Neiman Marcus 2014 Annual Report Download - page 93

Download and view the complete annual report

Please find page 93 of the 2014 Neiman Marcus annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Table of Contents

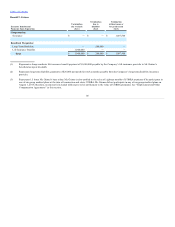

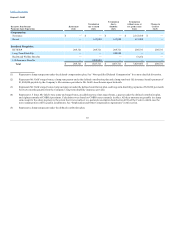

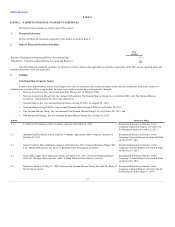

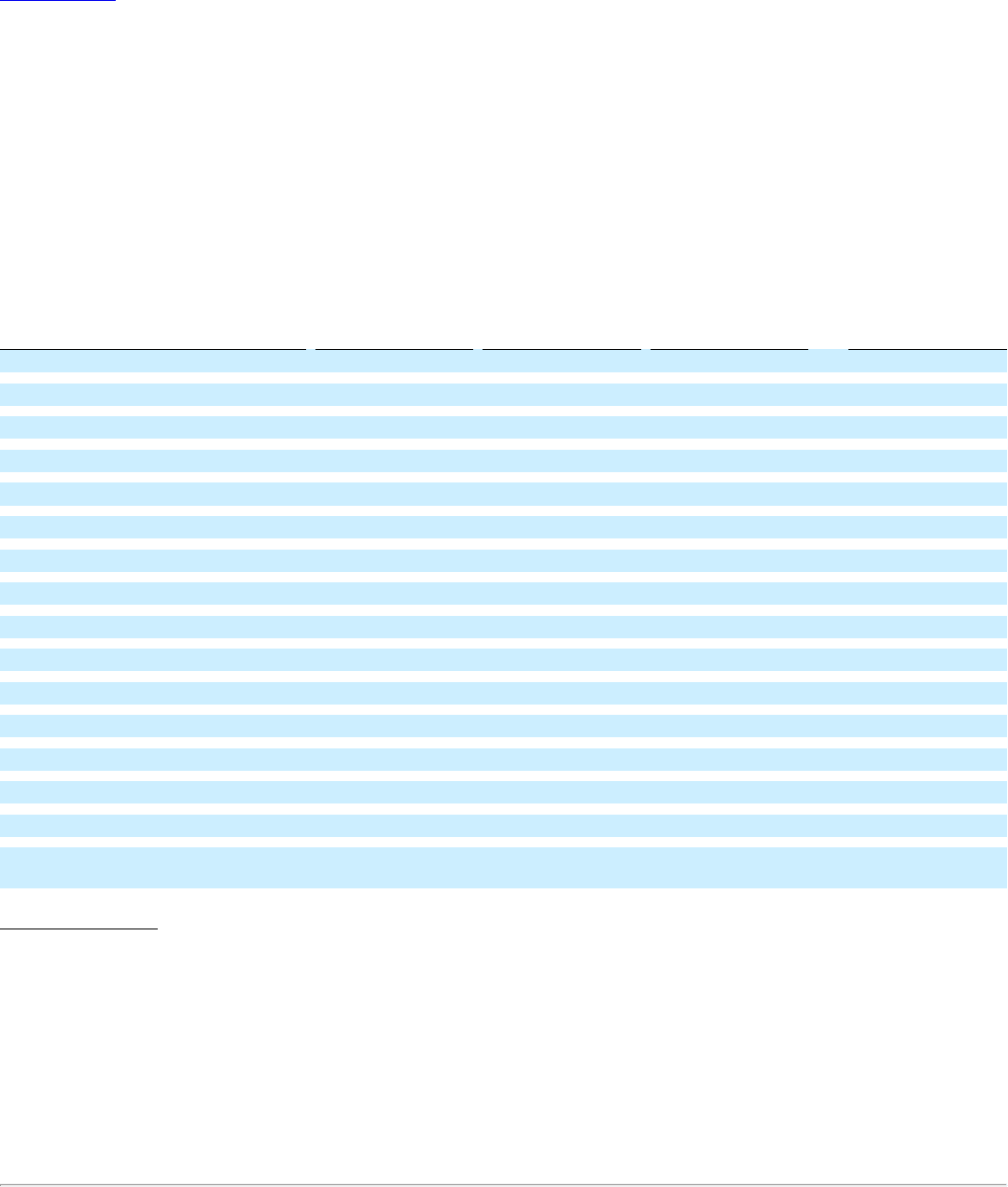

The following table sets forth, as of September 15, 2015, certain information relating to the beneficial ownership of the common stock of Parent, the

sole member of Holdings, which in turn is the sole member of the Company, by (i) each person or group known by us to own beneficially more than 5% of the

outstanding shares of Class A Common Stock and Class B Common Stock, (ii) each of our directors, (iii) each of our named executive officers and (iv) all of

our executive officers and directors as a group. Beneficial ownership for the purposes of the following table is determined in accordance with the rules and

regulations of the SEC. These rules generally provide that a person is the beneficial owner of securities if such person has or shares the power to vote or direct

the voting of securities, or to dispose or direct the disposition of securities or has the right to acquire such powers within 60 days. For purposes of calculating

each person’s percentage ownership, common stock issuable pursuant to options exercisable within 60 days are included as outstanding and beneficially

owned for that person or group, but are not deemed outstanding for the purposes of computing the percentage ownership of any other person. Except as

disclosed in the footnotes to this table and subject to applicable community property laws, we believe, based on the information furnished to us, that each

beneficial owner identified in the table below possesses sole voting and investment power over all common stock shown as beneficially owned by the

beneficial owner. The information in the table below does not necessarily indicate beneficial ownership for any other purpose. The percentages of shares

outstanding provided in the table below are based on 1,557,350 shares of Class A Common Stock and 1,557,350 shares of Class B Common Stock

outstanding as of September 15, 2015.

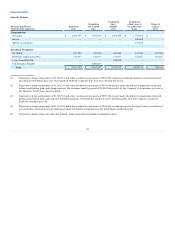

Affiliates of Ares Management, L.P. (3)

907,350

58.26%

1,130,400 (4) 72.58%

CPP Investment Board (USRE) Inc. (5)

907,350

58.26%

684,300

43.94%

Norman Axelrod (6)

—

—

—

—

Nora Aufreiter (6)

—

—

—

—

Phillip Bourguignon (6)

—

—

—

—

David Kaplan (7)

—

—

—

—

Adam Stein (7)

—

—

—

—

Scott Nishi (8)

—

—

—

—

Shane Feeney (8)

—

—

—

—

Adam Brotman (9)

—

—

—

—

Karen W. Katz (10)

29,506

1.86%

29,506

1.86%

Donald T. Grimes

—

—

—

—

James J. Gold (11)

12,252

0.78%

12,252

0.78%

John E. Koryl (12)

6,957

0.44%

6,957

0.44%

Joshua G. Schulman (13)

5,200

0.33%

5,200

0.33%

—

—

—

—

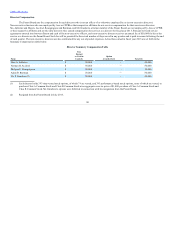

(1) Except as otherwise noted, the address of each beneficial owner is c/o Neiman Marcus, 1618 Main Street, Dallas, Texas 75201.

(2) Pursuant to the terms of the Stockholders Agreement, each of our Sponsors has the right to designate three members of the Parent Board and to

jointly designate two independent members of the Parent Board, in each case for so long as they or their respective affiliates own at least 25% of the

shares of Class A Common Stock that they owned as of the closing of the Acquisition. Each stockholder that is a party to the Stockholders

Agreement has agreed to vote their shares of Parent's common stock in favor of such designees. The Stockholders Agreement also contains

significant transfer restrictions and certain rights of first offer, tag-along rights, and drag-along rights. As a result, each of our Sponsors may be

deemed to be the beneficial owner of the Class A Common Stock and Class B Common Stock directly owned by the other parties to the

Stockholders Agreement, including the other Sponsor. While our Sponsors have shared beneficial ownership of the shares of Parent’s common stock

directly owned by the other parties to the Stockholders Agreement, each of our Sponsors expressly disclaims beneficial ownership of the shares of

Class A Common Stock and Class B Common Stock directly held by the other Sponsor, and, as a result, such shares have not

92