Neiman Marcus 2014 Annual Report Download - page 94

Download and view the complete annual report

Please find page 94 of the 2014 Neiman Marcus annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Table of Contents

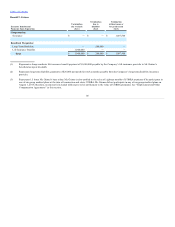

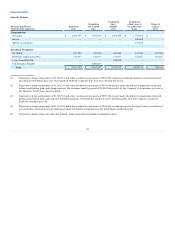

been included in the table above for purposes of calculating the number of shares beneficially owned by affiliates of Ares Management, L.P. (Ares

Management) or CPP Investment Board (USRE) Inc.

For additional detail regarding the Stockholders Agreement, see “Certain Relationships and Related Transactions, and Director Independence-

Stockholders Agreement.”

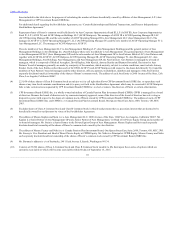

(3) Represents shares of Parent’s common stock held directly by Ares Corporate Opportunities Fund III, L.P. (ACOF III), Ares Corporate Opportunities

Fund IV, L.P. (ACOF IV) and ACOF Mariposa Holdings LLC (ACOF Mariposa). The manager of ACOF III is ACOF Operating Manager III, LLC

(ACOF Operating Manager III), and the sole member of ACOF Operating Manager III is Ares Management LLC (Ares Management LLC). The

manager of ACOF IV is ACOF Operating Manager IV, LLC (ACOF Operating Manager IV), and the sole member of ACOF Operating Manager IV is

Ares Management LLC. The manager of ACOF Mariposa is ACOF IV.

The sole member of Ares Management LLC is Ares Management Holdings L.P. (Ares Management Holdings) and the general partner of Ares

Management Holdings is Ares Holdings Inc. (Ares Holdings), whose sole stockholder is Ares Management. The general partner of Ares Management

is Ares Management GP LLC (Ares Management GP) and the sole member of Ares Management GP is Ares Partners Holdco LLC (Ares Partners and,

together with ACOF III, ACOF IV, ACOF Mariposa, ACOF Operating Manager III, ACOF Operating Manager IV, Ares Management LLC, Ares

Management Holdings, Ares Holdings, Ares Management, and Ares Management GP, the Ares Entities). Ares Partners is managed by a board of

managers, which is composed of Michael Arougheti, David Kaplan, John Kissick, Antony Ressler and Bennett Rosenthal. Decisions by Ares

Partners’ board of managers generally are made by a majority of the members, which majority, subject to certain conditions, must include Antony

Ressler. Each of the Ares Entities (other than each of ACOF III, ACOF IV and ACOF Mariposa with respect to the shares held directly by it) and the

members of Ares Partners’ board of managers and the other directors, officers, partners, stockholders, members and managers of the Ares Entities

expressly disclaims beneficial ownership of the shares of Parent’s common stock. The address of each Ares Entity is 2000 Avenue of the Stars, 12th

Floor, Los Angeles, California 90067.

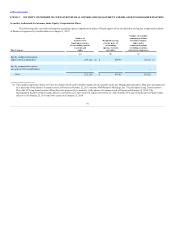

(4) 223,050 of these shares of Class B Common Stock are subject to (i) a call right that allows CPP Investment Board (USRE) Inc. to repurchase such

shares at any time for de minimis consideration and (ii) a proxy set forth in the Stockholders Agreement which may be exercised if ACOF Mariposa

fails to take certain actions requested by CPP Investment Board (USRE) Inc. to elect or remove the directors of Parent or certain other matters.

(5) CPP Investment Board (USRE) Inc. is a wholly owned subsidiary of Canada Pension Plan Investment Board (CPPIB). CPPIB is managed by a board

of directors. Because the board of directors acts by consensus/majority approval, none of the directors of the board of directors has sole voting or

dispositive power with respect to the shares of common stock of Parent owned by CPP Investment Board (USRE) Inc. The address of each of CPP

Investment Board (USRE) Inc. and CPPIB is c/o Canada Pension Plan Investment Board, One Queen Street East, Suite 2500, Toronto, ON, M5C

2W5.

(6) Excludes shares of Class A Common Stock and Class B Common Stock in which such person(s) have a pecuniary interest that are deemed to be

beneficially owned by our Sponsors by virtue of the Stockholders Agreement.

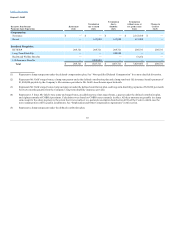

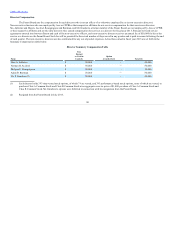

(7) The address of Messrs. Kaplan and Stein is c/o Ares Management LLC, 2000 Avenue of the Stars, 12th Floor, Los Angeles, California 90067. Mr.

Kaplan is a Senior Partner of Ares Management GP and a Senior Partner of Ares Management, Co-Head of its Private Equity Group and a member of

its board of managers. Mr. Stein is a Senior Partner in the Private Equity Group of Ares Management. Messrs. Kaplan and Stein each expressly

disclaim beneficial ownership of the shares of Parent’s common stock owned by the Ares Entities.

(8) The address of Messrs. Feeney and Nishi is c/o Canada Pension Plan Investment Board, One Queen Street East, Suite 2600, Toronto, ON, M5C 2W5.

Mr. Feeney is Vice President and Head of Direct Private Equity at CPPIB Equity. Mr. Nishi is a Principal at CPPIB Equity. Messrs. Feeney and Nishi

each expressly disclaim beneficial ownership of the shares of Parent’s common stock owned by CPP Investment Board (USRE) Inc.

(9) Mr. Brotman’s address is c/o of Starbucks, 2401 Utah Avenue S, Seattle, Washington 98134.

(10) Consists of 29,506 shares of Class A Common Stock and Class B Common Stock issuable to Ms. Katz upon the exercise of options which are

currently exercisable or which will become exercisable within 60 days of September 15, 2015.

93