Neiman Marcus 2014 Annual Report Download - page 134

Download and view the complete annual report

Please find page 134 of the 2014 Neiman Marcus annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Table of Contents

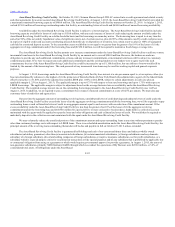

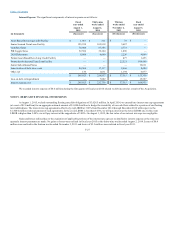

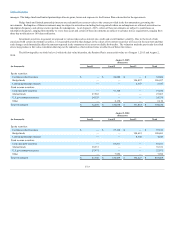

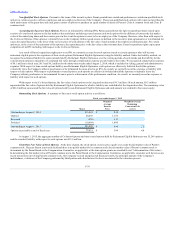

Cost of Benefits. The components of the expenses we incurred under our Pension Plan, SERP Plan and Postretirement Plan are as follows:

Pension Plan:

Interest cost

$ 25,527

$ 19,516

$ 5,781

$ 21,243

Expected return on plan assets

(24,935)

(18,499)

(6,401)

(26,381)

Net amortization of losses

—

—

1,095

6,287

Pension Plan expense

$ 592

$ 1,017

$ 475

$ 1,149

SERP Plan:

Interest cost

$ 4,505

$ 3,653

$ 1,104

$ 4,037

Net amortization of losses

—

—

—

522

SERP Plan expense

$ 4,505

$ 3,653

$ 1,104

$ 4,559

Postretirement Plan:

Service cost

$ 11

$ 19

$ 5

$ 34

Interest cost

451

520

142

650

Net amortization of prior service cost

—

—

(321)

(1,556)

Net amortization of losses (gains)

(372)

—

35

589

Postretirement Plan expense (income)

$ 90

$ 539

$ (139)

$ (283)

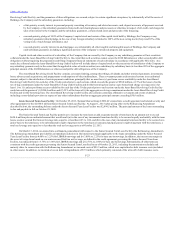

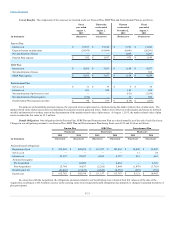

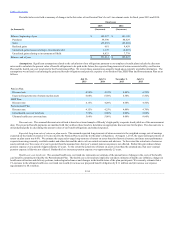

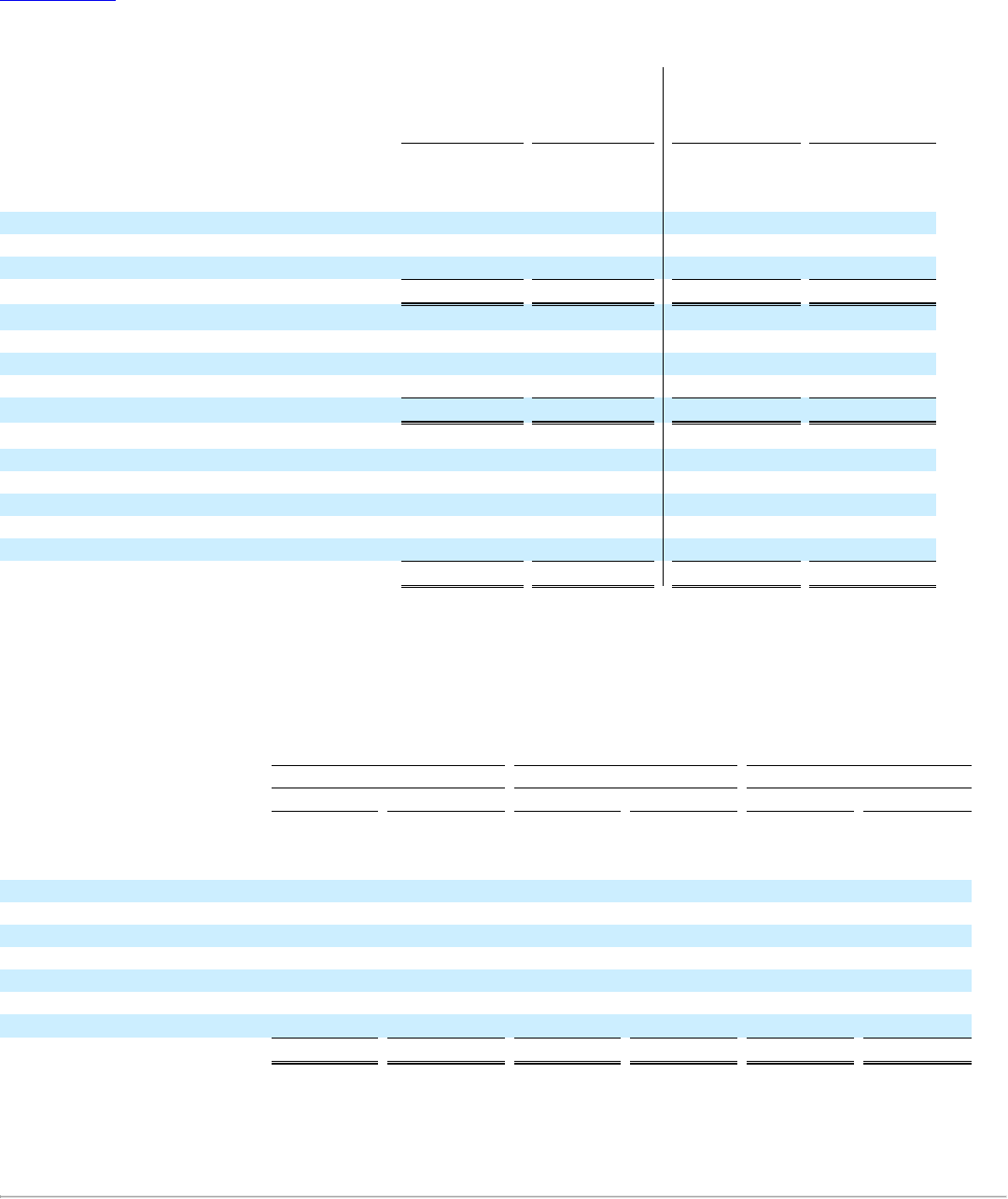

For purposes of determining pension expense, the expected return on plan assets is calculated using the market related value of plan assets. The

market related value of plan assets does not immediately recognize realized gains and losses. Rather, these effects of realized gains and losses are deferred

initially and amortized over three years in the determination of the market related value of plan assets. At August 1, 2015, the market related value of plan

assets exceeded the fair value by $3.5 million.

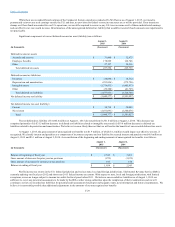

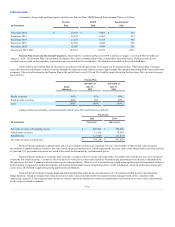

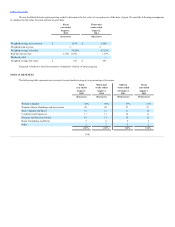

Benefit Obligations. Our obligations for the Pension Plan, SERP Plan and Postretirement Plan are valued annually as of the end of each fiscal year.

Changes in our obligations pursuant to our Pension Plan, SERP Plan and Postretirement Plan during fiscal years 2015 and 2014 are as follows:

Projected benefit obligations:

Beginning of year

$ 592,918

$ 489,856

$ 113,787

$ 103,854

$ 10,945

$ 12,429

Service cost

—

—

—

—

11

24

Interest cost

25,527

25,297

4,505

4,757

451

662

Actuarial loss (gain):

Pre-Acquisition

—

62,603

—

4,484

—

2,329

Post-Acquisition

15,764

36,837

(2,292)

5,044

(1,476)

(3,765)

Benefits paid, net

(21,447)

(21,675)

(4,843)

(4,352)

(810)

(734)

End of year

$ 612,762

$ 592,918

$ 111,157

$ 113,787

$ 9,121

$ 10,945

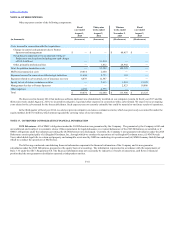

In connection with the Acquisition, the obligations and assets related to our benefit plans were valued at their fair values as of the date of the

Acquisition, resulting in a $66.5 million increase in the carrying value of our long-term benefit obligations due primarily to changes in assumed mortality of

plan participants.

F-31