Neiman Marcus 2014 Annual Report Download - page 11

Download and view the complete annual report

Please find page 11 of the 2014 Neiman Marcus annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Table of Contents

code and transmit the necessary information to a computer to record merchandise on hand. We utilize third-party carriers to distribute our merchandise to

individual stores.

We primarily operate on a pre-distribution model through which we allocate merchandise on our initial purchase orders to each store. This

merchandise is shipped from our designers to our distribution facilities for delivery to designated stores. We closely monitor the inventory levels and

assortments in our retail stores to facilitate reorder and replenishment decisions, satisfy customer demand and maximize sales.

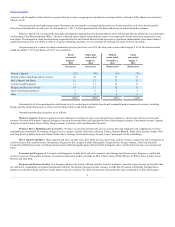

We maintain inventories at the Longview and Pittston distribution facilities. We utilize a “locker stock” inventory management program to maintain

a portion of our most in-demand and high fashion merchandise at these distribution facilities. For products stored in locker stock, we can ship merchandise to

the stores that demonstrate the highest customer demand or directly to our customers, from our stores or our e-commerce platform. This program helps us to

restock inventory at individual stores more efficiently, to maximize the opportunity for full-price selling and to minimize the potential risks related to excess

inventories.

The two distribution centers in the Dallas-Fort Worth area support our online operations in the United States, and our distribution center outside of

Munich, Germany supports our MyTheresa operations. These distribution centers facilitate the receipt and storage of inventories from designers, fulfill

customer orders on a timely and efficient basis and receive, research and resolve customer returns.

We invest capital to support our long-term business goals and objectives with a goal of generating strong returns. We invest capital in the

development and construction of new and existing stores, online platforms, distribution and support facilities and information technology. Since fiscal year

2011, we have made gross capital expenditures aggregating $838.0 million related primarily to: (i) the construction of a new store in Walnut Creek,

California (opened in fiscal year 2012) and a distribution facility in Pittston, Pennsylvania; (ii) investments in our online platforms and technology and

information systems; (iii) enhancements to our merchandising and store systems; and (iv) the remodel of our Bergdorf Goodman men’s store on Fifth Avenue

in New York City and Neiman Marcus stores in Bal Harbour, Florida, Chicago, Illinois, Oak Brook, Illinois and Beverly Hills, California.

Currently, we project gross capital expenditures for fiscal year 2016 to be $320 million to $350 million. Net of developer contributions, capital

expenditures for fiscal year 2016 are projected to be $270 million to $300 million.

We are focused on operating only in attractive markets that can profitably support our stores as well as maintaining the quality of our stores and

online platforms and, consequently, our brands. We conduct extensive demographic, marketing and lifestyle research to identify attractive retail markets with

a high concentration of our target customers prior to our decision to construct a new store. We receive allowances from developers related to the construction

of our stores, thereby reducing our cash investment in these stores. We received construction allowances aggregating $34.7 million in fiscal year 2015, $5.7

million for the thirty-nine weeks ended August 2, 2014, none for the thirteen weeks ended November 2, 2013 and $7.2 million in fiscal year 2013. Two new

Neiman Marcus locations are currently in development that will significantly expand our presence in New York:

•Roosevelt Field: We expect to open an approximately 100,000 square‑foot full‑line Neiman Marcus store in Long Island, New York in the third

quarter of fiscal year 2016. The store will be located in the Roosevelt Field Mall in Garden City, which is currently undergoing a $200 million

redevelopment program.

•Hudson Yards: We have signed a lease to open a flagship full‑line Neiman Marcus store on Manhattan’s flourishing west side at Hudson Yards,

a new $20 billion, 28‑acre mixed‑use development project. The 250,000 square‑foot, multi‑level store, which we currently expect to open in

fiscal year 2019, marks the first full‑line Neiman Marcus store in New York City and will anchor the one‑million‑square‑foot Shops at Hudson

Yards. This new store will offer to New York’s residents and visitors Neiman Marcus’s signature mix of the world’s most exclusive luxury brands

and superior customer service.

In addition to the construction of new stores, we also invest in our existing stores to drive traffic, increase our selling opportunities and enhance

customer service.

10