Neiman Marcus 2014 Annual Report Download - page 152

Download and view the complete annual report

Please find page 152 of the 2014 Neiman Marcus annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Table of Contents

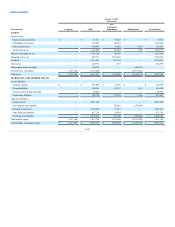

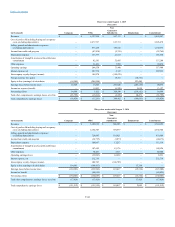

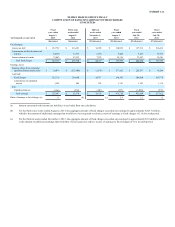

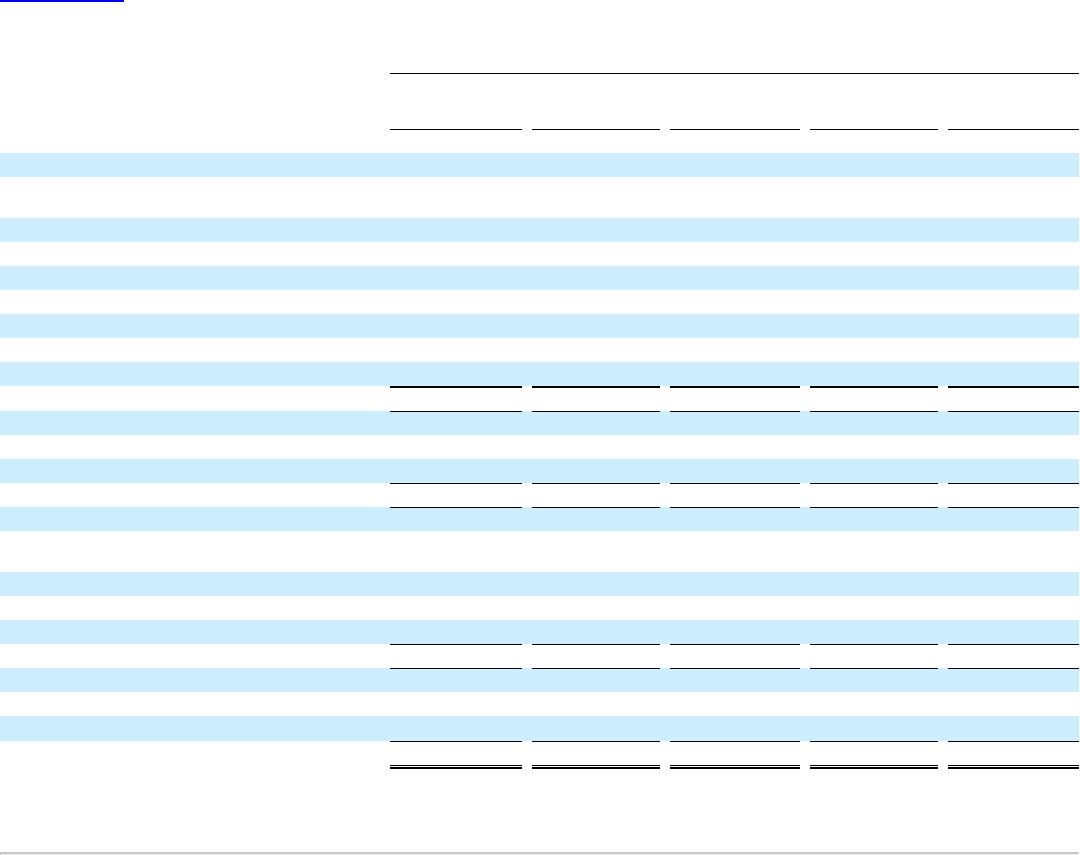

Net earnings (loss)

$ 163,699

$ 163,699

$ 237,816

$ (401,515)

$ 163,699

Adjustments to reconcile net earnings (loss) to net cash

provided by operating activities:

Depreciation and amortization expense

—

171,102

26,253

—

197,355

Loss on debt extinguishment

—

15,597

—

—

15,597

Deferred income taxes

—

(19,439)

—

—

(19,439)

Other

—

5,785

12,973

—

18,758

Intercompany royalty income payable (receivable)

—

130,459

(130,459)

—

—

Equity in loss (earnings) of subsidiaries

(163,699)

(237,816)

—

401,515

—

Changes in operating assets and liabilities, net

—

95,260

(121,871)

—

(26,611)

Net cash provided by operating activities

—

324,647

24,712

—

349,359

Capital expenditures

—

(131,697)

(14,808)

—

(146,505)

Investment in Asian e-commerce retailer

—

—

(10,000)

—

(10,000)

Net cash used for investing activities

—

(131,697)

(24,808)

—

(156,505)

Borrowings under Former Asset-Based Revolving Credit

Facility

—

100,000

—

—

100,000

Borrowings under Former Senior Secured Term Loan Facility

—

500,000

—

—

500,000

Repayment of borrowings

—

(695,668)

—

—

(695,668)

Debt issuance costs paid

—

(9,763)

—

—

(9,763)

Net cash used for financing activities

—

(105,431)

—

—

(105,431)

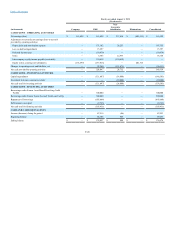

Increase (decrease) during the period

—

87,519

(96)

—

87,423

Beginning balance

—

48,308

945

—

49,253

Ending balance

$ —

$ 135,827

$ 849

$ —

$ 136,676

F-49