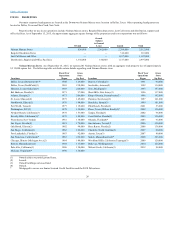

Neiman Marcus 2014 Annual Report Download - page 21

Download and view the complete annual report

Please find page 21 of the 2014 Neiman Marcus annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Table of Contents

us or our importers, designers, manufacturers, distributors or other business partners, or if the interpretation of these laws, rules or regulations changes, we

could experience delays in shipments and receipt of merchandise, suffer damage to our reputation or be subject to fines or other penalties under the

controlling regulations, any of which could adversely affect our business or results of operations.

If we are unable to enforce our intellectual property rights, if we are accused of infringing a third party’s intellectual property rights, or if the merchandise

we purchase from vendors is alleged to have infringed a third party’s intellectual property rights, our business or results of operations may be adversely

affected.

Our future success and competitive position depend in part on our ability to maintain and protect our brand. We and our subsidiaries currently own

various intellectual property rights in the United States and in various foreign jurisdictions, including our trademarks, tradenames and service marks, such as

the “Neiman Marcus,” “Bergdorf Goodman” and “mytheresa” marks, that differentiate us from our competitors. We currently rely on a combination of

copyright, trademark, trade dress and unfair competition laws to establish and protect our intellectual property and other proprietary rights, but the steps we

take to protect such rights may be inadequate to prevent infringement of our trademarks and proprietary rights by others. Such unauthorized use of our

trademarks, trade secrets, or other proprietary rights may cause significant damage to our brand and have an adverse effect on our business. In addition, the

laws of some foreign countries do not protect proprietary rights to the same extent as do the laws of the United States and there can be no assurance that we

are adequately protected in all countries or that we will prevail when defending our trademark or proprietary rights. The loss or reduction of any of our

significant intellectual property or proprietary rights could have an adverse effect on our business.

Additionally, third parties may assert claims against us alleging infringement, misappropriation or other violations of their intellectual property or

other proprietary rights, whether or not the claims have merit. Such claims could be time consuming and expensive to defend and may divert management’s

attention and resources. This could have an adverse effect on our business or results of operations and cause us to incur significant litigation costs and

expenses. In addition, resolution of such claims may require us to cease using the relevant intellectual property or other rights or selling the allegedly

infringing products, or to license rights from third parties.

We purchase merchandise from vendors that may incorporate protected intellectual property, and we do not independently investigate whether these

vendors legally hold intellectual property rights to merchandise that they are manufacturing or distributing. As a result, we rely upon the vendors’

representations and indemnifications set forth in our purchase orders and supplier agreements concerning their right to sell us the products that we purchase

from them. If a third party claims to have rights with respect to merchandise we purchased from a vendor, or if we acquire unlicensed merchandise, we could

be obligated to remove such merchandise from our stores, incur costs associated with destruction of such merchandise if the distributor or vendor is unwilling

or unable to reimburse us and be subject to liability under various civil and criminal causes of action, including actions to recover unpaid royalties and other

damages and injunctions. Any of these results could harm our brand image and have a material adverse effect on our business and growth.

Claims under our insurance plans and policies may differ from our estimates, which could adversely affect our results of operations.

We use a combination of insurance and self‑insurance plans to provide for potential liabilities for workers’ compensation, general liability, business

interruption, property and directors’ and officers’ liability insurance, vehicle liability and employee health-care benefits. Our insurance coverage may not be

sufficient, and any insurance proceeds may not be timely paid to us. In addition, liabilities associated with the risks that are retained by us are estimated, in

part, by considering historical claims experience, demographic factors, severity factors and other actuarial assumptions, and our business, financial condition

and results of operations may be adversely affected if such assumptions are incorrect.

Our high level of fixed lease obligations could adversely affect our business, financial condition and results of operations.

Our high level of fixed lease obligations will require us to use a significant portion of cash generated by our operations to satisfy these obligations

and could adversely affect our ability to obtain future financing to support our growth or other operational investments. We will require substantial cash

flows from operations to make our payments under our operating leases, which in some cases provide for periodic adjustments in our rent rates. If we are not

able to make the required payments under the leases, the owners of or lenders with a security interest in the relevant stores, distribution centers or

administrative offices may, among other things, repossess those assets, which could adversely affect our ability to conduct our operations. In addition, our

failure to make payments under our operating leases could trigger defaults under other leases or under agreements governing our indebtedness, which could

cause the counterparties under those agreements to accelerate the obligations due thereunder.

20