Nokia 2006 Annual Report Download

Download and view the complete annual report

Please find the complete 2006 Nokia annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Form 20-F 2006

Table of contents

-

Page 1

Form 20-F 2006 -

Page 2

... on March 12, 2007. UNITED STATES SECURITIES AND EXCHANGE COMMISSION Washington, D.C. 20549 FORM 20ÂF ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 For the fiscal year ended December 31, 2006 Commission file number 1Â13202 Nokia Corporation (Exact name of... -

Page 3

... MANAGEMENT AND EMPLOYEES Directors and Senior Management Compensation Board Practices Employees Share Ownership MAJOR SHAREHOLDERS AND RELATED PARTY TRANSACTIONS Major Shareholders Related Party Transactions Interests of Experts and Counsel FINANCIAL INFORMATION Consolidated Statements... -

Page 4

... AND LISTING Offer and Listing Details Plan of Distribution Markets Selling Shareholders Dilution Expenses of the Issue ADDITIONAL INFORMATION Share Capital Memorandum and Articles of Association Material Contracts Exchange Controls Taxation Dividends and Paying Agents Statement by... -

Page 5

... rates. In this Form 20ÂF, unless otherwise stated, references to ''shares'' are to Nokia Corporation shares, par value EUR 0.06. Our principal executive office is currently located at Keilalahdentie 4, P.O. Box 226, FINÂ00045 Nokia Group, Espoo, Finland and our telephone number is +358 (0) 7 1800... -

Page 6

... to develop, implement and commercialize new products, solutions and technologies; ) expectations regarding market growth, developments and structural changes; ) expectations regarding our mobile device volume growth, market share, prices and margins; ) expectations and targets for our results of... -

Page 7

... turmoil in emerging market countries where we do business; 20. our success in collaboration arrangements relating to development of technologies or new products and solutions; 21. the success, financial condition and performance of our collaboration partners, suppliers and customers; 22. any... -

Page 8

27. our ability to recruit, retain and develop appropriately skilled employees; and 28. the impact of changes in government policies, laws or regulations; as well as the risk factors specified in this annual report on Form 20ÂF under ''Item 3.D Risk Factors.'' Other unknown or unpredictable factors... -

Page 9

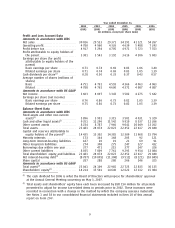

... TIMETABLE Not applicable. ITEM 3. KEY INFORMATION 3.A Selected Financial Data The financial data set forth below at December 31, 2005 and 2006 and for each of the years in the threeÂyear period ended December 31, 2006 have been derived from our audited consolidated financial statements included in... -

Page 10

... 13 084 29 848 (10 849) 325 30 135 15 984 (2) The cash dividend for 2006 is what the Board of Directors will propose for shareholders' approval at the Annual General Meeting convening on May 3, 2007. Total assets and shareholders' equity have each been increased by EUR 154 million for all periods... -

Page 11

...of earnings must not result in insolvency of the company. Subject to exceptions relating to the right of minority shareholders to request otherwise, the distribution may not exceed the amount proposed by the Board of Directors. Share BuyÂbacks Under the Finnish Companies Act, Nokia Corporation may... -

Page 12

... dollar equivalent of the euro price of the shares on the Helsinki Stock Exchange and, as a result, are likely to affect the market price of the ADSs in the United States. See also ''Item 3.D Risk Factors-Our sales, costs and results are affected by exchange rate fluctuations, particularly between... -

Page 13

... offering of commercially appealing mobile devices with attractive aesthetics, design, features and functionality for all major consumer segments and price points supported by the Nokia brand, quality and competitive cost structure. In our networks business, a competitive product portfolio means... -

Page 14

... replace their existing mobile devices, and also the number of new subscribers and increased usage. Our sales and profitability are also affected by the extent to which there is increasing demand for, and development of, valueÂadded services, leading to opportunities for us to successfully market... -

Page 15

... device businesses, and enterprise mobility infrastructure as well as managed services, systems integration and consulting businesses in our infrastructure business. However, a number of the new market segments in the mobile communications industry are still in the early stages of development, and... -

Page 16

.... As a result of developments in our industry, including convergence of mobile phone technology with the Internet, we also face new competition from companies in related industries, such as Internet based products and services, consumer electronics manufacturers and business device and solution... -

Page 17

... if these technologies or subsequent new technologies on which we focus do not achieve as broad acceptance among customers as we expect, or if we fail to adapt to different technology platforms that emerge over time. Currently expected benefits and synergies from forming Nokia Siemens Networks may... -

Page 18

... our management, which could harm our business and that of Nokia Siemens Networks. The government investigations could also harm Nokia Siemens Networks' relationships with existing customers, impair its ability to obtain new customers, business partners and public procurement contracts and result in... -

Page 19

... products and solutions or by companies with which we work in cooperative research and development activities. Similarly, we and our customers may face claims of infringement in connection with our customers' use of our products and solutions. In many aspects, the business models for mobile services... -

Page 20

... our operating results. See ''Item 4.B Business Overview-Patents and Licenses'' for a more detailed discussion of our intellectual property activities. Our products and solutions include numerous new Nokia patented, standardized, or proprietary technologies on which we depend. Third parties may use... -

Page 21

..., key mats and antennas. Software includes various thirdÂparty software that enables various new features and applications to be added, like thirdÂparty eÂmail, into our products. In networks business, components and subÂassemblies sourced and manufactured by thirdÂparty suppliers include Nokia... -

Page 22

..., the number of our customers may diminish due to operator consolidation. This will increase our reliance on fewer larger customers, which may negatively impact our bargaining position, sales and profitability. Our sales derived from, and assets located in, emerging market countries may be... -

Page 23

... on our sales and profitability. We invite the providers of technology, components or software to work with us to develop technologies or new products and solutions. These arrangements involve the commitment by each company of various resources, including technology, research and development efforts... -

Page 24

... fields from base stations and from the use of mobile devices. While a substantial amount of scientific research conducted to date by various independent research bodies has indicated that these radio signals, at levels within the limits prescribed by safety standards set by and recommendations... -

Page 25

...regulation in each of the countries in which we, the companies with which we work or our customers do business. As a result, changes in various types of regulations applicable to current or new technologies, products or services could affect our business adversely. For example, it is in our interest... -

Page 26

...had production facilities in nine countries, sales in more than 150 countries, and a global network of sales, customer service and other operational units. History During our 140 year history, Nokia has evolved from its origins in the paper industry to become a world leader in mobile communications... -

Page 27

... business segment see Note 2 to our consolidated financial statements included in Item 18 of this annual report on Form 20ÂF. Nokia maintains listings on four major securities exchanges. The principal trading markets for the shares are the Helsinki Stock Exchange, in the form of shares, and the New... -

Page 28

.... While today mobile devices are still used primarily for voice and text message communication, people increasingly also use them to take and send pictures, listen to music, record video, watch TV, play games, surf the Internet, check eÂmail, manage their schedules, browse and create documents, and... -

Page 29

.... Mobile Phones has five business units: Broad Appeal, Lifestyle Products, Entry, CDMA and Vertu. Broad Appeal focuses on the Nokia 6000 family of midÂrange products where the balance between price, functionality and style is key. The vast majority of the mobile device models in Nokia's portfolio... -

Page 30

... key CDMA markets, with a special focus on North America, China and India. Accordingly, Nokia is ramping down its CDMA research, development and production, which will cease by April 2007. Vertu focuses on establishing a luxury mobile phone category with handcrafted, luxury communications products... -

Page 31

.... Based on the open source Linux operating system, the Nokia 770 is a nonÂcellular device optimized for Internet communications. Key applications include Internet browsing and eÂmail. In January 2007, Nokia launched the second product from this program, the Nokia N800 Internet Tablet. Enterprise... -

Page 32

... program to enable sales of Nokia products and solutions through complementary Value Added Reseller, or VAR, systems integrator, and distributor channels. ) First shipments of new security appliances for the firewall market, the IP390 and IP560. Enterprise Solutions has four business units: Mobile... -

Page 33

... services to help corporate customers with more complex mobility solutions. Networks This section describes our Networks business group through 2006. Around the end of March 2007, we expect that our networks business will be conducted through Nokia Siemens Networks, a new company owned by Nokia... -

Page 34

... four business units are based. The business units are: Radio Access, Broadband Access, Service Core and Applications, IP Networking and Transport, Operating Support Systems, and Services. Nokia Siemens Networks' Customer and Market Operations will supervise the new company's regional teams; manage... -

Page 35

... customer executive teams with Nokia Group Executive Board members as the customer executives for the largest global operators, covering both our mobile device and networks businesses. We also have specialized sales channels for certain business groups in order to reach customers in segments where... -

Page 36

... experience, opening stores in Chicago, Helsinki, Hong Kong, Mexico City and New York during 2006. ) We renewed the Nokia website to ensure that our online digital presence continues to support our consumer relationship management strategy. Our website records millions of visitors annually and we... -

Page 37

...: three in Finland, two in China and one in India. In line with our strategy to invest resources in key areas to improve efficiency, in our networks business some product support activities and over 50% of the whole production is outsourced. Nokia generally prefers to have multiple sources for its... -

Page 38

... Officer. Technology Platforms Technology Platforms manages the delivery of leading technologies and platforms to Nokia's business groups and external customers through a combination of research and development, close cooperation with leading technology vendors, and open source software communities... -

Page 39

...Nokia's corporate research center creates assets and competencies in technology areas that we believe will be vital to the company's future success. The Research Center works closely with Nokia's four business groups and Technology Platforms to develop, for example, leadingÂedge mobile and Internet... -

Page 40

... and Sony Ericsson. Mobile network operators also offer mobile phones under their own brand, which may result in increasing competition from nonÂbranded mobile device manufacturers. However, we face new competition, particularly in our Multimedia and Enterprise Solutions business groups, where... -

Page 41

...areas like multimedia technologies and GPS. For example, in October 2006 we signed an agreement with Trimble, which gives us full access to their world class GPS patent portfolio for our own unrestricted use and for subÂlicensing purposes in the wireless consumer product and service space. Nokia is... -

Page 42

... license agreements with major telecommunications companies that cover broad product areas and provide Nokia with access to relevant technologies. With the introduction of new mobile data and other evolving technologies, such as those enabling multimedia services, our products and solutions include... -

Page 43

... our office in Brussels. Our business is subject to direct and indirect regulation in each of the countries in which we, the companies with which we work or our customers do business. As a result, changes in various types of regulations applicable to current or new technologies, products or services... -

Page 44

...messages. Currently, the Code of Conduct is available in 31 languages, with an enhanced focus directed towards our production sites, where eÂlearning activities are less readily available. By the end of 2006, almost 56 000, or more than 81%, of all Nokia employees, had completed the Code of Conduct... -

Page 45

... OF KOREA UNITED KINGDOM (1) Manaus (mobile devices) Beijing (mobile devices) Dongguan (mobile devices) Suzhou (base stations, cellular network transmission products) Beijing (home location registers, mobile switch centers, base station controllers) Salo (mobile devices) Rusko (base stations) Espoo... -

Page 46

... our Results of Operations- Mobile Devices'' and ''Item 5.C Research and Development, Patents and Licenses'', our mobile device net sales and costs include the total net sales and costs of the Mobile Phones and Multimedia business groups, as well as the Mobile Devices business unit of the Enterprise... -

Page 47

...by Business Group 2006 Operating Profit/(Loss) Year Ended December 31, 2005 Net Operating Sales Profit/(Loss) (EUR millions) 2004 Operating Profit/(Loss) Net Sales Net Sales Mobile Phones Multimedia Enterprise Solutions*********** Networks Common Group Expenses ****** Eliminations Total 24... -

Page 48

... product portfolio covers all major user segments and price points from entryÂlevel to midÂrange and highÂend devices offering voice, data, multimedia and business applications. The following table sets forth Nokia's estimates for the global mobile device market volumes and yearÂonÂyear growth... -

Page 49

...markets, including the United Kingdom, as a result of the intense competitive environment. In Middle East & Africa, our volume growth was below regional industry volume growth resulting in a loss of market share, while the overall high growth of the area and Nokia's strong market position positively... -

Page 50

... to be purchases of devices with color screens, cameras, music players, WCDMA and other general aesthetics drivers. We also expect that push email, mobile TV and navigation services will be significant drivers of the replacement market in the future, but not in 2007. Replacement volumes in the... -

Page 51

..., such as, mobile photography, mobile music and location based service. Nokia believes there is significant sales growth potential in bringing mobility to enterprises where the market is still at the early stages of development. Nokia device net sales are also impacted by device ASPs. ASPs are... -

Page 52

... terms in 2007. We expect the market to be driven by continuing subscriber growth, growing minutes of use, technology evolution and the growth of the services market. Networks net sales are also impacted by pricing developments. Like our mobile device business, the products and solutions offered by... -

Page 53

... of Nokia Siemens Networks. This merger is designed to provide the new company with needed scale and a more competitive convergence portfolio, and we believe it will further spur industry consolidation. The scale advantages of the merger, coupled with the significant restructure program planned, are... -

Page 54

... net assets acquired and expects to finalize the purchase price allocation and to realize a gain on this transaction during 2007. See ''Item 4 Business Overview-Nokia Siemens Networks'' for more information on Nokia Siemens Networks. Certain Other Factors United States Dollar In 2006, the US dollar... -

Page 55

... time of sale, mainly in the mobile device business. Sales adjustments for volume based discount programs are estimated based largely on historical activity under similar programs. Price protection adjustments are based on estimates of future price reductions and certain agreed customer inventories... -

Page 56

...identifiable components based upon relative fair values. Networks' current sales and profit estimates for projects may change due to the early stage of a longÂterm project, new technology, changes in the project scope, changes in costs, changes in timing, changes in customers' plans, realization of... -

Page 57

... Nokia's products are covered by product warranty plans of varying periods, depending on local practices and regulations. While we engage in extensive product quality programs and processes, including actively monitoring and evaluating the quality of our component suppliers, our warranty obligations... -

Page 58

... the cash inflows and outflows. Management determines discount rates to be used based on the risk inherent in the related activity's current business model and industry comparisons. Terminal values are based on the expected life of products and forecasted life cycle and forecasted cash flows over... -

Page 59

... 5 to our consolidated financial statements and include, among others, the discount rate, expected longÂterm rate of return on plan assets and annual rate of increase in future compensation levels. A portion of our plan assets is invested in equity securities. The equity markets have experienced... -

Page 60

... from shareÂbased payment awards may not correspond to the expense amounts recorded by the Group. Results of Operations 2006 compared with 2005 Nokia Group The following table sets forth selective line items and the percentage of net sales that they represent for Nokia for the fiscal years 2006... -

Page 61

... in Mobile Phones' and Multimedia's operating profit in 2006 more than offset an unchanged operating loss in Enterprise Solutions and an operating profit decline in Networks. Networks operating profit included the negative impact of EUR 39 million incremental costs related to Nokia Siemens Networks... -

Page 62

...intends to selectively participate in key CDMA markets, with a special focus on North America, China and India. Accordingly, Nokia is ramping down its CDMA research, development and production, which will cease by April 2007. In 2006, Mobile Phones operating profit increased 14% to EUR 4 100 million... -

Page 63

... business group for the fiscal years 2006 and 2005. Year Ended December 31, 2006 Year Ended Percentage of December 31, Percentage of Net Sales 2005 Net Sales (EUR millions, except percentage data) Percentage Increase/ (Decrease) Net sales Cost of sales Gross profit Research and development... -

Page 64

...highest in China, North America, Europe, Latin America and AsiaÂPacific. Net sales declined in Middle East & Africa. The Nokia Eseries sold almost 2 million units since its introduction in the second quarter 2006. In Enterprise Solutions, gross profit increased by 12% to EUR 449 million as a result... -

Page 65

...to Nokia Siemens Networks. The business group's operating margin for 2006 was 10.8% compared with 13.0% in 2005. The lower operating profit primarily reflected pricing pressure and our efforts to gain market share, a greater proportion of sales from the emerging markets and a higher share of service... -

Page 66

... refunds from previous years of EUR 84 million compared with EUR 48 million in 2005. The effective tax rate decreased to 23.7% in 2006 compared with 25.8% in 2005, due to mix of foreign earnings. Minority Interests Minority shareholders' interest in our subsidiaries' profits totaled EUR 60 million... -

Page 67

... in 2005 was also affected by intense price competition in both the device and infrastructure markets, as well as by the lower margin services business and emerging markets representing an increased share of Networks sales. Research and development, or R&D, expenses were EUR 3.8 billion in both... -

Page 68

... reflected a higher proportion of sales of lower priced entry level phones, driven by strong demand in emerging markets where our share is high. Mobile Phones 2005 R&D expenses increased by 4% to EUR 1 245 million, with the target to bring more new products to the market, compared with EUR 1 196... -

Page 69

... such as the Nokia 6680 and the Nokia 6630, as well as the Nokia N70 towards the end of the year. Sales growth was highest in the Middle East & Africa, Europe and China, as well as in AsiaÂPacific. Multimedia sales in the Americas continued at a low level. Multimedia 2005 gross profit increased by... -

Page 70

... Enterprise Solutions business group for the fiscal years 2005 and 2004. Year Ended December 31, 2005 Year Ended Percentage of December 31, Percentage of Net Sales 2004 Net Sales (EUR millions, except percentage data) Percentage Increase/ (Decrease) Net sales Cost of sales Gross profit Research... -

Page 71

... for the Networks business group for the fiscal years 2005 and 2004. Year Ended December 31, 2005 Year Ended Percentage of December 31, Percentage of Net Sales 2004 Net Sales (EUR millions, except percentage data) Percentage Increase/ (Decrease) Net sales Cost of Sales Gross profit Research and... -

Page 72

...any director, executive officer or at least 5% shareholder. There are no material transactions with enterprises controlling, controlled by or under common control with Nokia or associates of Nokia. See Note 33 to our consolidated financial statements included in Item 18 of this annual report on Form... -

Page 73

...of development costs, pensions, shareÂbased compensation expense, identifiable intangible assets acquired, amortization and impairment of goodwill, translation of goodwill and cash flow hedges. See Note 38 to our consolidated financial statements included in Item 18 of this annual report on Form 20... -

Page 74

... as shareholders' equity and minority interests, was (68%), (77%) and (79%) at December 31, 2006, 2005 and 2004, respectively. The change in 2006 resulted from liquid assets used for funding share buybacks. Nokia's Board of Directors will propose a dividend of EUR 0.43 per share for the year ended... -

Page 75

...expenditures in machinery and equipment to support the company's growing volumes. Principal capital expenditures during the three years included production lines, test equipment and computer hardware used primarily in research and development as well as office and manufacturing facilities. We expect... -

Page 76

...to our consolidated financial statements included in Item 18 of this annual report on Form 20ÂF for additional information relating to our committed and outstanding customer financing. As a strategic market requirement, we plan to continue to provide customer financing and extended payment terms to... -

Page 77

... or early payment by the customer. See Note 31 to our consolidated financial statements included in Item 18 of this annual report on Form 20ÂF for further information regarding commitments and contingencies. 5.C Research and Development, Patents and Licenses Success in the mobile communications... -

Page 78

...provisions of the Finnish Companies Act and our articles of association, the control and management of Nokia is divided among the shareholders at a general meeting, the Board of Directors and the Group Executive Board. Board of Directors The current members of the Board of Directors were elected at... -

Page 79

... and Finnish Business and Policy Forum EVA. Daniel R. Hesse, b. 1953 Chairman and Chief Executive Officer of EMBARQ Corporation. Board member since 2005. B.A. (University of Notre Dame), M.B.A. (Cornell University), M.S. (Massachusetts Institute of Technology). CEO of Sprint Communication, Local... -

Page 80

...London) 1986Â1992. Corporate strategy consultant at the Boston Consulting Group (London) 1979Â1986. Board member of IKANO Holdings S.A. Dame Marjorie Scardino, b. 1947 Chief Executive and member of the Board of Directors of Pearson plc. Board member since 2001. B.A. (Baylor), J.D. (University of... -

Page 81

... be elected as new members of the Nokia Board for the term from the Annual General Meeting in 2007 until the close of the Annual General Meeting in 2008. Ms. Gupte is former Joint Managing Director of ICICI Bank Limited, the secondÂlargest bank in India, and currently nonÂexecutive Chairman of the... -

Page 82

... Area General Manager, South Asia 1999Â2000, Regional Director of Business Development, Project and Trade Finance of Nokia Networks, AsiaÂPacific 1998Â1999, Chief Executive Officer of Modi Telstra, India 1995Â 1998, General Manager, Banking and Finance, Corporate and Government business unit of... -

Page 83

... & Sales 2001Â2002, Vice President and General Manager of Nokia Networks, Mobile Internet Applications 2000Â2001, Vice President of Nokia Network Systems, Marketing 1997Â1998. Holder of executive and managerial positions at HewlettÂPackard Company 1987Â1997. Member of the Board of Directors of... -

Page 84

.... Group Executive Board Member since 2005. Joined Nokia in 1991. Doctor of Technology (Signal Processing), Master of Science (Engineering) (Tampere University of Technology). Senior Vice President, Business Line Management, Mobile Phones 2004Â2005; Senior Vice President, Mobile Phones Business Unit... -

Page 85

... TDMA/GSM 1900 Product Line, Nokia Mobile Phones 1999Â2002; Vice President, TDMA Product Line 1997Â1999; Holder of technical and managerial positions in Nokia Consumer Electronics and Nokia Mobile Phones, 1991Â1997. Member of the Board of Directors of the Finnish Funding Agency for Technology and... -

Page 86

...cash and the balance in Nokia shares acquired from the market. Not applicable to any nonÂexecutive member of the Board of Directors. This table includes fees paid for Mr. Ollila, Chairman, for his services as Chairman of the Board. For compensation paid in his role as CEO until June 1, 2006, please... -

Page 87

... in Nokia Corporation shares purchased from the market. Executive Compensation Executive Compensation Philosophy Nokia operates in the extremely competitive, complex and rapidly evolving mobile communications industry. We are a leading company in the industry and conduct a global business. The key... -

Page 88

... on current market trends, and for advice regarding specific compensation questions. Components of Executive Compensation The compensation program for executive officers includes the following components: Annual Cash Compensation ) Base salaries targeted at globally competitive market levels... -

Page 89

... executive officer's overall compensation with that of other executives in the relevant market. Performance shares are Nokia's main vehicle for longÂterm equityÂbased incentives and only vest as shares, if at least one of the preÂdetermined threshold performance levels, tied to Nokia's financial... -

Page 90

...and shareÂbased incentive grants vested for the members of the Group Executive Board during 2006 are included in ''Item 6.E Share Ownership.'' Aggregate Cash Compensation to the Group Executive Board for 2006 Number of Members December 31, 2006 Cash Incentive Payments(1)(2) EUR Year Base Salaries... -

Page 91

... liability of EUR 4 787 000 for Mr. Ollila's early retirement benefit at the age of 60 provided under his service agreement was also cancelled as of June 1, 2006. These resulted in a decrease of Nokia's total liability of EUR 5 463 117. All other compensation for Mr. Ollila includes: EUR 375 000 for... -

Page 92

... under his service contract. (13) All other compensation for Mr. Moerk includes: EUR 245 434 provided as a benefit under Nokia's expatriate policy and EUR 24 468 for car allowance, financial counseling and Employee Stock Purchase Plan benefit. * None of the named executive officers participated in... -

Page 93

... The members of the Group Executive Board in 2006 participate in the local retirement programs applicable to employees in the country where they reside. Executives in Finland participate in the Finnish TEL pension system, which provides for a retirement benefit based on years of service and earnings... -

Page 94

...'s service contract covers his current position as President and CEO and Chairman of the Group Executive Board. The contract also covered his prior position as President and COO. Mr. Kallasvuo's annual total gross base salary, which is subject to an annual review by the Board of Directors, was... -

Page 95

... determined in accordance with a preÂagreed schedule after the release of Nokia's periodic financial results and are based on the trade volume weighted average price of a Nokia share on the Helsinki Stock Exchange during the trading days of the first whole week of the second month of the respective... -

Page 96

... plans, see Note 23 to our consolidated financial statements included in Item 18 of this annual report on Form 20ÂF. EquityÂBased Compensation Program 2007 The Board of Directors announced the proposed scope and design for the 2007 Equity Program on January 25, 2007. The main equity instrument... -

Page 97

... entitle the option holder to subscribe for one Nokia share. The exercise price of the stock options would be determined at the time of grant on a quarterly basis and would be based on the trade volume weighted average price of a Nokia share on the Helsinki Stock Exchange for the first whole week... -

Page 98

... was also Nokia's CEO until June 1, 2006. The other members of the Board are all nonÂexecutive and independent as defined under Finnish rules and regulations. In January 2007, the Board determined that seven members of the Board are independent, as defined in the New York Stock Exchange's corporate... -

Page 99

... technical equipment. The Personnel Committee consists of a minimum of three members of the Board who meet all applicable independence requirements of Finnish law and the rules of the stock exchanges where Nokia shares are listed, including the Helsinki Stock Exchange and the New York Stock Exchange... -

Page 100

...three to five members of the Board who meet all applicable independence requirements of Finnish law and the rules of the stock exchanges where Nokia shares are listed, including the Helsinki Stock Exchange and the New York Stock Exchange. Since March 30, 2006, the Corporate Governance and Nomination... -

Page 101

...to their activity and geographical location as follows: 2006 2005 2004 Mobile Phones Multimedia Enterprise Solutions Networks Customer and Market Operations Technology Platforms Common Group Functions Nokia Group Finland Other European countries MiddleÂEast & Africa China AsiaÂPacific... -

Page 102

... held personally and shares held through a company. Share Ownership of the Group Executive Board The following table sets forth the share ownership, as well as potential ownership interest through holding of equity based incentives, of the members of the Group Executive Board as of December 31... -

Page 103

The following table sets forth the number of shares and ADSs beneficially held by members of the Group Executive Board as of December 31, 2006. Shares ADSs OlliÂPekka Kallasvuo Robert Andersson Simon BeresfordÂWylie Mary McDowell Hallstein Moerk Tero Ojanper¨ a Niklas Savander Richard ... -

Page 104

...issued pursuant to Nokia Stock Option Plans 2001, 2003 and 2005. For a description of our stock option plans, please see Note 23 to our consolidated financial statements in Item 18 of this annual report on Form 20ÂF. Exercise Price per Share (EUR) Total Intrinsic Value of Stock Options, December 31... -

Page 105

... option entitlement. Stock options vest over 4 years: 25% after one year and 6.25% each quarter thereafter. The intrinsic value of the stock options is based on the difference between the exercise price of the options and the closing market price of Nokia shares on the Helsinki Stock Exchange as of... -

Page 106

... were forfeited upon termination of employment in accordance with the plan rules. The intrinsic value of the stock options is based on the difference between the exercise price of the options and the closing market price of Nokia shares on the Helsinki Stock Exchange as of May 31, 2006 of EUR 16.71... -

Page 107

... a description of our performance share and restricted share plans, please see Note 23 to the consolidated financial statements in Item 18 of this annual report on Form 20ÂF. Performance Shares Number of Performance Shares at Threshold(2) Number of Performance Shares at Maximum(2) Intrinsic Value... -

Page 108

...value is based on the closing market price of a Nokia share on the Helsinki Stock Exchange as of December 29, 2006 of EUR 15.48. The value of performance shares is presented on the basis of the company's estimation of the number of shares expected to vest. Under the restricted share plans 2003, 2004... -

Page 109

... based on the market price of the Nokia share on the Helsinki Stock Exchange as of October 23, 2006 of EUR 15.60. Jorma Ollila resigned as CEO and Chairman of the Group Executive Board effective June 1, 2006, and ceased employment with Nokia on that date. Mr. Korhonen resigned as member of the Group... -

Page 110

... in Nokia's shares is three times his annual base salary. To meet this requirement, all members are expected to retain afterÂtax equity gains in shares until the minimum investment level is met. Insiders' Trading in Securities The Board of Directors has established and regularly updates a policy in... -

Page 111

...Nokia by any director, executive officer or 5% shareholder. There are no material transactions with enterprises controlling, controlled by or under common control with Nokia or associates of Nokia. See Note 33 to our consolidated financial statements included in Item 18 of this annual report on Form... -

Page 112

...), which then controlled and managed Telsim's assets. In December 2005, the Turkish government completed an auction of Telsim's assets to Vodafone. Nokia's settlement payment, 7.5% of the purchase price i.e. USD 341 250 000, was received in May 2006 in connection with the closing of the sale. On the... -

Page 113

... Nokia's sale of 3G products was fully released thru the date of the settlement agreements. Additionally, IDT agreed not to initiate patent infringement claims against Nokia prior to January 1, 2007. Notably, Nokia and IDT currently have pending legal disputes in the United States and United Kingdom... -

Page 114

.... In August 2006, Nokia entered into a merger agreement with Loudeye Corporation, a company in the business of facilitating and providing digital media services. On October 6, 2006, Nokia was named as a defendant in a Washington state court securities case involving activities associated with the... -

Page 115

...and low quoted prices for the shares, in the form of ADSs, on the New York Stock Exchange. Helsinki Stock Exchange Price per share High Low (EUR) New York Stock Exchange Price per ADS High Low (USD) 2002 2003 2004 2005 First Quarter Second Quarter Third Quarter Fourth Quarter Full Year 2006... -

Page 116

Helsinki Stock Exchange Price per share High Low (EUR) New York Stock Exchange Price per ADS High Low (USD) Most recent six months September 2006 October 2006 November 2006 December 2006 January 2007 February 2007 9.B Plan of Distribution Not applicable. 9.C Markets 16.13 16.09 16.14 15.63 ... -

Page 117

... own a minimum number of shares in order to qualify to act as a director. Share Rights, Preferences and Restrictions Each share confers the right to one vote at general meetings. According to Finnish law, a company generally must hold an Annual General Meeting called by the Board once a year. In... -

Page 118

... of trade. Under the Finnish Companies Act of 2006, a shareholder whose holding exceeds nineÂtenths of the total number of shares or voting rights in Nokia has both the right and the obligation to purchase all the shares of the minority shareholders for the current market price. The market price is... -

Page 119

... does not purport to be a complete analysis or listing of all potential tax effects relevant to ownership of our shares represented by ADSs. The statements of United States and Finnish tax laws set out below are based on the laws in force as of the date of this annual report on Form 20ÂF and may be... -

Page 120

... met. Dividends that Nokia pays with respect to its shares and ADSs generally will be qualified dividend income if Nokia was not, in the year prior to the year in which the dividend was paid, and is not, in the year in which the dividend is paid, a passive foreign investment company. Nokia currently... -

Page 121

... the following information on the beneficial owner of the dividend is provided to the payer prior to the dividend payment: name, date of birth or business ID (if applicable) and address in the country of residence. US and Finnish Tax on Sale or Other Disposition A US Holder generally will recognize... -

Page 122

...or business in the United States or (b) in the case of an individual, that individual is present in the United States for 183 days or more in the taxable year of the disposition and other conditions are met. US Information Reporting and Backup Withholding Dividend payments with respect to shares or... -

Page 123

... and New York/Sao Paolo, and a Corporate Treasury unit in Espoo. This international organization enables Nokia to provide the Group companies with financial services according to local needs and requirements. The Treasury function is governed by policies approved by the Group Executive Board or... -

Page 124

...various local currencies because of Nokia's substantial production and sales outside the Eurozone. Due to the changes in the business environment, currency combinations may also change within the financial year. The most significant nonÂeuro sales currencies during the year were US dollar (USD), UK... -

Page 125

... resulting from adverse changes in market factors using a specified time period and confidence level based on historical data. For interest rate risk VaR, Nokia uses varianceÂcovariance methodology. Volatilities and correlations are calculated from a oneÂyear set of daily data. The annualized... -

Page 126

... and Chief Executive Officer and our Executive Vice President, Chief Financial Officer, after evaluating the effectiveness of the Group's disclosure controls and procedures (as defined in US Exchange Act Rule 13aÂ15(e)) as of the end of the period covered by this annual report on Form 20ÂF, have... -

Page 127

... 303A.02 of the New York Stock Exchange's Listed Company Manual. ITEM 16B. CODE OF ETHICS We have adopted a code of ethics that applies to our Chief Executive Officer, President, Chief Financial Officer and Corporate Controller. This code of ethics is posted on our website, www.nokia.com, and may be... -

Page 128

... until 2007. There were no unbilled tax fees at yearÂend 2005. All Other Fees include fees billed for company establishment, forensic accounting and occasional training services. (2) (3) (4) Audit Committee PreÂapproval Policies and Procedures The Audit Committee of Nokia's Board of Directors... -

Page 129

... Announced Plans and Programs'' represents repurchases of a total of 500 000 shares in openÂmarket transactions effected by affiliates of Nokia Corporation to cover the Group's obligations in connection with certain employee stock option plans. When ADRs were purchased the USD price paid was... -

Page 130

...our consolidated financial statements included in Item 18 of this annual report on Form 20ÂF for information on how earnings per share information was calculated. 8. List of significant subsidiaries. 12.1 Certification of OlliÂPekka Kallasvuo, Chief Executive Officer of Nokia Corporation, pursuant... -

Page 131

... in a mobile network for controlling one or more base transceiver stations in the call setÂup functions, in signaling, in the use of radio channels, and in various maintenance tasks. Bluetooth: A technology that provides shortÂrange radio links to allow mobile computers, mobile phones, digital... -

Page 132

... and increase data rates of existing GSM networks to as high as 473 Kbit/s. Engine: Hardware and software that perform essential core functions for telecommunication or application tasks. A mobile device engine includes, for example, the printed circuit boards, radio frequency components, basic... -

Page 133

...): 3GPP radio technology evolution architecture. Maemo: An application development platform for Nokia Internet Tablet products. MMS (Multimedia Messaging Services): An open standard defined by the Open Mobile Alliance that enables mobile phone users to send and receive messages with rich content... -

Page 134

... dualÂmode mobile handsets. VAR (Value Added Reseller): A reseller that adds something to a product, thus creating a complete customer solution which it then sells under its own name. VoIP (Voice over Internet Protocol): Use of the Internet protocol to carry and route twoÂway voice communications... -

Page 135

(This page has been left blank intentionally) 134 -

Page 136

... OF INDEPENDENT REGISTERED PUBLIC ACCOUNTING FIRM To the Board of Directors and Shareholders of NOKIA CORPORATION: We have completed an integrated audit of Nokia Corporation's 2006 consolidated financial statements and of its internal control over financial reporting as of December 31, 2006 and... -

Page 137

... regarding the reliability of financial reporting and the preparation of financial statements for external purposes in accordance with generally accepted accounting standards. A company's internal control over financial reporting includes those policies and procedures that (i) pertain to the... -

Page 138

(This page has been left blank intentionally) FÂ3 -

Page 139

Nokia Corporation and Subsidiaries Consolidated Profit and Loss Accounts Notes Financial year ended December 31 2006 2005 2004 EURm EURm EURm Net sales Cost of sales Gross profit Research and development expenses Selling and marketing expenses **** Administrative and general expenses Other ... -

Page 140

Nokia Corporation and Subsidiaries Consolidated Balance Sheets Notes December 31 2006 2005 EURm EURm ASSETS NonÂcurrent assets Capitalized development costs Goodwill Other intangible assets Property, plant and equipment Investments in associated companies AvailableÂforÂsale investments ... -

Page 141

Nokia Corporation and Subsidiaries Consolidated Cash Flow Statements Financial year ended December 31 2006 2005 2004 EURm EURm EURm Notes Cash flow from operating activities Profit attributable to equity holders of the parent Adjustments, total Profit attributable to equity holders of the parent... -

Page 142

Nokia Corporation and Subsidiaries Consolidated Cash Flow Statements (Continued) Financial year ended December 31 2006 2005 2004 EURm EURm EURm Notes Cash flow from financing activities Proceeds from stock option exercises Purchase of treasury shares Proceeds from longÂterm borrowings ... -

Page 143

Nokia Corporation and Subsidiaries Consolidated Statements of Changes in Shareholders' Equity Fair value Share and Number of Share issue Treasury Translation other shares capital premium shares differences reserves (000's) Before minority Minority interests interests Retained earnings(1) Total ... -

Page 144

Nokia Corporation and Subsidiaries Consolidated Statements of Changes in Shareholders' Equity (Continued) Fair value Share and Number of Share issue Treasury Translation other shares capital premium shares differences reserves (000's) Before minority Minority interests interests Retained earnings... -

Page 145

... accounting policies below. The notes to the consolidated financial statements also conform with Finnish Accounting legislation. On January 25, 2007, Nokia's Board of Directors authorized the financial statements for issuance. Adoption of pronouncements under IFRS In the current year, the Group has... -

Page 146

... to appoint or remove the majority of the members of the board of the entity. The Group's share of profits and losses of associated companies is included in the consolidated profit and loss account in accordance with the equity method of accounting. An associated company is an entity over which the... -

Page 147

... resulting from the translation of income and expenses at the average rate and assets and liabilities at the closing rate are treated as an adjustment affecting consolidated shareholders' equity. On the disposal of all or part of a foreign Group company by sale, liquidation, repayment of share... -

Page 148

... to the Consolidated Financial Statements (Continued) 1. Accounting principles (Continued) Derivatives Fair values of forward rate agreements, interest rate options, futures contracts and exchange traded options are calculated based on quoted market rates at each balance sheet date. Discounted cash... -

Page 149

... volume based discounts. Service revenue is generally recognized on a straight line basis over the specified period unless there is evidence that some other method better represents the stage of completion. Except for separately licensed software solutions and certain Networks' equipment, the Group... -

Page 150

...estimable. The Group's customer contracts may include the provision of separately identifiable components of a single transaction, for example the construction of a network solution and subsequent network maintenance services or postÂcontract customer support on software solutions. Accordingly, for... -

Page 151

Notes to the Consolidated Financial Statements (Continued) 1. Accounting principles (Continued) Pensions The Group companies have various pension schemes in accordance with the local conditions and practices in the countries in which they operate. The schemes are generally funded through payments to... -

Page 152

...income on loans to customers is accrued monthly on the principal outstanding at the market rate on the date of financing and is included in other operating income. Income taxes Current taxes are based on the results of the Group companies and are calculated according to local tax rules. Deferred tax... -

Page 153

... in profit or loss for the period. The Group recognizes a provision for tax contingencies based upon the estimated future settlement amount at each balance sheet date. ShareÂbased compensation The Group offers three types of equity settled shareÂbased compensation schemes for employees: stock... -

Page 154

...the overall project outcome are revised. Current sales and profit estimates for projects may materially change due to the early stage of a longÂterm project, new technology, changes in the project scope, changes in costs, changes in timing, changes in customers' plans, realization of penalties, and... -

Page 155

... when it is probable that a development project will generate future economic benefits and certain criteria, including commercial and technological feasibility, have been met. Should a product fail to substantiate its estimated feasibility or life cycle, material development costs may be required to... -

Page 156

Notes to the Consolidated Financial Statements (Continued) 1. Accounting principles (Continued) Fair value of derivatives and other financial instruments The fair value of financial instruments that are not traded in an active market (for example, unlisted equities, currency options and embedded ... -

Page 157

... Phones, Multimedia, Enterprise Solutions and Networks. Nokia's reportable segments represent the strategic business units that offer different products and services for which monthly financial information is provided to the Board. Mobile Phones connects people by providing expanding mobile voice... -

Page 158

... to the Consolidated Financial Statements (Continued) 2. Segment information (Continued) No single customer represents 10% or more of the Group revenues. Mobile Phones EURm Multimedia EURm Enterprise Solutions EURm Networks EURm Total reportable segments EURm Common Group Functions EURm Eliminations... -

Page 159

... to the Consolidated Financial Statements (Continued) 2. Segment information (Continued) Mobile Phones EURm Multimedia EURm Enterprise Solutions EURm Networks EURm Total reportable segments EURm Common Group Functions EURm Eliminations EURm Group EURm 2004 Profit and Loss Information Net sales to... -

Page 160

Notes to the Consolidated Financial Statements (Continued) 2. Segment information (Continued) Segment assets by geographic area 2006 EURm 2005 EURm Finland China USA India Great Britain Germany Other Total Capital expenditures by market area 4 165 1 257 1 270 618 523 615 3 456 11 904 2006... -

Page 161

Notes to the Consolidated Financial Statements (Continued) 4. Personnel expenses 2006 EURm 2005 EURm 2004 EURm Wages and salaries ShareÂbased compensation expense, total Pension expenses, net Other social expenses Personnel expenses as per profit and loss account 3 457 192 310 439 4 398 3 ... -

Page 162

Notes to the Consolidated Financial Statements (Continued) 5. Pensions (Continued) The following table sets forth the changes in the benefit obligation and fair value of plan assets during the year and the funded status of the significant defined benefit pension plans showing the amounts that are ... -

Page 163

... the Consolidated Financial Statements (Continued) 5. Pensions (Continued) The amounts recognized in the profit and loss account are as follows: 2006 EURm 2005 EURm 2004 EURm Current service cost Interest cost Expected return on plan assets Net actuarial losses recognized in year Past service... -

Page 164

...key CDMA markets, with special focus on North America, China and India. Accordingly, Nokia is ramping down its CDMA research, development and production which will cease by April 2007. In 2006, Enterprise Solutions recorded a charge of EUR 8 million for personnel expenses and other costs as a result... -

Page 165

... policy period. In all three years presented ''Other operating income and expenses'' include the costs of hedging forecasted sales and purchases (forward points of cash flow hedges). 8. Impairment Mobile Phones EURm 2006 Multimedia EURm Enterprise Solutions EURm Networks EURm Common Group Functions... -

Page 166

... 10, 2006, the Group completed its acquisition of all of the outstanding common stock of Intellisync Corporation. Intellisync is a leader in synchronization technology for platformÂindependent wireless messaging and other business applications for mobile devices. The acquisition of Intellisync... -

Page 167

... of digital music platforms and digital media distribution services. The Group acquired a 100% ownership interest in Loudeye Corporation on October 16, 2006. ) gate5 AG, based in Berlin, Germany, a leading supplier of mapping, routing and navigation software and services. The Group acquired a 100... -

Page 168

... Consolidated Financial Statements (Continued) 11. Financial income and expenses 2006 EURm 2005 EURm 2004 EURm Income from availableÂforÂsale investments Dividend income Interest income Other financial income Foreign exchange gains and losses Interest expense Other financial expenses Total... -

Page 169

...Consolidated Financial Statements (Continued) 12. Income taxes (Continued) Income taxes include a tax benefit from received and accrued tax refunds from previous years of EUR 84 million in 2006 (EUR 48 million in 2005). Certain of the Group companies' income tax returns for periods ranging from 2001... -

Page 170

Notes to the Consolidated Financial Statements (Continued) 13. Intangible assets (Continued) 2006 EURm 2005 EURm Accumulated amortization January 1 Translation differences Disposals during the period Amortization for the period Accumulated amortization December 31 Net book value January 1 Net... -

Page 171

... to the Consolidated Financial Statements (Continued) 14. Property, plant and equipment (Continued) 2006 EURm 2005 EURm Accumulated depreciation January 1 Translation differences Disposals during the period Depreciation for the period Accumulated depreciation December 31 Net book value January... -

Page 172

..., was EUR 185 million in 2006 and EUR 165 million in 2005. Fair value for equity investments traded in active markets is determined by using exchange quoted bid prices. For other investments, fair value is estimated by using the current market value of similar instruments or by reference to the... -

Page 173

... and to customers principally to support their financing of network infrastructure and services or working capital, net of allowances and writeÂoffs amounts (Note 8), are repayable as follows: 2006 EURm 2005 EURm Under 1 year Between 1 and 2 years 7 Between 2 and 5 years 12 Over 5 years 19 18... -

Page 174

... ensure that the amounts transferred to the Hedging reserve do not include gains/losses on forward exchange contracts that have been designated to hedge forecasted sales or purchases that are no longer expected to occur. Because of the number of transactions undertaken during each period and FÂ39 -

Page 175

... 2006 following the new authorization granted by the Annual General Meeting 2006. At the Annual General Meeting held on March 30, 2006 Nokia shareholders authorized the Board of Directors to decide on an increase of the share capital by a maximum of EUR 48 540 000 within one year from the resolution... -

Page 176

... shares of the company. It is proposed that the authorization be effective until June 30, 2008. 23. ShareÂbased payment The Group has several equityÂbased incentive programs for employees. The programs include performance share plans, stock option plans and restricted share plans. Both executives... -

Page 177

... based on the stock options issued under the 2001, 2003 and 2005 stock option plans are settled with newly issued Nokia shares which entitle the holder to a dividend for the financial year in which the subscription occurs. Other shareholder rights commence on the date on which the shares subscribed... -

Page 178

... (2) The stock options under the 2001 plan are listed on the Helsinki Stock Exchange. The Group's current global stock option plans have a vesting schedule with 25% vesting one year after grant, and quarterly vesting thereafter, each of the quarterly lots representing 6.25% of the total grant. The... -

Page 179

Notes to the Consolidated Financial Statements (Continued) 23. ShareÂbased payment (Continued) Total stock options outstanding Number of shares Weighted average exercise price EUR Weighted average share price EUR Aggregate intrinsic value EURm Shares under option at December 31, 2003 ******** ... -

Page 180

...or transfer of existing treasury shares. The Group may also settle the plans using Nokia shares purchased on the open market or instead of shares cash settlement. The Group introduced performance shares in 2004 as the main element to its broadÂbased equity compensation program, to further emphasize... -

Page 181

... fair value of performance shares is estimated based on the grant date market price of the Company's share less the present value of dividends expected to be paid during the vesting period. The aggregate intrinsic value reflects management's estimate of the number of shares expected to vest. FÂ46 -

Page 182

Notes to the Consolidated Financial Statements (Continued) 23. ShareÂbased payment (Continued) (3) (4) Includes a minor number of performance shares granted under other employee equity plans than the global plans. Based on the performance of the Group during the Interim Measurement Period 2004Â... -

Page 183

... Consolidated Financial Statements (Continued) 23. ShareÂbased payment (Continued) (2) Includes a minor number of restricted shares granted under other employee equity plans than the global plans. Other equity plans for employees The Group also sponsors other immaterial equity plans for employees... -

Page 184

... deferred tax liabilities Net deferred tax asset The tax charged to shareholders' equity is as follows: Fair value and other reserves, fair value gains/losses and excess tax benefit on shareÂbased compensation (1) 34 41 134 253 - 104 243 809 (23) (16) (65) (101) (205) 604 49 7 151 280 43 88... -

Page 185

.... Final resolution of IPR claims generally occurs over several periods. This results in varying usage of the provision year to year. In 2006, usage of the provision includes an amount of EUR 208 million that was released against the settlement to InterDigital Communications Corporation. The... -

Page 186

... the Consolidated Financial Statements (Continued) 30. Earnings per share 2006 2005 As revised 2004 As revised Numerator (EURm) Basic/Diluted: Profit attributable to equity holders of the parent ******** Denominator (000's Shares) Basic: Weighted average shares Effect of dilutive securities: stock... -

Page 187

... relating to purchases of network infrastructure equipment and services. Venture fund commitments of EUR 208 million in 2006 (EUR 230 million in 2005) are financing commitments to a number of funds making technology related investments. As a limited partner in these funds Nokia is committed... -

Page 188

... Liabilities to associated companies Management compensation 28 1 61 14 10 1 33 14 (26) 2 37 3 The following table sets forth the salary and cash incentive information awarded and paid or payable by the company to the Chief Executive Officer and President of Nokia Corporation for fiscal FÂ53 -

Page 189

Notes to the Consolidated Financial Statements (Continued) 33. Related party transactions (Continued) years 2004Â2006 as well as the shareÂbased compensation expense relating to equityÂbased awards, expensed by the company. 2006 Cash ShareÂbased incentive compensation payments expense EUR EUR ... -

Page 190

... has also in his current position at Nokia a retirement benefit of 65% of his pensionable salary beginning at the age of 62. Early retirement is possible at the age of 55 with reduced benefits. Simon BeresfordÂWylie participates in the Nokia International Employee Benefit Plan (NIEBP). The NIEBP is... -

Page 191

... networks in a new company owned by Nokia and Siemens. Nokia and Siemens will each own approximately 50% of Nokia Siemens Networks. However, Nokia will effectively control Nokia Siemens Networks as it has the ability to appoint key officers and the majority of the members of its Board of Directors... -

Page 192

... and New York/Sao Paolo, and a Corporate Treasury unit in Espoo. This international organization enables Nokia to provide the Group companies with financial services according to local needs and requirements. The Treasury function is governed by policies approved by the Group Executive Board or... -

Page 193

... as liquidity and credit risk. Nokia is risk averse in its Treasury activities. Business Groups have detailed Standard Operating Procedures supplementing the Treasury Policy in financial risk management related issues. a) Market risk Foreign exchange risk Nokia operates globally and is thus exposed... -

Page 194

... EUR 8 million (EUR 8 million in 2005). There are currently no outstanding derivative financial instruments designated as hedges of these equity investments. In addition to the listed equity holdings, Nokia invests in private equity through Nokia Venture Funds. The fair value of these availableÂfor... -

Page 195

Notes to the Consolidated Financial Statements (Continued) 37. Risk management (Continued) customers in their financing of infrastructure investments. Nokia actively mitigates, market conditions permitting, this exposure by arrangements with these institutions and investors. Credit risks related to ... -

Page 196

... existing funding programs include: Revolving Credit Facility of USD 2 000 million, maturing in 2012 Local commercial paper program in Finland, totaling EUR 750 million Euro Commercial Paper (ECP) program, totaling USD 500 million US Commercial Paper (USCP) program, totaling USD 500 million... -

Page 197

... (e.g. product liability) are optimally insured. Nokia purchases both annual insurance policies for specific risks as well as multiÂline and/or multi year insurance policies, where available. Notional amounts of derivative financial instruments(1) 2006 EURm 2005 EURm Foreign exchange forward... -

Page 198

... to the Consolidated Financial Statements (Continued) 37. Risk management (Continued) Fair values of derivatives The net fair values of derivative financial instruments at the balance sheet date were: 2006 EURm 2005 EURm Derivatives with positive fair value(1): Forward foreign exchange contracts... -

Page 199

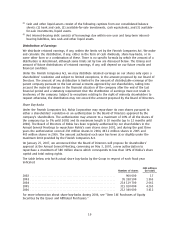

... the parent under IFRS to net income under US GAAP: Profit attributable to equity holders of the parent reported under IFRS ***** US GAAP adjustments: Pensions Development costs ShareÂbased compensation expense Cash flow hedges Amortization of identifiable intangible assets acquired Impairment... -

Page 200

... total shareholders' equity under US GAAP: Total equity reported under IFRS Less minority interests Capital and reserves attributable to equity holders of the parent under IFRS ****** US GAAP adjustments: Pensions (1 Development costs Share issue premium ShareÂbased compensation Amortization... -

Page 201

... in Note 1, the Group changed its method of quantifying misstatements. As a result of this change management has adjusted its financial statements. Previously reported deferred tax assets have been increased by EUR 154 million, previously reported goodwill has been decreased by EUR 90 million... -

Page 202

... amount and net realizable value of software related development costs. ShareÂbased compensation The Group maintains several shareÂbased employee compensation plans, which are described more fully in Note 23. Under IFRS, the Group accounts for equity instruments under IFRS 2 which was FÂ67 -

Page 203

...equity instruments using Statement of Financial Accounting Standards No. 123(R), Share Based Payment (''FAS 123R'') which was adopted using the modified prospective method at January 1, 2005. Since the terms of Nokia's stock option plans call for the exercise price to be set equal to the share price... -

Page 204

...are operating segments or one level below an operating segment (as defined in FAS 131, Disclosures about Segments of an Enterprise and Related Information). The goodwill impairment test under FAS 142 compares the carrying value for each reporting unit to its fair value based on discounted cash flows... -

Page 205

...and unlisted investments, acquisition purchase price, social security cost on shareÂbased payments, a sale and leaseback transaction, an adjustment to goodwill and a loss on disposal. Disclosures required by US GAAP Dependence on limited sources of supply Nokia's manufacturing operations depend to... -

Page 206

... were to third parties, and therefore at current market prices. Nokia evaluates the performance of its segments and allocates resources to them based on operating profit. Under IFRS, segment assets and liabilities of the horizontal groups are allocated to business groups on a symmetrical basis... -

Page 207

... Mobile Phones Multimedia Enterprise Solutions Networks Common Group Functions Group (1) 19 10 5 116 413 563 23 10 7 94 414 548 LongÂlived assets include property, plant and equipment. Compensation expense The following table illustrates the effect on net income and earnings per share... -

Page 208

...deferred taxes differs from the methodology set forth in US GAAP. For purposes of US GAAP, deferred tax assets and liabilities must either be classified as current or non current based on the classification of the related nonÂtax asset or liability for financial reporting. This table presents the... -

Page 209

... with pooled benefits. The following table sets forth the changes in the benefit obligation and fair value of plan assets during the year and the funded status of the significant defined benefit pension plans showing the amounts that are recognized in the Group's consolidated balance sheet... -

Page 210

... 25 223 In 2007, the Group expects to recognise amortization of transition asset of EUR 1 million, actuarial losses of EUR 6 million and amortization of prior service cost of EUR 2 million. The following table presents the reconciliation of prepaid benefit cost to the net pension asset (liability... -

Page 211

... plans' net periodic benefit cost for years ending December 31, are as follows: 2006 Domestic Foreign % % 2005 Domestic Foreign % % Discount rate for determining present values Expected long term rate of return on plan assets Annual rate of increase in future compensation levels ******* Pension... -

Page 212

...balance sheet outside of equity. Indemnification agreements The Group enters into standard indemnification agreements in the ordinary course of business. Pursuant to these agreements, the Group indemnifies, holds harmless, and agrees to reimburse the indemnified party for losses suffered or incurred... -

Page 213

.... In addition, the Group has entered into customary Directors' and Officers' liability insurance policy, and, to a limited extent, indemnification agreements covering its directors and officers. Adoption of pronouncements under US GAAP In November 2005, the FASB issued Staff Position No. (FSP) 115... -

Page 214

... of fair value in any new circumstances. The Group will apply this standard for annual periods beginning January 1, 2007. The Group is currently evaluating the potential impact that the adoption of FAS 157 will have on its consolidated financial statements. In February 2007, the FASB issued FAS 159... -

Page 215

... all of the requirements for filing on Form 20ÂF and that it has duly caused and authorized the undersigned to sign this annual report on its behalf. NOKIA CORPORATION By: /s/ ANJA KORHONEN Name: Anja Korhonen Title: Senior Vice President, Corporate Controller By: /s/ KAARINA STA Ëš HLBERG Name... -

Page 216

Copyright © 2007. Nokia Corporation. All rights reserved. Nokia and Nokia Connecting People are registered trademarks of Nokia Corporation.