Neiman Marcus 2014 Annual Report Download - page 33

Download and view the complete annual report

Please find page 33 of the 2014 Neiman Marcus annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Table of Contents

The following discussion and analysis of our financial condition and results of operations should be read in conjunction with our Consolidated

Financial Statements and related notes contained in Item 15. Unless otherwise specified, the meanings of all defined terms in Management’s Discussion and

Analysis of Financial Condition and Results of Operations (MD&A) are consistent with the meanings of such terms as defined in the Notes to Consolidated

Financial Statements in Item 15. This discussion contains forward-looking statements. Please see “Special Note Regarding Forward-Looking Statements” for

a discussion of the risks, uncertainties and assumptions relating to our forward-looking statements.

The Company is a subsidiary of Neiman Marcus Group, Inc. (f/k/a NM Mariposa Holdings, Inc.), a Delaware corporation (Parent), which is owned by

entities affiliated with Ares Management, L.P. and Canada Pension Plan Investment Board (together, the Sponsors) and certain co-investors. The Company’s

operations are conducted through its wholly owned subsidiary, The Neiman Marcus Group LLC (NMG). The Sponsors acquired the Company on October 25,

2013 (the Acquisition). Prior to the Acquisition, we were owned by Newton Holding, LLC, which was controlled by investment funds affiliated with TPG

Global, LLC (collectively with its affiliates, TPG) and Warburg Pincus LLC (together with TPG, the Former Sponsors). References made to "we," "our" and

"us" are used to refer to the Company or collectively to the Company and its subsidiaries, as appropriate to the context.

We are a luxury retailer conducting operations principally under the Neiman Marcus, Bergdorf Goodman and MyTheresa brand names. We believe

that our customers have allocated a higher portion of their luxury spending to online retailing in recent years and that our customers increasingly expect a

seamless shopping experience across our in-store and online channels, and we expect these trends to continue for the foreseeable future. As a result, we have

made investments and redesigned processes to integrate our shopping experience across channels so that it is consistent with our customers' shopping

preferences and expectations. In particular, we have invested and continue to invest in technology and systems that further our omni-channel retailing

capabilities, and in fiscal year 2014, we realigned the management and merchandising responsibilities for our Neiman Marcus brand on an omni-channel

basis. With the acceleration of omni-channel retailing and our past and ongoing investments in our omni-channel retail model, we believe the growth in our

total comparable revenues and results of operations are the best measures of our ongoing performance. As a result, effective August 3, 2014, we began

viewing and reporting our specialty retail stores and online operations as a single, omni-channel reporting segment.

The accompanying Consolidated Financial Statements are presented as “Predecessor” or “Successor” to indicate whether they relate to the period

preceding the Acquisition or the period succeeding the Acquisition, respectively. The Acquisition and the allocation of the purchase price have been

recorded for accounting purposes as of November 2, 2013, the end of our first quarter of fiscal year 2014.

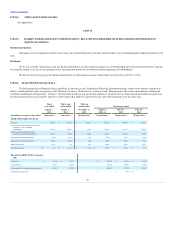

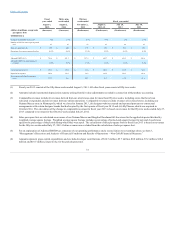

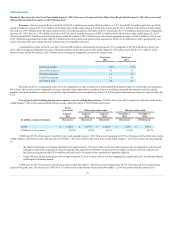

We have prepared our presentation and discussion of the results of operations for the fiscal year ended August 1, 2015 in accordance with the rules

and regulations of the SEC by comparing the results of operations of the Successor for the fiscal year ended August 1, 2015 to the results of operations of the

Successor for the thirty-nine weeks ended August 2, 2014 and the results of operations of the Predecessor for the thirteen week period ended November 2,

2013. In addition, in some cases we have also prepared our presentation and discussion of the results of operations for the fiscal year ended August 1, 2015 by

comparing (i) the results of operations of the Successor for the thirty-nine weeks ended August 1, 2015 to the results of operations of the Successor for the

thirty-nine weeks ended August 2, 2014 and (ii) the results of operations of the Successor for the thirteen weeks ended November 1, 2014 to the results of

operations of the Predecessor for the thirteen weeks ended November 2, 2013. We have included this additional disclosure because we believe that it assists

readers in understanding and assessing the trends and significant changes in our results of operations and provides a more meaningful method of comparison,

in part by minimizing the effect that seasonality has on our results of operations when comparing periods comprised of different portions of the calendar year.

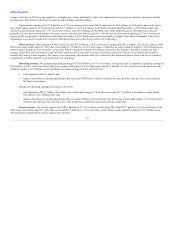

Our fiscal year ends on the Saturday closest to July 31. Like many other retailers, we follow a 4-5-4 reporting calendar, which means that each fiscal

quarter consists of thirteen weeks divided into periods of four weeks, five weeks and four weeks. This resulted in an extra week in fiscal year 2013 (the 53rd

week). All references to (i) fiscal year 2015 relate to the fifty-two weeks ended August 1, 2015, (ii) fiscal year 2014 relate to the fifty-two weeks ended

August 2, 2014, comprised of the thirty-nine weeks ended August 2, 2014 (Successor) and the thirteen weeks ended November 2, 2013 (Predecessor), and (iii)

fiscal year 2013 relate to the fifty-three weeks ended August 3, 2013. References to fiscal year 2012 and years preceding and fiscal year 2016 and years

thereafter relate to our fiscal years for such periods. Certain amounts presented in tables are subject to rounding adjustments and, as a result, the totals in such

tables may not sum.

32