Neiman Marcus 2014 Annual Report Download - page 31

Download and view the complete annual report

Please find page 31 of the 2014 Neiman Marcus annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Table of Contents

Not applicable.

Subsequent to the Acquisition and the Conversion, our membership unit is privately held and there is no established public trading market for such

unit.

We do not currently intend to pay any dividends, distributions or other similar payments on our membership unit in the foreseeable future. Instead,

we currently intend to use all of our earnings for the operation and growth of our business and the repayment of indebtedness.

We did not declare or pay any dividends, distributions or other amounts on our membership unit in fiscal year 2015 or 2014.

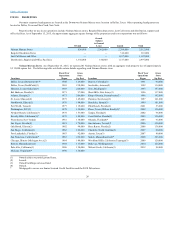

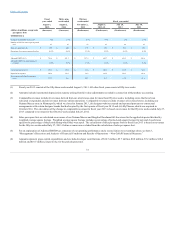

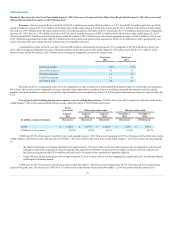

The following selected financial data is qualified in entirety by our Consolidated Financial Statements and the related notes thereto contained in

Item 15 and should be read in conjunction with "Business" in Item 1, "Risk Factors" in Item 1A and “Management’s Discussion and Analysis of Financial

Condition and Results of Operations” in Item 7. Our historical results are not necessarily indicative of results for any future period and results of operations

for interim periods are not necessarily indicative of the results that might be expected for any other interim period or for an entire year.

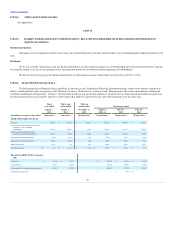

Revenues $ 5,095.1

$ 3,710.2

$ 1,129.1 $ 4,648.2

$ 4,345.4 $ 4,002.3

Cost of goods sold including buying and

occupancy costs (excluding

depreciation) 3,305.5

2,563.0

685.4 2,995.4

2,794.7 2,589.3

Selling, general and administrative

expenses (excluding depreciation) 1,162.1

835.0

266.4 1,047.8

1,006.9 924.3

Income from credit card program (52.8)

(40.7)

(14.7)

(53.4)

(51.6)

(46.0)

Depreciation and amortization (2) 322.8

262.0

46.0 188.9

180.2 194.9

Operating earnings 318.0

8.8

32.1

446.4

403.6 329.7

Net earnings (loss) $ 14.9

$ (134.1)

$ (13.1)

$ 163.7

$ 140.1

$ 31.6

Total assets $ 8,875.8

$ 8,761.7

$ 5,300.2

$ 5,201.9

$ 5,364.8

Total liabilities 7,462.0

7,329.1

4,469.2

4,586.3

4,370.5

Long-term debt, excluding current maturities 4,681.3

4,580.5

2,697.1

2,781.9

2,681.7

Cash dividends per share $ —

$ —

$ —

$ 435.0

$ —

30