Neiman Marcus 2014 Annual Report Download - page 138

Download and view the complete annual report

Please find page 138 of the 2014 Neiman Marcus annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Table of Contents

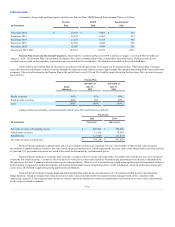

Leases. We lease certain property and equipment under various operating leases. The leases provide for monthly fixed rentals and/or contingent

rentals based upon sales in excess of stated amounts and normally require us to pay real estate taxes, insurance, common area maintenance costs and other

occupancy costs. Generally, the leases have primary terms ranging from three to 99 years and include renewal options ranging from two to 80 years.

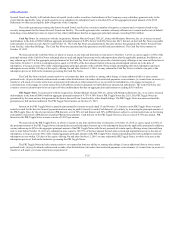

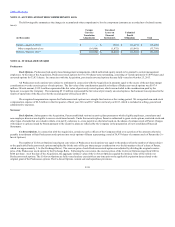

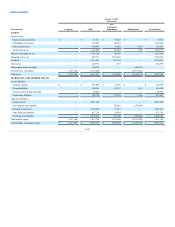

Rent expense and related occupancy costs under operating leases is as follows:

Minimum rent

$ 73,700

$ 47,800

$ 15,200

$ 60,100

Contingent rent

27,700

22,600

6,900

28,200

Other occupancy costs

16,500

9,400

4,000

16,300

Amortization of deferred real estate credits

(800)

(200)

(2,000)

(7,900)

Total rent expense

$ 117,100

$ 79,600

$ 24,100

$ 96,700

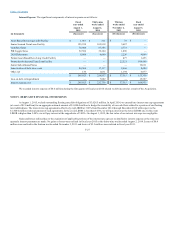

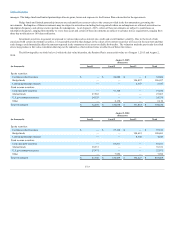

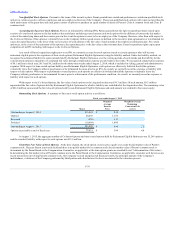

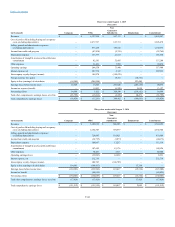

Future minimum rental commitments, excluding renewal options, under non-cancelable leases for the next five fiscal years and thereafter are as

follows (in thousands):

2016 $ 81,200

2017 79,200

2018 77,700

2019 73,700

2020 66,400

Thereafter 1,736,600

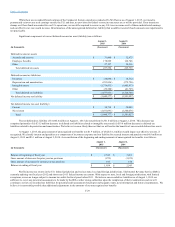

Employment and Consumer Class Actions Litigation On April 30, 2010, a Class Action Complaint for Injunction and Equitable Relief was filed

against the Company, Newton Holding, LLC, TPG Capital, L.P. and Warburg Pincus LLC in the U.S. District Court for the Central District of California by

Sheila Monjazeb, individually and on behalf of other members of the general public similarly situated. On July 12, 2010, all defendants except for the

Company were dismissed without prejudice, and on August 20, 2010, this case was dismissed by Ms. Monjazeb and refiled in the Superior Court of

California for San Francisco County. This complaint, along with a similar class action lawsuit originally filed by Bernadette Tanguilig in 2007, sought

monetary and injunctive relief and alleged that the Company has engaged in various violations of the California Labor Code and Business and Professions

Code, including without limitation, by (i) asking employees to work “off the clock,” (ii) failing to provide meal and rest breaks to its employees,

(iii) improperly calculating deductions on paychecks delivered to its employees and (iv) failing to provide a chair or allow employees to sit during shifts. The

Monjazeb and Tanguilig class actions were deemed “related” cases and were then brought before the same trial court judge. On October 24, 2011, the court

granted the Company’s motion to compel Ms. Monjazeb and Juan Carlos Pinela (a co-plaintiff in the Tanguilig case) to arbitrate their individual claims in

accordance with the Company’s Mandatory Arbitration Agreement, foreclosing their ability to pursue a class action in court. However, the court’s order

compelling arbitration did not apply to Ms. Tanguilig because she is not bound by the Mandatory Arbitration Agreement. Further, the court determined that

Ms. Tanguilig could not be a class representative of employees who are subject to the Mandatory Arbitration Agreement, thereby limiting the putative class

action to those associates who were employed between December 2003 and July 15, 2007 (the effective date of our Mandatory Arbitration Agreement).

Following the court’s order, Ms. Monjazeb and Mr. Pinela filed demands for arbitration with the American Arbitration Association (AAA) seeking to arbitrate

not only their individual claims, but also class claims, which the Company asserted violated the class action waiver in the Mandatory Arbitration Agreement.

This led to further proceedings in the trial court, a stay of the arbitrations, and a decision by the trial court, on its own motion, to reconsider its order

compelling arbitration. The trial court ultimately decided to vacate its order compelling arbitration due to a recent California appellate court decision.

Following this ruling, the Company timely filed two separate appeals, one with respect to Mr. Pinela and one with respect to Ms. Monjazeb, with the

California Court of Appeal, asserting that the trial court did not have jurisdiction to change its earlier determination of the enforceability of the arbitration

agreement. The appeal with respect to Mr. Pinela has been fully briefed, and oral argument was held on June 9, 2015. On June 29, 2015, the California Court

of Appeal issued its order affirming the trial court's denial of our motion to compel arbitration and awarding Mr. Pinela his costs of

F-35