Neiman Marcus 2014 Annual Report Download - page 43

Download and view the complete annual report

Please find page 43 of the 2014 Neiman Marcus annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Table of Contents

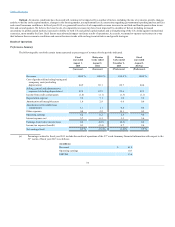

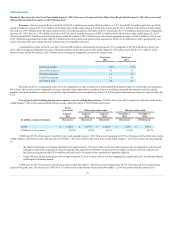

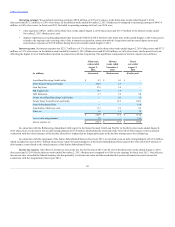

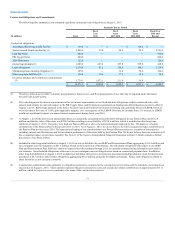

Asset-Based Revolving Credit Facility

$ 1.5

$ 0.3

$ 0.1

Senior Secured Term Loan Facility

125.6

102.8

3.7

Cash Pay Notes

76.8

57.6

2.8

PIK Toggle Notes

52.5

39.3

1.9

2028 Debentures

8.9

6.7

2.2

Former Asset-Based Revolving Credit Facility

—

—

0.5

Former Senior Secured Term Loan Facility

—

—

22.5

Amortization of debt issue costs

24.6

17.1

2.5

Other, net

0.1

1.0

1.2

$ 289.9

$ 224.9

$ 37.3

Loss on debt extinguishment

—

7.9

—

Interest expense, net

$ 289.9

$ 232.7

$ 37.3

In connection with the Refinancing Amendment (as defined below) with respect to the Senior Secured Term Loan Facility in fiscal year 2014, we

incurred a loss on debt extinguishment of $7.9 million, which primarily consisted of the write-off of debt issuance costs incurred in connection with the

initial issuance of the facility allocable to lenders that did not participate in the facility subsequent to the refinancing.

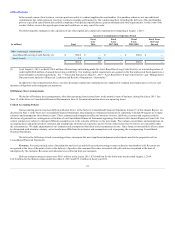

Income tax expense. Our effective income tax rate for fiscal year 2015 was 46.8% compared to 40.1% for the thirty-nine weeks ended August 2,

2014 (Successor) and 152.9% for the thirteen weeks ended November 2, 2013 (Predecessor). Our effective income tax rate for fiscal year 2015 exceeded the

federal statutory tax rate due primarily to:

• the non-deductible portion of transaction and other costs incurred in connection with the MyTheresa acquisition; and

• state income taxes.

Our effective income tax rate for thirty-nine weeks ended August 2, 2014 (Successor) and thirteen weeks ended November 2, 2013 (Predecessor)

exceeded the federal statutory tax rate due primarily to:

• the non-deductible portion of transaction costs incurred in connection with the Acquisition; and

• state income taxes.

While our future effective income tax rate will depend on the factors described above, we currently anticipate that our effective income tax rate in

future periods will be closer to our historical effective income tax rate of approximately 39.2%.

We file income tax returns in the U.S. federal jurisdiction and various state, local and foreign jurisdictions. The Internal Revenue Service (IRS) is

currently auditing our fiscal year 2012 and short-year 2013 federal income tax returns. With respect to state, local and foreign jurisdictions, with limited

exceptions, we are no longer subject to income tax audits for fiscal years before 2011. We believe our recorded tax liabilities as of August 1, 2015 are

sufficient to cover any potential assessments to be made by the IRS or other taxing authorities upon the completion of their examinations and we will

continue to review our recorded tax liabilities for potential audit assessments based upon subsequent events, new information and future circumstances. We

believe it is reasonably possible that additional adjustments in the amounts of our unrecognized tax benefits could occur within the next twelve months as a

result of settlements with tax authorities or expiration of statutes of limitation. At this time, we do not believe such adjustments will have a material impact

on our Consolidated Financial Statements.

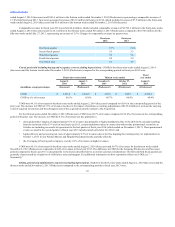

Results of Operations for the Thirty-Nine Weeks Ended August 2, 2014 (Successor) and Thirteen Weeks Ended November 2, 2013 (Predecessor) Compared

to the Fiscal Year Ended August 3, 2013 (Predecessor)

Revenues. Our revenues increased by $191.1 million, or 4.1%, to $4,839.3 million in fiscal year 2014, which included revenues of $3,710.2 million

in the thirty-nine weeks ended August 2, 2014 (Successor) and $1,129.1 million in the thirteen weeks ended November 2, 2013 (Predecessor), from $4,648.2

million in fiscal year 2013. Revenues generated by our online operations in fiscal year 2014 were $1,154.2 million, which included revenues of $912.6

million in the thirty-nine weeks

42