Neiman Marcus 2014 Annual Report Download - page 133

Download and view the complete annual report

Please find page 133 of the 2014 Neiman Marcus annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Table of Contents

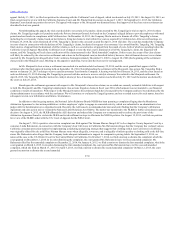

could occur within the next twelve months as a result of settlements with tax authorities or expiration of statutes of limitation. At this time, we do not believe

such adjustments will have a material impact on our Consolidated Financial Statements.

Subsequent to the Acquisition, Parent and its subsidiaries, including the Company, file U.S. federal income taxes as a consolidated group. The

Company has elected to be treated as a corporation for U.S. federal income tax purposes and all operations of Parent are conducted through Holdings and its

subsidiaries, including the Company. Income taxes are presented as if the Company and its subsidiaries are separate taxpayers from Parent. There are no

differences between the Company's and Parent's current and deferred income taxes.

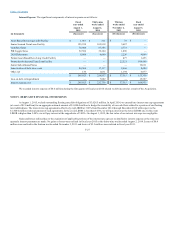

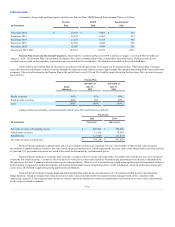

Description of Benefit Plans. We currently maintain defined contribution plans consisting of a retirement savings plan (RSP) and a defined

contribution supplemental executive retirement plan (Defined Contribution SERP Plan). As of January 1, 2011, employees make contributions to the RSP

and we match an employee’s contribution up to a maximum of 6% of the employee’s compensation subject to statutory limitations for a potential maximum

match of 75% of employee contributions. We also sponsor an unfunded key employee deferred compensation plan, which provides certain employees with

additional benefits. Our aggregate expense related to these plans was approximately $30.5 million in fiscal year 2015, $23.5 million for the thirty-nine

weeks ended August 2, 2014, $7.1 million for the thirteen weeks ended November 2, 2013 and $30.4 million in fiscal year 2013.

In addition, we sponsor a defined benefit pension plan (Pension Plan) and an unfunded supplemental executive retirement plan (SERP Plan) which

provides certain employees additional pension benefits. As of the third quarter of fiscal year 2010, benefits offered to all participants in our Pension Plan and

SERP Plan were frozen. Retirees and active employees hired prior to March 1, 1989 are eligible for certain limited postretirement health care benefits

(Postretirement Plan) if they meet certain service and minimum age requirements.

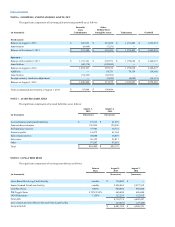

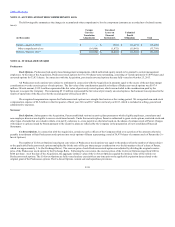

Obligations for our employee benefit plans, included in other long-term liabilities, are as follows:

Pension Plan

$ 218,612

$ 189,890

SERP Plan

111,157

113,787

Postretirement Plan

9,121

10,945

338,890

314,622

Less: current portion

(6,724)

(6,602)

Long-term portion of benefit obligations

$ 332,166

$ 308,020

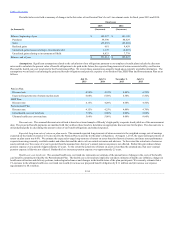

As of August 1, 2015, we have $31.5 million (net of taxes of $20.3 million) of adjustments to state such obligations at fair value recorded as

increases to accumulated other comprehensive loss.

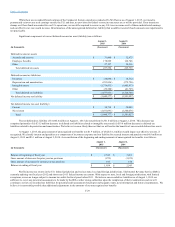

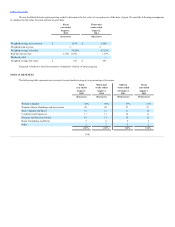

Funding Policy and Status. Our policy is to fund the Pension Plan at or above the minimum level required by law. For fiscal years 2015 and 2014,

we were not required to make contributions to the Pension Plan. As of August 1, 2015, we do not believe we will be required to make contributions to the

Pension Plan for fiscal year 2016. We will continue to evaluate voluntary contributions to our Pension Plan based upon the unfunded position of the Pension

Plan, our available liquidity and other factors.

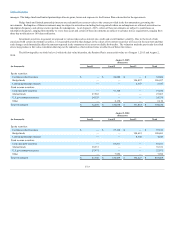

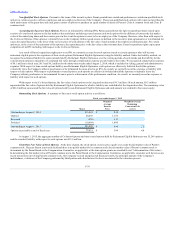

The funded status of our Pension Plan, SERP Plan and Postretirement Plan is as follows:

Projected benefit obligation

$ 612,762

$ 592,918

$ 111,157

$ 113,787

$ 9,121

$ 10,945

Fair value of plan assets

(394,150)

(403,028)

—

—

—

—

Accrued obligation

$ 218,612

$ 189,890

$ 111,157

$ 113,787

$ 9,121

$ 10,945

F-30