Neiman Marcus 2014 Annual Report Download - page 75

Download and view the complete annual report

Please find page 75 of the 2014 Neiman Marcus annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.-

1

1 -

2

2 -

3

3 -

4

4 -

5

5 -

6

6 -

7

7 -

8

8 -

9

9 -

10

10 -

11

11 -

12

12 -

13

13 -

14

14 -

15

15 -

16

16 -

17

17 -

18

18 -

19

19 -

20

20 -

21

21 -

22

22 -

23

23 -

24

24 -

25

25 -

26

26 -

27

27 -

28

28 -

29

29 -

30

30 -

31

31 -

32

32 -

33

33 -

34

34 -

35

35 -

36

36 -

37

37 -

38

38 -

39

39 -

40

40 -

41

41 -

42

42 -

43

43 -

44

44 -

45

45 -

46

46 -

47

47 -

48

48 -

49

49 -

50

50 -

51

51 -

52

52 -

53

53 -

54

54 -

55

55 -

56

56 -

57

57 -

58

58 -

59

59 -

60

60 -

61

61 -

62

62 -

63

63 -

64

64 -

65

65 -

66

66 -

67

67 -

68

68 -

69

69 -

70

70 -

71

71 -

72

72 -

73

73 -

74

74 -

75

75 -

76

76 -

77

77 -

78

78 -

79

79 -

80

80 -

81

81 -

82

82 -

83

83 -

84

84 -

85

85 -

86

86 -

87

87 -

88

88 -

89

89 -

90

90 -

91

91 -

92

92 -

93

93 -

94

94 -

95

95 -

96

96 -

97

97 -

98

98 -

99

99 -

100

100 -

101

101 -

102

102 -

103

103 -

104

104 -

105

105 -

106

106 -

107

107 -

108

108 -

109

109 -

110

110 -

111

111 -

112

112 -

113

113 -

114

114 -

115

115 -

116

116 -

117

117 -

118

118 -

119

119 -

120

120 -

121

121 -

122

122 -

123

123 -

124

124 -

125

125 -

126

126 -

127

127 -

128

128 -

129

129 -

130

130 -

131

131 -

132

132 -

133

133 -

134

134 -

135

135 -

136

136 -

137

137 -

138

138 -

139

139 -

140

140 -

141

141 -

142

142 -

143

143 -

144

144 -

145

145 -

146

146 -

147

147 -

148

148 -

149

149 -

150

150 -

151

151 -

152

152 -

153

153 -

154

154 -

155

155 -

156

156 -

157

157 -

158

158 -

159

159 -

160

160 -

161

161

|

|

Table of Contents

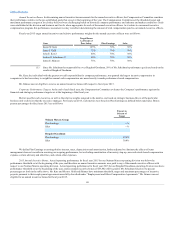

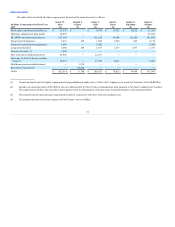

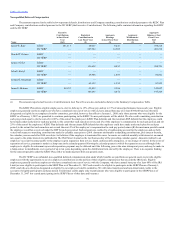

The table below sets forth all other compensation for each of the named executive officers.

401(k) plan contributions paid by us

$ 11,925

$ —

$ 9,594

$ 11,925

$ 10,552

$ 11,305

Deferred compensation plan match

50,057

—

—

—

—

25,422

DC SERP contributions paid by us

267,944

—

151,658

59,946

62,140

143,694

Group term life insurance

3,419

196

1,802

1,020

825

4,710

Financial counseling/tax preparation

5,000

—

5,000

—

—

5,000

Long-term disability

1,480

168

1,477

1,477

1,477

1,477

Transition benefit (1)

7,800

—

—

—

—

—

New York travel reimbursement (2)

23,866

—

12,531

—

—

—

Gross-ups for New York non-resident

taxes (3)

54,423

—

17,995

4,057

5,461

Healthcare premium reimbursement

—

1,218

—

—

—

—

Relocation expenses (4)

—

30,204

—

—

—

—

Totals

$ 425,914

$ 31,786

$ 200,057

$ 78,425

$ 74,994

$ 197,069

(1) Transition benefit paid to highly compensated and grandfathered employees or “Rule of 65” employees as a result of the freeze of the SERP Plan.

(2) Includes an annual payment of $15,000 in lieu of reimbursement for New York accommodations paid pursuant to Ms. Katz’s employment contract.

The employment contract also includes a gross-up provision for the payment of income taxes incurred pursuant to such annual payment.

(3) The amounts shown represent gross-up payments made in connection with New York non-resident taxes.

(4) The amount includes relocation expenses for Mr. Grimes’ move to Dallas.

74