Neiman Marcus 2014 Annual Report Download - page 32

Download and view the complete annual report

Please find page 32 of the 2014 Neiman Marcus annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Table of Contents

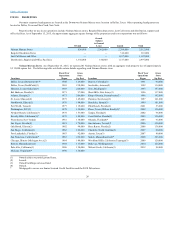

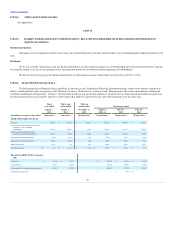

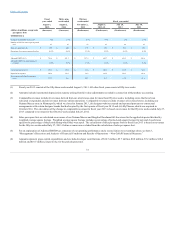

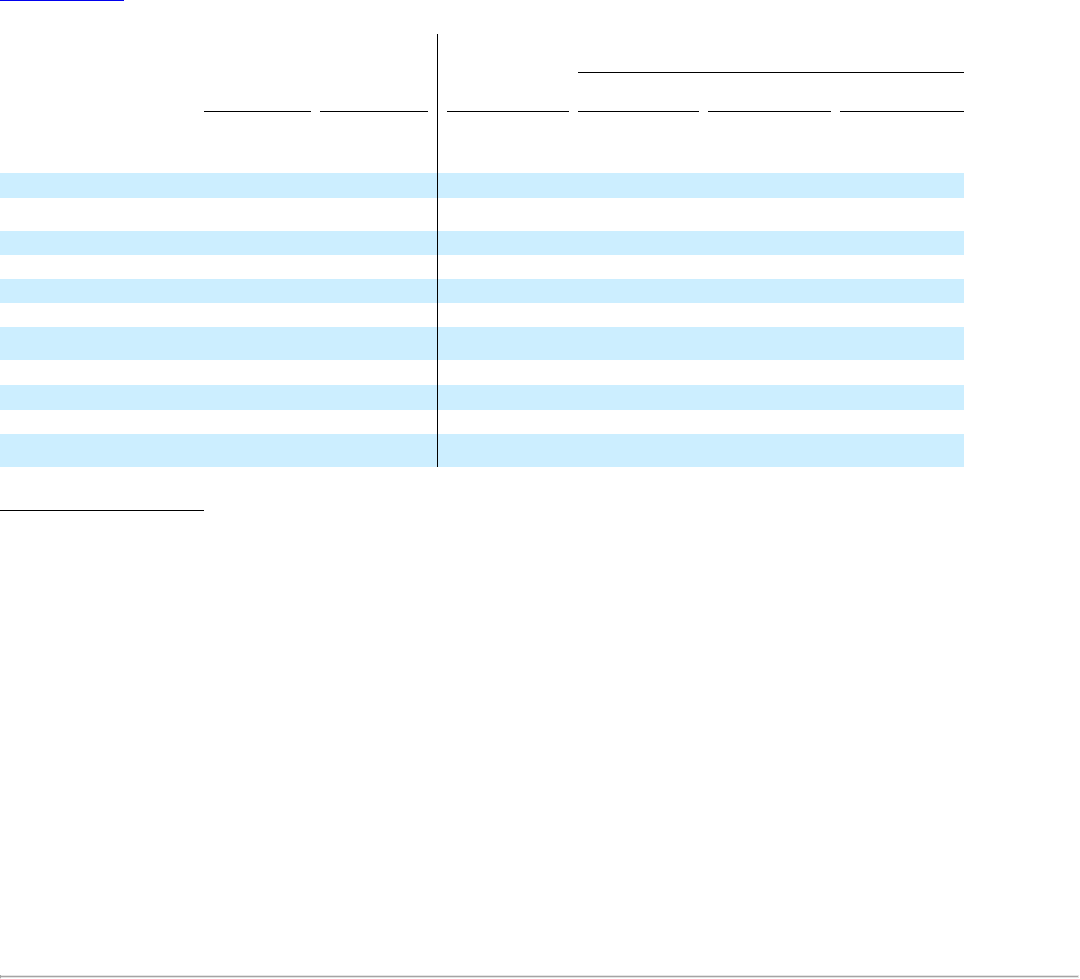

Change in comparable revenues (3) 3.9%

5.4%

5.7%

4.9%

7.9%

8.1%

Number of full-line stores open at period

end 43

43

43

43

44

43

Sales per square foot (4) $ 590

$ 440

$ 138

$ 552

$ 535

$ 505

Percentage of revenues transacted online 26.3%

24.6%

21.4%

22.2%

20.2%

18.9%

Adjusted EBITDA (5) $ 710.6

$ 501.3

$ 197.2

$ 682.7

$ 619.5

$ 544.6

Adjusted EBITDA as a percentage of

revenues 13.9%

13.5%

17.5%

14.7%

14.3%

13.6%

Capital expenditures (6) $ 270.5

$ 138.0

$ 36.0

$ 146.5

$ 152.8

$ 94.2

Depreciation expense 185.6

113.3

34.2

141.5

130.1

132.4

Rent expense and related occupancy

costs 117.1

79.6

24.1

96.7

91.9

87.6

(1) Fiscal year 2013 consists of the fifty-three weeks ended August 3, 2013. All other fiscal years consist of fifty-two weeks.

(2) Amounts include incremental depreciation expense arising from fair value adjustments recorded in connection with purchase accounting.

(3) Comparable revenues include (i) revenues derived from our retail stores open for more than fifty-two weeks, including stores that have been

relocated or expanded, and (ii) revenues from our online operations. Comparable revenues exclude revenues of (i) closed stores, including our

Neiman Marcus store in Minneapolis, which we closed in January 2013, (ii) designer websites created and operated pursuant to contractual

arrangements with certain designer brands that had expired by the first quarter of fiscal year 2015 and (iii) MyTheresa, which was acquired in

October 2014. The calculation of the change in comparable revenues for fiscal year 2013 is based on revenues for the fifty-two weeks ended July 27,

2013 compared to revenues for the fifty-two weeks ended July 28, 2012.

(4) Sales per square foot are calculated as revenues of our Neiman Marcus and Bergdorf Goodman full-line stores for the applicable period divided by

weighted average square footage. Weighted average square footage includes a percentage of period-end square footage for new and closed stores

equal to the percentage of the period during which they were open. The calculation of sales per square foot for fiscal year 2013 is based on revenues

for the fifty-two weeks ended July 27, 2013. Online revenues are excluded from the calculation of sales per square foot.

(5) For an explanation of Adjusted EBITDA as a measure of our operating performance and a reconciliation to net earnings (loss), see Item 7,

“Management’s Discussion and Analysis of Financial Condition and Results of Operations —Non-GAAP Financial Measures.”

(6) Amounts represent gross capital expenditures and exclude developer contributions of $34.7 million, $5.7 million, $0.0 million, $7.2 million, $10.6

million and $10.5 million, respectively, for the periods presented.

31