Neiman Marcus 2014 Annual Report Download - page 86

Download and view the complete annual report

Please find page 86 of the 2014 Neiman Marcus annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Table of Contents

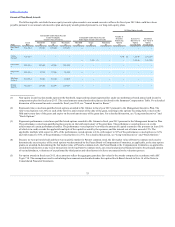

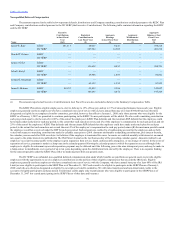

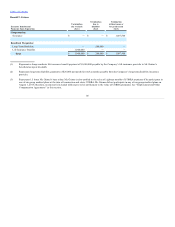

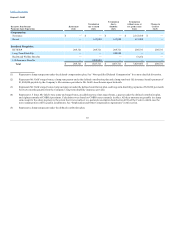

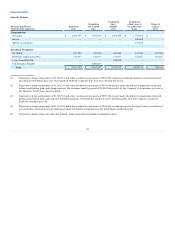

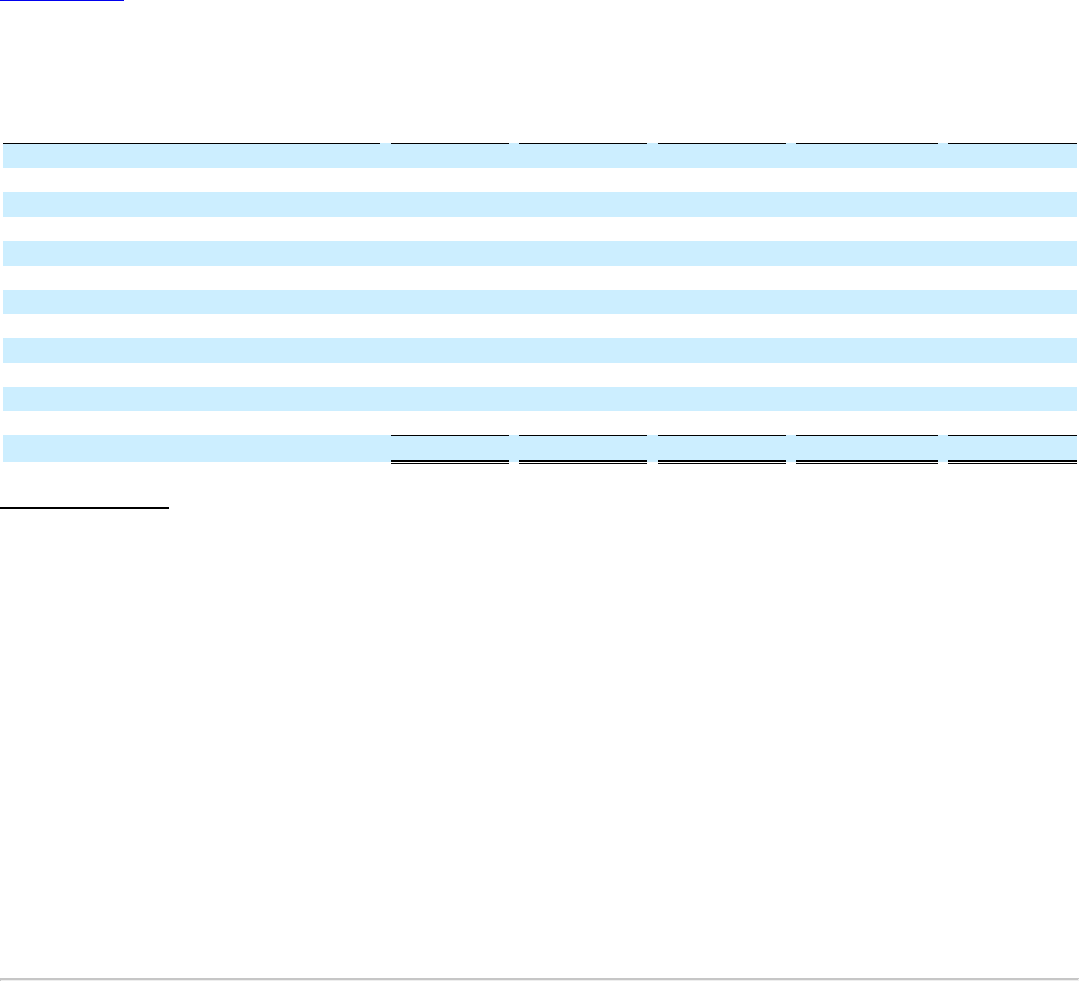

Severance

$ —

$ —

$ —

$ 4,950,000

$ —

Bonus

—

1,375,000

1,375,000

1,375,000

—

Option Acceleration

1,029,059

—

—

1,029,059

4,116,195

Retirement Plan Enhancement

196,000

—

—

—

—

DC SERP

481,318

481,318

481,318

481,318

481,318

Deferred Compensation Plan

394,216

394,216

394,216

394,216

394,216

Long-Term Disability

—

—

240,000

—

—

Health and Welfare Benefits

—

—

—

57,984

—

Life Insurance Benefits

—

1,000,000

—

7,795

—

$ 2,100,593

$ 3,250,534

$ 2,490,534

$ 8,295,372

$ 4,991,729

(1) Represents the SERP Plan enhancement provided in Ms. Katz’s employment agreement, 12 months' acceleration of Ms. Katz's time-vested stock

options, and a lump sum payout under the deferred compensation plans. See “Non-qualified Deferred Compensation” for a more detailed discussion

of the deferred compensation plans.

(2) Represents Ms. Katz’s target bonus (payable in a lump sum), a lump sum payout under the deferred compensation plan and defined contribution

plan, and a lump sum basic life insurance benefit payment of $1,000,000 payable by the Company’s life insurance provider to Ms. Katz’s

beneficiaries upon her death.

(3) Represents Ms. Katz’s target bonus (payable in a lump sum), lump sum payout under the deferred compensation plan and defined contribution plan,

and long-term disability payments of $20,000 per month for twelve months payable from the Company’s long-term disability insurance provider.

(4) Represents a lump sum payment of two times target bonus and two times base salary, an additional one times target bonus (payable in a lump sum),

12 months' acceleration of Ms. Katz's time-vested stock options, and a lump sum payout under the deferred compensation plan and defined

contribution plan. The amount included for health and welfare benefits represents a lump-sum payment equal to the value of 18 months of COBRA

premiums and six months of retiree medical premiums. Calculations were based on COBRA rates currently in effect. The amount included for life

insurance represents coverage for a period of two years at the same benefit level in effect at the time of termination. See “Employment and Other

Compensation Agreements” in this section.

(5) Represents full acceleration of Ms. Katz's time-vested stock options (applicable only in connection with a termination by the Company without

cause or by Ms. Katz for good reason (i) prior to an initial public offering and (ii) following a change in control) and a lump sum payout under the

deferred compensation plan and defined contribution plan.

85