163 -

164

164 -

165

165 -

166

166 -

167

167 -

168

168 -

169

169 -

170

170 -

171

171 -

172

172 -

173

173 -

174

174 -

175

175 -

176

176 -

177

177 -

178

178 -

179

179 -

180

180 -

181

181 -

182

182 -

183

183 -

184

184 -

185

185 -

186

186 -

187

187 -

188

188 -

189

189 -

190

190 -

191

191 -

192

192 -

193

193 -

194

194 -

195

195 -

196

196 -

197

197 -

198

198 -

199

199 -

200

200 -

201

201 -

202

202 -

203

203 -

204

204 -

205

205 -

206

206 -

207

207 -

208

208 -

209

209 -

210

210 -

211

211 -

212

212 -

213

213 -

214

214 -

215

215 -

216

216

|

|

Notes to the Consolidated Financial Statements (Continued)

37. Risk management (Continued)

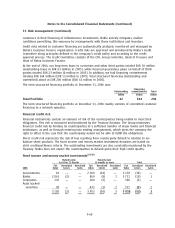

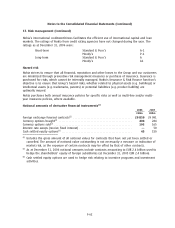

Maturity date Maturity date

less than 12 Months 12 months or more Total

Fair Unrealized Unrealized Fair Unrealized Unrealized Fair Unrealized Unrealized

2005 Value Losses Gains Value Losses Gains Value Losses Gains

Governments ******* 30 — — 3 919 (32) 2 3 949 (32) 2

Banks ************* 2 962 (3) — 803 (5) 1 3 765 (7) 1

Corporates ********* 60 — — 433 (1) 2 459 (1) 2

Asset backed

securities ******** 25 — — 112 — — 172 — —

3 077 (3) — 5 267 (38) 5 8 345 (41) 5

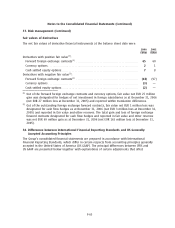

2006 2005

EURm EURm

Fixed rate investments ******************************************************** 5 853 7 531

Floating rate investments ***************************************************** 1 205 814

Total************************************************************************ 7 058 8 345

(1) Fixed income and moneymarket investments include Term deposits, investments in Liquidity

funds and investments in fixed income instruments classified as Availableforsale. Availablefor

sale investments are carried at fair value in 2006 and 2005.

(2) Weighted average interest rate for fixed income and moneymarket investments was 3.33% in

2006 and 3.52% in 2005.

(3) Included within fixed income and moneymarket investments is EUR 10 million of restricted cash

at December 31, 2006 (10 million at December 31, 2005)

c) Liquidity risk

Nokia guarantees a sufficient liquidity at all times by efficient cash management and by investing in

liquid interest bearing securities. Due to the dynamic nature of the underlying business Treasury also

aims at maintaining flexibility in funding by keeping committed and uncommitted credit lines

available. At the end of December 31, 2006 the committed facility totaled USD 2.0 billion. The

committed credit facility is intended to be used for US and Euro Commercial Paper Programs back up

purposes. The commitment fee on the facility is 0.045% per annum.

The most significant existing funding programs include:

Revolving Credit Facility of USD 2 000 million, maturing in 2012

Local commercial paper program in Finland, totaling EUR 750 million

Euro Commercial Paper (ECP) program, totaling USD 500 million

US Commercial Paper (USCP) program, totaling USD 500 million

None of the above programs have been used to a significant degree in 2006.

F61