Neiman Marcus 2014 Annual Report Download - page 126

Download and view the complete annual report

Please find page 126 of the 2014 Neiman Marcus annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Table of Contents

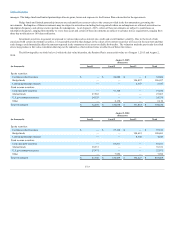

Revolving Credit Facility, and the guarantees of those obligations, are secured, subject to certain significant exceptions, by substantially all of the assets of

Holdings, the Company and the subsidiary guarantors, including:

• a first-priority security interest in personal property consisting of inventory and related accounts, cash, deposit accounts, all payments received

by the Company or the subsidiary guarantors from credit card clearinghouses and processors or otherwise in respect of all credit card charges for

sales of inventory by the Company and the subsidiary guarantors, certain related assets and proceeds of the foregoing;

• a second-priority pledge of 100% of the Company’s capital stock and certain of the capital stock held by Holdings, the Company or any

subsidiary guarantor (which pledge, in the case of any foreign subsidiary is limited to 100% of the non-voting stock (if any) and 65% of the

voting stock of such foreign subsidiary); and

• a second-priority security interest in, and mortgages on, substantially all other tangible and intangible assets of Holdings, the Company and

each subsidiary guarantor, including a significant portion of the Company’s owned real property and equipment.

Capital stock and other securities of a subsidiary of the Company that are owned by the Company or any subsidiary guarantor will not constitute

collateral under the Asset-Based Revolving Credit Facility to the extent that such securities cannot secure the 2028 Debentures or other secured public debt

obligations without requiring the preparation and filing of separate financial statements of such subsidiary in accordance with applicable SEC rules. As a

result, the collateral under the Asset-Based Revolving Credit Facility will include shares of capital stock or other securities of subsidiaries of the Company or

any subsidiary guarantor only to the extent that the applicable value of such securities (on a subsidiary-by-subsidiary basis) is less than 20% of the aggregate

principal amount of the 2028 Debentures or other secured public debt obligations of the Company.

The Asset-Based Revolving Credit Facility contains covenants limiting, among other things, dividends and other restricted payments, investments,

loans, advances and acquisitions, and prepayments or redemptions of other indebtedness. These covenants permit such restricted actions in an unlimited

amount, subject to the satisfaction of certain payment conditions, principally that we must have (x) pro forma excess availability under the Asset-Based

Revolving Credit Facility for each day of the 30-day period prior to such actions, which exceeds the greater of $90.0 million or 15% of the lesser of (a) the

revolving commitments under the Asset-Based Revolving Credit Facility and (b) the borrowing base and (y) a pro forma fixed charge coverage ratio of at

least 1.0 to 1.0, unless pro forma excess availability for each day of the 30-day period prior to such actions under the Asset-Based Revolving Credit Facility

would exceed the greater of (1) $200.0 million and (2) 25% of the lesser of (i) the aggregate revolving commitments under the Asset-Based Revolving Credit

Facility and (ii) the borrowing base. The Asset-Based Revolving Credit Facility also contains customary affirmative covenants and events of default,

including a cross-default provision in respect of any other indebtedness that has an aggregate principal amount exceeding $50.0 million.

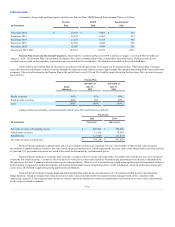

Senior Secured Term Loan Facility. On October 25, 2013, Neiman Marcus Group LTD LLC entered into a credit agreement and related security and

other agreements for the $2,950.0 million Senior Secured Term Loan Facility. At August 1, 2015 (after giving effect to the Refinancing Amendment

described below), the outstanding balance under the Senior Secured Term Loan Facility was $2,898.5 million. The principal amount of the loans outstanding

is due and payable in full on October 25, 2020.

The Senior Secured Term Loan Facility permits us to increase the term loans or add a separate tranche of term loans by an amount not to exceed

$650.0 million plus an unlimited amount that would result (a) in the case of any incremental term loan facility to be secured equally and ratably with the term

loans, a senior secured first lien net leverage ratio equal to or less than 4.25 to 1.00, and (b) in the case of any incremental term loan facility to be secured on a

junior basis to the term loans, to be subordinated in right of payment to the term loans or unsecured and pari passu in right of payment with the term loans, a

total net leverage ratio equal to or less than the total net leverage ratio as of October 25, 2013.

On March 13, 2014, we entered into a refinancing amendment with respect to the Senior Secured Term Loan Facility (the Refinancing Amendment).

The Refinancing Amendment provided for an immediate reduction in the interest rate margin applicable to the loans outstanding under the Senior Secured

Term Loan Facility from (a) 4.00% to 3.25% for LIBOR borrowings and (b) 3.00% to 2.25% for base rate borrowings. In addition, the interest rate margin in

the event of a step down based on our senior secured first lien net leverage, as defined in the credit agreement governing the Senior Secured Term Loan

Facility, was reduced from (1) 3.75% to 3.00% for LIBOR borrowings and (2) 2.75% to 2.00% for base rate borrowings. Substantially all other terms are

consistent with the credit agreement governing the Senior Secured Term Loan Facility as of October 25, 2013, including the amortization schedule and

maturity dates. In connection with the Refinancing Amendment, we incurred costs of $29.5 million, which were capitalized as debt issuance costs (included

in other assets). In addition, we incurred a loss on debt extinguishment of $7.9 million, which primarily consisted of the write-off of debt issuance costs,

F-23