Neiman Marcus 2014 Annual Report Download - page 81

Download and view the complete annual report

Please find page 81 of the 2014 Neiman Marcus annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Table of Contents

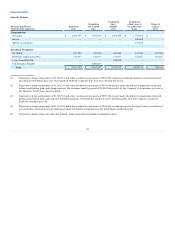

participant in the DC SERP on January 1, 2008. The amount of a transitional credit is the product of a participant’s eligible compensation in excess of the

IRS Limit and an applicable percentage ranging from 0% to 6% depending upon the age of the participant. Non-transitional credits apply to all eligible

participants. The amount of a non-transitional credit is the product of a participant’s eligible compensation in excess of the IRS Limit and 10.5%. All

transitional and non-transitional credits are credited to a bookkeeping account and vest upon the earlier of (i) an eligible employee’s attainment of five years

of service, (ii) an eligible employee’s attainment of age 65, (iii) an eligible employee’s death, (iv) an eligible employee’s "disability," and (v) a change of

control (as defined in the DC SERP) while in our employ. Notwithstanding the preceding, amounts credited to an account are subject to forfeiture if the

employee is terminated for cause. Accounts are credited monthly with interest at an annual rate equal to the prime interest rate published in The Wall Street

Journal on the last business day of the preceding calendar quarter. Vested amounts credited to an employee’s account become payable in the form of five

annual installments beginning upon the later of the employee’s separation from service and age 55, or such later age as the employee may elect. Upon the

employee’s death or “disability” or upon our change of control, vested amounts credited to an employee’s account will be paid in a single lump sum.

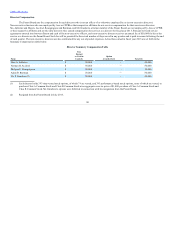

We have entered into employment agreements with Karen W. Katz, Donald T. Grimes, James J. Gold and James E. Skinner. Each of Messrs. Koryl and

Schulman is a party to a confidentiality, non-competition and termination benefits agreement, discussed below.

Employment Agreement with Ms. Katz

In connection with the Acquisition, we entered into a new employment agreement with Karen W. Katz which became effective on October 25, 2013

and will extend until the fourth anniversary thereof and thereafter be subject to automatic one-year renewals of the term if neither party submits a notice of

termination at least three months prior to the end of the then-current term. The agreement may be terminated by either party on three months’ notice, subject

to severance obligations in the event of termination under certain circumstances described herein. Pursuant to the agreement, Ms. Katz's base salary will not

be less than $1,070,000 unless the reduction is pursuant to a reduction in the annual salaries of all senior executives by substantially equal amounts or

percentages.

Ms. Katz’s agreement also provides that she will participate in our annual incentive bonus plan. The actual amounts will be determined according to

the terms of the annual incentive bonus program and will be payable at the discretion of the Compensation Committee. However, Ms. Katz’s agreement

provides for a minimum bonus of 50% of her base salary if threshold performance targets are achieved. If applicable goals are met at target level she will be

entitled to 125% of base salary while her maximum bonus will be 250% of base salary contingent on the applicable goals being met.

Additionally, Ms. Katz is entitled to receive reimbursement of up to $5,000 for financial and tax planning advice as well as a lump sum cash

payment during each year of the employment term in the amount of $15,000 in lieu of any reimbursement of hotel or other lodging expenses incurred in

connection with business trips to New York, plus an amount necessary to gross-up such payment for income tax purposes. Ms. Katz's agreement also provides

for reimbursement of liability for any New York state and city taxes, on an after-tax basis.

The agreement provides that if (i) during the term, her employment is terminated by the Company for any reason other than death, “disability,” or

“cause” (as defined in the employment agreement), (ii) during the term, she terminates her employment for “good reason” or “retirement” (as defined in the

employment agreement), or (iii) her employment terminates upon expiration of the term following the provision by us of a notice of non-renewal, and, in any

such case, on the date of such termination she has not yet reached age 65, her SERP Plan benefit shall not be reduced according to the terms of the SERP Plan

solely by reason of her failure to reach age 65 as of the termination date. During the employment term, she will accrue benefits under the DC SERP, provided

that the amounts credited to her account as of the last day of her employment term shall not be less than the present value of the additional benefits she would

have accrued under the SERP Plan had it remained in effect.

If we terminate Ms. Katz’s employment without “cause” or if she resigns for “good reason” or following her receipt of a notice of non-renewal from

us relating to the employment term, she will be entitled to receive, subject to her execution and non-revocation of a waiver and release agreement, (i) an

amount of annual incentive pay equal to a prorated portion of her target bonus amount for the year in which the employment termination date occurs, and (ii)

a lump sum equal to (A) 18 times (or 12 times in the case of non-renewal by us) the monthly COBRA premium applicable to Ms. Katz, plus (B) six times the

monthly premium if Ms. Katz elected coverage as a retiree under our group medical plan for retired employees in effect under our group medical plan, other

than in the case of non-renewal by us, plus (C) two times (or one times in the case of non-renewal by us) the sum of her base salary and target bonus, at the

level in effect as of the employment termination date

80