Neiman Marcus 2014 Annual Report Download - page 76

Download and view the complete annual report

Please find page 76 of the 2014 Neiman Marcus annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Table of Contents

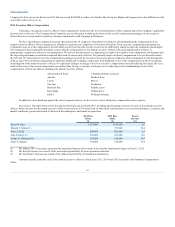

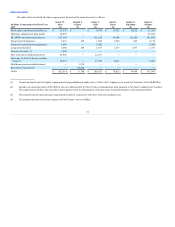

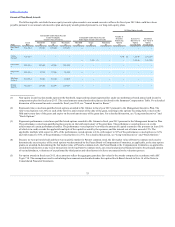

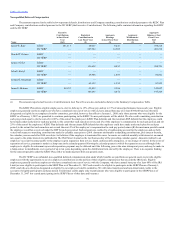

The following table sets forth the non‑equity incentive plan awards to our named executive officers for fiscal year 2015 that could have been

payable pursuant to our annual cash incentive plan and equity awards granted pursuant to our long‑term equity plans.

Katz, Karen

W.

9/12/2014

550,000

1,375,000

2,750,000

—

—

—

—

—

—

Grimes,

Donald T.

7/21/2015

—

—

—

5,500 (2) 1,205.00

1,912,790

—

5,500 (3) —

—

1,205.00

1,912,790

Gold, James

J.

9/12/2014

205,000

615,000

1,230,000

—

—

—

—

—

—

Koryl, John

E.

9/12/2014

93,750

375,000

750,000

—

—

—

—

—

—

Schulman,

Joshua G.

9/12/2014

91,500

366,000

732,000

—

—

—

—

—

—

Skinner,

James E.

9/12/2014

187,500

562,500

1,125,000

—

—

—

—

—

—

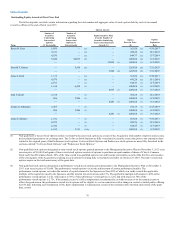

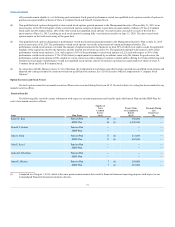

(1) Non‑equity incentive plan awards represent the threshold, target and maximum opportunities under our performance‑based annual cash incentive

compensation plan for fiscal year 2015. The actual amounts earned under this plan are disclosed in the Summary Compensation Table. For a detailed

discussion of the annual incentive awards for fiscal year 2015, see “Annual Incentive Bonus.”

(2) Represents time‑vested non‑qualified stock options awarded to Mr. Grimes in fiscal year 2015 pursuant to the Management Incentive Plan. The

time‑vested options vest 20% on each of the first five anniversaries of the date of the grant, resulting in the options becoming fully vested on the

fifth anniversary date of the grant, and expire on the tenth anniversary of the grant date. For a detailed discussion, see “Long‑term Incentives” and

“Stock Options.”

(3) Represents performance‑vested non‑qualified stock options awarded to Mr. Grimes in fiscal year 2015 pursuant to the Management Incentive Plan.

The performance‑vested non‑qualified options expire on the tenth anniversary of the grant date. The performance‑vested options vest on the

achievement of certain performance hurdles. The performance‑vested options vest when the amount of capital returned to the sponsors (at least 50%

of which is in cash) exceeds the applicable multiple of the capital invested by the sponsors, and the internal rate of return exceeds 15%. The

applicable multiple with respect to 40% of the performance‑vested options is 2.0x, with respect to 30% of the performance‑vested options is 2.25x

and with respect to 30% of the performance‑vested options is 2.75x. For a detailed discussion, see “Long‑term Incentives” and “Stock Options.”

(4) Because we were privately held and there was no public market for Parent's common stock, the fair market value of Parent's common stock used to

determine the exercise price of the stock options was determined by the Parent Board or Compensation Committee, as applicable, at the time option

grants are awarded. In determining the fair market value of Parent's common stock, the Parent Board or the Compensation Committee, as applicable,

considered such factors as any recent transactions involving Parent's common stock, our actual and projected financial results, the principal amount

of our indebtedness, valuations of us performed by third parties and other factors it believes are material to the valuation process.

(5) For option awards in fiscal year 2015, these amounts reflect the aggregate grant date fair value for the awards computed in accordance with ASC

Topic 718. The assumptions used in calculating these amounts are described under the caption Stock-Based Awards in Note 14 of the Notes to

Consolidated Financial Statements.

75