Neiman Marcus 2014 Annual Report Download - page 115

Download and view the complete annual report

Please find page 115 of the 2014 Neiman Marcus annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Table of Contents

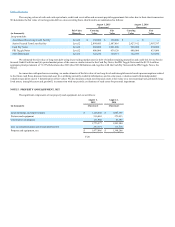

We assess the recoverability of the carrying values of our store assets, consisting of property and equipment, customer lists and favorable lease

commitments, annually and upon the occurrence of certain events. The recoverability assessment requires judgment and estimates of future store generated

cash flows.

Intangible Assets Subject to Amortization. Prior to the Acquisition, Predecessor definite-lived intangible assets, primarily customer lists, were

amortized over their estimated useful lives, ranging from four to 24 years (weighted average life of 13 years from the October 6, 2005 acquisition by the

Former Sponsors). Predecessor favorable lease commitments were amortized over the remaining lives of the leases, ranging from nine to 49 years (weighted

average life of 33 years from the October 6, 2005 acquisition by the Former Sponsors).

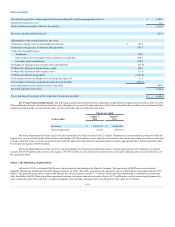

Subsequent to the Acquisition and the MyTheresa acquisition, Successor definite-lived intangible assets, which primarily consist of customer lists,

are amortized using accelerated methods which reflect the pattern in which we receive the economic benefit of the asset, currently estimated at six to 16 years

(weighted average life of 13 years from the respective acquisition dates). Successor favorable lease commitments are amortized straight-line over the

remaining lives of the leases, ranging from two to 55 years (weighted average life of 30 years from the acquisition dates). Total amortization of all intangible

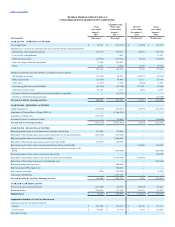

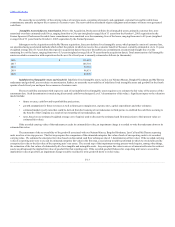

assets recorded in connection with acquisitions for the next five fiscal years is currently estimated as follows (in thousands):

2016 $ 111,681

2017 105,701

2018 99,755

2019 96,631

2020 89,970

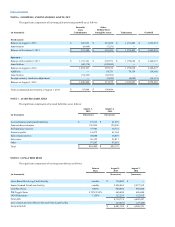

Indefinite-lived Intangible Assets and Goodwill. Indefinite-lived intangible assets, such as our Neiman Marcus, Bergdorf Goodman and MyTheresa

tradenames and goodwill, are not subject to amortization. Rather, we assess the recoverability of indefinite-lived intangible assets and goodwill in the fourth

quarter of each fiscal year and upon the occurrence of certain events.

The recoverability assessment with respect to each of our indefinite-lived intangible assets requires us to estimate the fair value of the asset as of the

assessment date. Such determination is made using discounted cash flow techniques (Level 3 determination of fair value). Significant inputs to the valuation

model include:

• future revenue, cash flow and/or profitability projections;

• growth assumptions for future revenues as well as future gross margin rates, expense rates, capital expenditures and other estimates;

• estimated market royalty rates that could be derived from the licensing of our tradenames to third parties to establish the cash flows accruing to

the benefit of the Company as a result of our ownership of our tradenames; and

• rates, based on our estimated weighted average cost of capital, used to discount the estimated cash flow projections to their present value (or

estimated fair value).

If the recorded carrying value of the tradename exceeds its estimated fair value, an impairment charge is recorded to write the tradename down to its

estimated fair value.

The assessment of the recoverability of the goodwill associated with our Neiman Marcus, Bergdorf Goodman, Last Call and MyTheresa reporting

units involves a two-step process. The first step requires the comparison of the estimated enterprise fair value of each of our reporting units to its recorded

carrying value. We estimate the enterprise fair value based on discounted cash flow techniques (Level 3 determination of fair value). If the recorded carrying

value of a reporting unit were to exceed its estimated enterprise fair value in the first step, a second step would be performed in which we would allocate the

enterprise fair value to the fair value of the reporting unit’s net assets. The second step of the impairment testing process would require, among other things,

the estimation of the fair values of substantially all of our tangible and intangible assets. Any enterprise fair value in excess of amounts allocated to such net

assets would represent the implied fair value of goodwill for that reporting unit. If the recorded goodwill balance for a reporting unit were to exceed the

implied fair value of goodwill, an impairment charge would be recorded to write goodwill down to its fair value.

F-13