Neiman Marcus 2014 Annual Report Download - page 135

Download and view the complete annual report

Please find page 135 of the 2014 Neiman Marcus annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Table of Contents

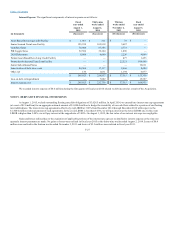

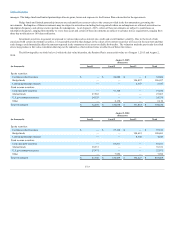

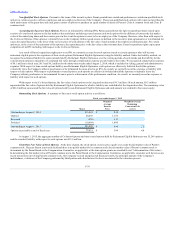

A summary of expected benefit payments related to our Pension Plan, SERP Plan and Postretirement Plan is as follows:

Fiscal year 2016

$ 23,988

$ 6,086

$ 638

Fiscal year 2017

25,592

6,485

633

Fiscal year 2018

27,207

6,755

643

Fiscal year 2019

28,702

6,840

585

Fiscal year 2020

30,109

6,989

561

Fiscal years 2021-2025

169,710

35,782

2,693

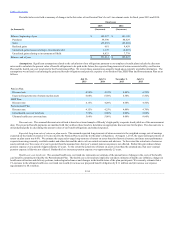

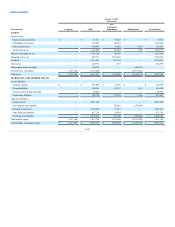

Pension Plan Assets and Investment Valuations. Assets held by our Pension Plan were $394.2 million at August 1, 2015 and $403.0 million at

August 2, 2014. The Pension Plan’s investments are stated at fair value or estimated fair value, as more fully described below. Purchases and sales of

securities are recorded on the trade date. Interest income is recorded on the accrual basis. Dividends are recorded on the ex-dividend date.

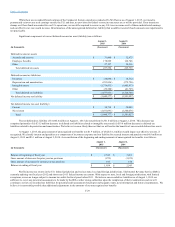

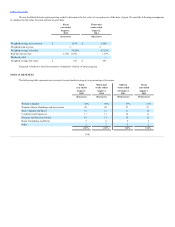

Assets held by our Pension Plan are invested in accordance with the provisions of our approved investment policy. The Pension Plan’s strategic

asset allocation was structured to reduce volatility through diversification and enhance return to approximate the amounts and timing of the expected benefit

payments. The asset allocation for our Pension Plan at the end of fiscal years 2015 and 2014 and the target allocation for fiscal year 2016, by asset category,

are as follows:

Equity securities

60%

62%

60%

Fixed income securities

40%

38%

40%

Total

100%

100%

100%

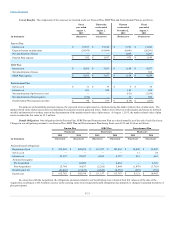

Changes in the assets held by our Pension Plan in fiscal years 2015 and 2014 are as follows:

Fair value of assets at beginning of year

$ 403,028

$ 385,838

Actual return on assets

12,569

38,865

Benefits paid

(21,447)

(21,675)

Fair value of assets at end of year

$ 394,150

$ 403,028

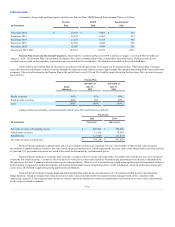

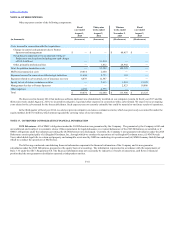

Pension Plan investments in mutual funds and U.S. government securities are classified as Level 1 investments within the fair value hierarchy.

Investments in mutual funds are valued at fair value based on quoted market prices, which represent the net asset value of the shares held by the Pension Plan

at year-end. U.S. government securities are stated at fair value as determined by quoted market prices.

Pension Plan investments in corporate debt securities, common/collective trusts and certain other investments are classified as Level 2 investments

within the fair value hierarchy. Common/collective trusts are valued at net asset value based on the underlying investments of such trust as determined by

the sponsor of the trust. Common/collective trusts can be redeemed daily. Other Level 2 investments are valued using updated quotes from market makers or

broker-dealers recognized as market participants, information from market sources integrating relative credit information, observed market movements and

sector news, all of which is applied to pricing applications and models.

Pension Plan investments in hedge funds and limited partnership interests are classified as Level 3 investments within the fair value hierarchy.

Hedge funds are valued at estimated fair value based on net asset value as determined by the respective fund manager based on the valuation of the

underlying securities. Limited partnership interests in venture capital investments are valued at estimated fair value based on net asset value as determined

by the respective fund investment

F-32