Neiman Marcus 2014 Annual Report Download - page 50

Download and view the complete annual report

Please find page 50 of the 2014 Neiman Marcus annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Table of Contents

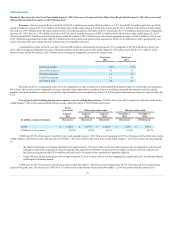

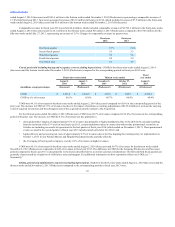

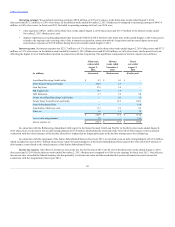

in the Acquisition and thirty-nine weeks ended August 2, 2014 (Successor) of approximately $147.3 million to fund costs and expenses incurred in

connection with the Acquisition, partially offset by (ii) a $101.9 million increase in cash requirements for income taxes and interest. The decrease in net cash

provided by operating activities in fiscal year 2015 compared to the thirty-nine weeks ended August 2, 2014 (Successor) and the thirteen weeks ended

November 2, 2013 (Predecessor) is due primarily to the factors described above.

Net cash used for investing activities was $452.2 million in fiscal year 2015 compared to $3,491.6 million in the Acquisition and thirty-nine weeks

ended August 2, 2014 (Successor) and $36.0 million in the thirteen weeks ended November 2, 2013 (Predecessor). In fiscal year 2015, net cash used for

investing activities includes cash payments of $181.7 million incurred in connection with the MyTheresa acquisition. In the Acquisition and thirty-nine

weeks ended August 2, 2014 (Successor), net cash used for investing activities consisted primarily of payments of $3,388.6 million made in connection with

the Acquisition. Capital expenditures were $270.5 million in fiscal year 2015, $138.0 million in the Acquisition and thirty-nine weeks ended August 2, 2014

(Successor) and $36.0 million in the thirteen weeks ended November 2, 2013 (Predecessor). Currently, we project gross capital expenditures for fiscal year

2016 to be $320 million to $350 million. Net of developer contributions, capital expenditures for fiscal year 2016 are projected to be $270 million to $300

million.

Net cash provided by financing activities was $100.3 million in fiscal year 2015 compared to $3,288.6 million in the Acquisition and thirty-nine

weeks ended August 2, 2014 (Successor) and $3.1 million in the thirteen weeks ended November 2, 2013 (Predecessor). Net cash provided by financing

activities in fiscal year 2015 was comprised primarily of net borrowings under our Asset-Based Revolving Credit Facility to fund the MyTheresa acquisition

and seasonal working capital requirements. In the Acquisition and thirty-nine weeks ended August 2, 2014 (Successor), proceeds from debt incurred in

connection with the Acquisition, net of debt issuance costs, were $4,437.6 million and cash equity contributions received in connection with the Acquisition

were $1,557.4 million. Also in connection with the Acquisition, we repaid outstanding borrowings under our former $700.0 million senior secured asset-

based revolving credit facility (the Former Asset-Based Revolving Credit Facility) and our former $2,560.0 million senior secured term loan facility (the

Former Senior Secured Term Loan Facility and, together with the Former Asset-Based Revolving Credit Facility, the Former Senior Secured Credit Facilities).

Subject to applicable restrictions in our credit agreements and indentures, we or our affiliates, at any time and from time to time, may purchase,

redeem or otherwise retire our outstanding debt securities, including through open market or privately negotiated transactions with third parties or pursuant

to one or more tender or exchange offers or otherwise, upon such terms and at such prices, as well as with such consideration, as we, or any of our affiliates,

may determine.

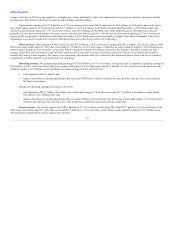

Our major sources of funds are comprised of the $900.0 million Asset-Based Revolving Credit Facility, the $2,898.5 million Senior Secured Term

Loan Facility, $960.0 million Cash Pay Notes, $600.0 million PIK Toggle Notes, $125.0 million 2028 Debentures (each as described in more detail below),

vendor payment terms and operating leases.

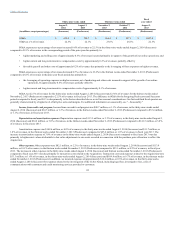

Asset-Based Revolving Credit Facility. At August 1, 2015, the Asset-Based Revolving Credit Facility provided for a maximum committed

borrowing capacity of $900.0 million. The Asset-Based Revolving Credit Facility matures on October 25, 2018. As of August 1, 2015, we had $130.0

million of borrowings outstanding under this facility, no outstanding letters of credit and $680.0 million of unused borrowing availability.

Availability under the Asset-Based Revolving Credit Facility is subject to a borrowing base. The Asset-Based Revolving Credit Facility includes

borrowing capacity available for letters of credit (up to $150.0 million, with any such issuance of letters of credit reducing the amount available under the

Asset-Based Revolving Credit Facility on a dollar-for-dollar basis) and for borrowings on same-day notice. The borrowing base is equal to at any time the

sum of (a) 90% of the net orderly liquidation value of eligible inventory, net of certain reserves, plus (b) 90% of the amounts owed by credit card processors

in respect of eligible credit card accounts constituting proceeds from the sale or disposition of inventory, less certain reserves, plus (c) 100% of segregated

cash held in a restricted deposit account. To the extent that excess availability is not equal to or greater than the greater of (a) 10% of the lesser of (1) the

aggregate revolving commitments and (2) the borrowing base and (b) $50.0 million, we will be required to maintain a fixed charge coverage ratio.

The weighted average interest rate on the outstanding borrowings pursuant to the Asset-Based Revolving Credit Facility was 1.44% at August 1,

2015.

See Note 8 of the Notes to Consolidated Financial Statements in Item 15, which contains a further description of the terms of the Asset-Based

Revolving Credit Facility.

49