Nokia 2006 Annual Report Download - page 155

Download and view the complete annual report

Please find page 155 of the 2006 Nokia annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.Notes to the Consolidated Financial Statements (Continued)

1. Accounting principles (Continued)

Inventoryrelated allowances

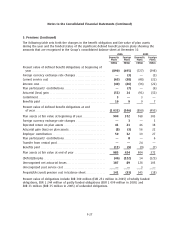

The Group periodically reviews inventory for excess amounts, obsolescence and declines in market

value below cost and records an allowance against the inventory balance for any such declines.

These reviews require management to estimate future demand for products. Possible changes in

these estimates could result in revisions to the valuation of inventory in future periods.

Warranty provisions

The Group provides for the estimated cost of product warranties at the time revenue is recognized.

The Group’s warranty provision is established based upon best estimates of the amounts necessary

to settle future and existing claims on products sold as of each balance sheet date. As new products

incorporating complex technologies are continuously introduced, and as local laws, regulations and

practices may change, changes in these estimates could result in additional allowances or changes to

recorded allowances being required in future periods.

Provision for intellectual property rights, or IPR, infringements

The Group provides for the estimated future settlements related to asserted and unasserted IPR

infringements based on the probable outcome of potential infringement. IPR infringement claims can

last for varying periods of time, resulting in irregular movements in the IPR infringement provision.

The ultimate outcome or actual cost of settling an individual infringement may materially vary from

estimates.

Legal contingencies

Legal proceedings covering a wide range of matters are pending or threatened in various

jurisdictions against the Group. Provisions are recorded for pending litigation when it is determined

that an unfavorable outcome is probable and the amount of loss can be reasonably estimated. Due

to the inherent uncertain nature of litigation, the ultimate outcome or actual cost of settlement may

materially vary from estimates.

Capitalized development costs

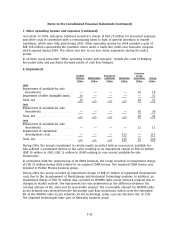

The Group capitalizes certain development costs when it is probable that a development project will

generate future economic benefits and certain criteria, including commercial and technological

feasibility, have been met. Should a product fail to substantiate its estimated feasibility or life cycle,

material development costs may be required to be writtenoff in future periods.

Valuation of longlived and intangible assets and goodwill

The Group assesses the carrying value of identifiable intangible assets, longlived assets and goodwill

annually, or more frequently if events or changes in circumstances indicate that such carrying value

may not be recoverable. Factors that trigger an impairment review include underperformance

relative to historical or projected future results, significant changes in the manner of the use of the

acquired assets or the strategy for the overall business and significant negative industry or economic

trends. The most significant variables in determining cash flows are discount rates, terminal values,

the number of years on which to base the cash flow projections, as well as the assumptions and

estimates used to determine the cash inflows and outflows. Amounts estimated could differ

materially from what will actually occur in the future.

F20