Neiman Marcus 2014 Annual Report Download - page 55

Download and view the complete annual report

Please find page 55 of the 2014 Neiman Marcus annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Table of Contents

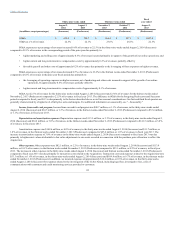

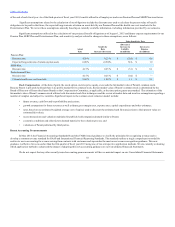

Indefinite-lived Intangible Assets and Goodwill. Indefinite-lived intangible assets, such as tradenames and goodwill, are not subject to

amortization. Rather, we assess the recoverability of indefinite-lived intangible assets and goodwill in the fourth quarter of each fiscal year and upon the

occurrence of certain events.

The recoverability assessment with respect to each of our indefinite-lived intangible assets requires us to estimate the fair value of the asset as of the

assessment date. Such determination is made using discounted cash flow techniques. Significant inputs to the valuation model include:

• future revenue, cash flow and/or profitability projections;

• growth assumptions for future revenues as well as future gross margin rates, expense rates, capital expenditures and other estimates;

• estimated market royalty rates that could be derived from the licensing of our tradenames to third parties to establish the cash flows accruing to

the benefit of the Company as a result of our ownership of our tradenames; and

• rates, based on our estimated weighted average cost of capital, used to discount the estimated cash flow projections to their present value (or

estimated fair value).

If the recorded carrying value of the tradename exceeds its estimated fair value, an impairment charge is recorded to write the tradename down to its

estimated fair value. We currently estimate that the fair value of our tradenames decreases by approximately $421 million for each 0.5% decrease in market

royalty rates and by approximately $108 million for each 0.25% increase in the weighted average cost of capital.

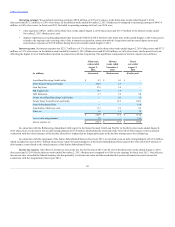

The assessment of the recoverability of the goodwill associated with our Neiman Marcus, Bergdorf Goodman, Last Call and MyTheresa reporting

units involves a two-step process. The first step requires the comparison of the estimated enterprise fair value of each of our reporting units to its recorded

carrying value. We estimate the enterprise fair value based on discounted cash flow techniques. If the recorded carrying value of a reporting unit were to

exceed its estimated enterprise fair value in the first step, a second step would be performed in which we would allocate the enterprise fair value to the fair

value of the reporting unit’s net assets. The second step of the impairment testing process would require, among other things, the estimation of the fair values

of substantially all of our tangible and intangible assets. Any enterprise fair value in excess of amounts allocated to such net assets would represent the

implied fair value of goodwill for that reporting unit. If the recorded goodwill balance for a reporting unit were to exceed the implied fair value of goodwill,

an impairment charge would be recorded to write goodwill down to its fair value. We currently estimate that a 5% decrease in the estimated fair value of the

net assets of each of our reporting units as compared to the values used in the preparation of these financial statements would decrease the excess of fair value

over the carrying value by approximately $348 million. In addition, we currently estimate that the fair value of our goodwill decreases by approximately

$299 million for each 0.25% increase in the discount rate used to estimate fair value.

The impairment testing process related to our indefinite-lived intangible assets is subject to inherent uncertainties and subjectivity. The use of

different assumptions, estimates or judgments with respect to the estimation of the projected future cash flows and the determination of the discount rate used

to reduce such projected future cash flows to their net present value could materially increase or decrease any related impairment charge. We believe our

estimates are appropriate based upon current market conditions and the best information available at the assessment date. However, future impairment

charges could be required if we do not achieve our current revenue and profitability projections or the weighted average cost of capital increases.

Leases. We lease certain retail stores and office facilities. Stores we own are often subject to ground leases. The terms of our real estate leases,

including renewal options, range from three to 130 years. Most leases provide for monthly fixed minimum rentals or contingent rentals based upon sales in

excess of stated amounts and normally require us to pay real estate taxes, insurance, common area maintenance costs and other occupancy costs. For leases

that contain predetermined, fixed calculations of minimum rentals, we recognize rent expense on a straight-line basis over the lease term. We recognize

contingent rent expenses when it is probable that the sales thresholds will be reached during the year.

Benefit Plans. We sponsor a defined benefit Pension Plan, an unfunded supplemental executive retirement plan (SERP Plan) which provides certain

employees additional pension benefits and a postretirement plan providing eligible employees limited postretirement health care benefits (Postretirement

Plan). In calculating our obligations and related expense, we make various assumptions and estimates, after consulting with outside actuaries and advisors.

The annual determination of expense involves calculating the estimated total benefits ultimately payable to plan participants. We use the traditional unit

credit method in recognizing pension liabilities. The Pension Plan, SERP Plan and Postretirement Plan are valued annually as

54