Neiman Marcus 2014 Annual Report Download - page 99

Download and view the complete annual report

Please find page 99 of the 2014 Neiman Marcus annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Table of Contents

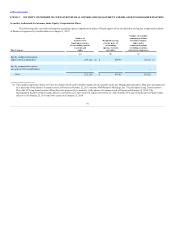

4.4 Form of 7.125% Senior Debentures Due 2028, dated May 27, 1998.

Incorporated herein by reference to the

Company’s Annual Report on Form 10-K for

the fiscal year ended August 1, 2009.

4.5 First Supplemental Indenture, dated as of July 11, 2006, to the Indenture, dated as of May 27,

1998, among The Neiman Marcus Group, Inc., Neiman Marcus, Inc., and The Bank of New

York Trust Company, N.A., as successor trustee.

Incorporated herein by reference to the

Company’s Annual Report on Form 10-K for

the fiscal year ended July 30, 2011.

4.6 Second Supplemental Indenture, dated as of August 14, 2006, to the Indenture, dated as of

May 27, 1998, among The Neiman Marcus Group, Inc., Neiman Marcus, Inc., and The Bank of

New York Trust Company, N.A., as successor trustee.

Incorporated herein by reference to the

Company’s Annual Report on Form 10-K for

the fiscal year ended July 30, 2011.

4.7 First Supplemental Indenture, dated as of October 25, 2013, to the Senior Cash Pay Notes

Indenture, dated as of October 21, 2013, among the Company (as successor by merger of

Mariposa Merger Sub LLC), Mariposa Borrower, Inc., each of the subsidiary guarantors named

therein and U.S. Bank National Association, as trustee.

Incorporated herein by reference to the

Company's Current Report on Form 8-K filed

on October 29, 2013.

4.8 First Supplemental Indenture, dated as of October 25, 2013, to the Senior PIK Toggle Notes

Indenture, dated as of October 21, 2013, among the Company (as successor by merger of

Mariposa Merger Sub LLC), Mariposa Borrower, Inc., each of the subsidiary guarantors named

therein and U.S. Bank National Association, as trustee.

Incorporated herein by reference to the

Company's Current Report on Form 8-K filed

on October 29, 2013.

10.1 Term Loan Credit Agreement, dated as of October 25, 2013, among Mariposa Intermediate

Holdings LLC, the Company (as successor by merger to Mariposa Merger Sub LLC), the

subsidiaries of the Company from time to time party thereto, Credit Suisse AG, Cayman Islands

Branch, as Administrative and Collateral Agent, and the lenders thereunder.

Incorporated herein by reference to the

Company's Current Report on Form 8-K filed

on October 29, 2013.

10.2 Refinancing Amendment, dated March 13, 2014, among the Company as Borrower, Mariposa

Intermediate Holdings LLC, Credit Suisse AG, Cayman Islands Branch, as Administrative

Agent, and the banks and other financial institutions party thereto as lenders.

Incorporated herein by reference to the

Company's Current Report on Form 8-K filed

on March 13, 2014.

10.3 Revolving Credit Agreement, dated as of October 25, 2013, among Mariposa Intermediate

Holdings LLC, the Company (as successor by merger to Mariposa Merger Sub LLC), the

subsidiaries of the Company from time to time party thereto, Deutsche Bank AG New York

Branch, as Administrative and Collateral Agent, and the lenders thereunder.

Incorporated herein by reference to the

Company's Current Report on Form 8-K filed

on October 29, 2013.

10.4 First Incremental Amendment to Revolving Credit Agreement, dated October 10, 2014, among

Neiman Marcus Group LTD LLC as Borrower, Mariposa Intermediate Holdings LLC, the co-

borrowers and subsidiary loan parties party thereto, each of the banks and other financial

institutions party thereto as lenders and Deutsche Bank AG New York Branch, as

administrative agent and collateral agent.

Incorporated herein by reference to the

Company's Current Report on Form 8-K filed

on October 16, 2014.

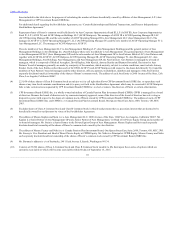

10.5 Employment Agreement, dated as of October 25, 2013, by and among The Neiman Marcus

Group LLC, the Company and Karen Katz.

Incorporated herein by reference to the

Company's Current Report on Form 8-K filed

on October 29, 2013.

10.6 Amended & Restated Employment Agreement, effective as of June 15, 2015, between The

Neiman Marcus Group LLC, the Company and James E. Skinner.

Incorporated herein by reference to the

Company's Current Report on Form 8-K filed

on June 3, 2015.

10.7 Employment Agreement between The Neiman Marcus Group LLC and Donald T. Grimes

effective as of June 15, 2015.

Incorporated herein by reference to the

Company's Current Report on Form 8-K filed

on June 3, 2015.

10.8 Amended and Restated Employment Agreement between The Neiman Marcus Group LLC and

James E. Skinner effective as of June 15, 2015.

Incorporated herein by reference to the

Company's Current Report on Form 8-K filed

on June 3, 2015.

10.9 Employment Agreement, dated as of October 25, 2013, by and among The Neiman Marcus

Group LLC, the Company and James J. Gold.

Incorporated herein by reference to the

Company's Current Report on Form 8-K filed

on October 29, 2013.

98