Neiman Marcus 2014 Annual Report Download - page 82

Download and view the complete annual report

Please find page 82 of the 2014 Neiman Marcus annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Table of Contents

(collectively the Severance Payment). Ms. Katz is also entitled to continuation of certain benefits for a two-year period (or a one-year period in the case of

non-renewal by us) following a termination of her employment for any reason as set forth more fully in her employment agreement.

For purposes of Ms. Katz’s employment agreement, “cause” is generally defined as one or more of the following: (i) Ms. Katz’s willful and material

failure to substantially perform her duties, or other material breach of her employment agreement; (ii) Ms. Katz’s (A) willful misconduct or (B) gross

negligence, in each case which is materially injurious to the Company or any of our affiliates; (iii) Ms. Katz’s willful breach of her fiduciary duty or duty of

loyalty to the Company or any of our affiliates; or (iv) Ms. Katz’s commission of any felony or other serious crime involving moral turpitude.

For purposes of Ms. Katz’s employment agreement, “good reason” is generally defined as any of the following without Ms. Katz’s consent: (i) a

material failure by the Company to comply with its obligations regarding assumption by a successor, compensation and the related provisions of the

employment agreement; (ii) a material reduction in Ms. Katz’s responsibilities or duties; (iii) any relocation of Ms. Katz’s place of business to a location 50

miles or more from the current location; (iv) the reduction in Ms. Katz’s title or reporting relationships; (v) so long as none of Parent's shares or any successor

are listed on a national securities exchange, any action or inaction by the Company or Parent's shareholders that prevents Ms. Katz from serving on the Parent

Board, other than (A) as required by law, (B) occurs because of a reorganization where Ms. Katz will serve on the board or boards of the successor(s) to our

business, or (C) occurs in connection with the termination of Ms. Katz's employment due to death, by us for cause or disability or by Ms. Katz without good

reason or for retirement; or (vi) our material breach of the employment agreement.

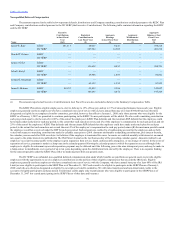

If Ms. Katz retires from the Company, she will be entitled to receive, subject to her execution and non-revocation of a waiver and release agreement,

a lump sum equal to one times the sum of her base salary and target bonus, at the level in effect as of the employment termination date (the Retirement

Payment).

Ms. Katz will be required to repay the Severance Payment or Retirement Payment, as applicable, if she violates certain restrictive covenants in her

agreement or if she is found to have engaged in certain acts of wrongdoing, each as further described in the agreement.

If Ms. Katz’s employment terminates before the end of the term due to her death or “disability” we will pay her or her estate, as applicable, (i) any

unpaid salary through the date of termination and any bonus payable for the preceding fiscal year that has otherwise not already been paid, (ii) any accrued

but unused vacation days, (iii) any reimbursement for business travel and other expenses to which she is entitled, and (iv) an amount of annual incentive pay

equal to a prorated portion of her target bonus amount for the year in which the employment termination date occurs.

Ms. Katz’s agreement also contains obligations on her part regarding non-competition and non-solicitation of employees following the termination

of her employment for any reason, confidential information and non-disparagement of us and our business. The non-competition agreement generally

prohibits Ms. Katz during employment and for a period of two years after termination from becoming a director, officer, employee or consultant for any

competing business that owns or operates a luxury specialty retail store or certain specifically listed businesses. The agreement also requires that she disclose

and assign to us any trademarks or inventions developed by her which relate to her employment by us or to our business.

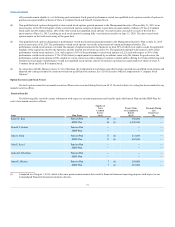

Option Agreement with Ms. Katz

In connection with the Acquisition, the Parent Board granted Ms. Katz 25,099 time-vested stock options that vest on each of the first five

anniversaries of the closing date of the Acquisition, pursuant to a Time-Vested Non-Qualified Stock Option Agreement dated November 5, 2013 (the “Katz

Option Agreement”). Under the terms of the Katz Stock Option Agreement, if Ms. Katz’s employment is terminated by us without cause or by her for good

reason (as both terms are defined above), by reason of our non-renewal of her employment agreement or on account of Ms. Katz’s retirement, then the stock

options that would have vested in the twelve month period following the date of such termination of employment will accelerate and vest. In addition, the

Parent Board granted Ms. Katz 25,099 performance-vested stock options that vest upon our achievement of certain performance hurdles. In connection with a

termination of Ms. Katz's employment by the Company without cause, or by Ms. Katz for any reason other than retirement, Ms. Katz will have 180 days

following the date of termination to exercise vested stock options. In connection with Ms. Katz's retirement, she will have three years to exercise the vested

portion of her time-vested stock options (or four years if an initial public offering at a sufficient price per share occurs within one year following such

retirement). If, following a change in control and prior to an initial public offering, Ms. Katz’s employment is terminated by us without cause or by her for

good reason, she will have the right for 90 days following the date of such termination to cause us to repurchase the outstanding vested portion of her time-

vested and performance-vested stock options.

81