Neiman Marcus 2014 Annual Report Download - page 56

Download and view the complete annual report

Please find page 56 of the 2014 Neiman Marcus annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Table of Contents

of the end of each fiscal year. As of the third quarter of fiscal year 2010, benefits offered to all employees under our Pension Plan and SERP Plan were frozen.

Significant assumptions related to the calculation of our obligations include the discount rates used to calculate the present value of benefit

obligations to be paid in the future, the expected long-term rate of return on assets held by our Pension Plan and the health care cost trend rate for the

Postretirement Plan. We review these assumptions annually based upon currently available information, including information provided by our actuaries.

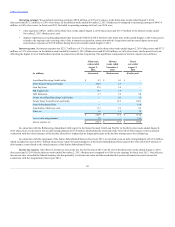

Significant assumptions utilized in the calculation of our projected benefit obligations as of August 1, 2015 and future expense requirements for our

Pension Plan, SERP Plan and Postretirement Plan, and sensitivity analysis related to changes in these assumptions, are as follows:

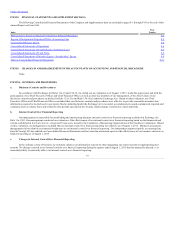

Pension Plan:

Discount rate

4.30%

0.25 %

$ (20.5)

$ 0.6

Expected long-term rate of return on plan assets

6.00%

(0.50)%

N/A

$ 1.9

SERP Plan:

Discount rate

4.15%

0.25 %

$ (3.1)

$ 0.1

Postretirement Plan:

Discount rate

4.15%

0.25 %

$ (0.2)

$ —

Ultimate health care cost trend rate

5.00%

1.00 %

$ 1.1

$ 0.1

Stock Compensation. At the date of grant, the stock option exercise price equals or exceeds the fair market value of Parent's common stock.

Because Parent is privately held and there is no public market for its common stock, the fair market value of Parent's common stock is determined by the

Board of Directors of Parent (the Parent Board) or the Compensation Committee, as applicable, at the time option grants are awarded. The estimation of the

fair market value of Parent's common stock utilizes both discounted cash flow techniques and the review of market data and involves assumptions regarding a

number of complex and subjective variables. Significant inputs to the common stock valuation model include:

• future revenue, cash flow and/or profitability projections;

• growth assumptions for future revenues as well as future gross margin rates, expense rates, capital expenditures and other estimates;

• rates, based on our estimated weighted average cost of capital, used to discount the estimated cash flow projections to their present value (or

estimated fair value);

• recent transactions and valuation multiples for publicly held companies deemed similar to Parent;

• economic conditions and other factors deemed material to the valuation process; and

• valuations of Parent performed by third parties.

In May 2014, the Financial Accounting Standards Board (the FASB) issued guidance to clarify the principles for recognizing revenue and to

develop a common revenue standard for GAAP and International Financial Reporting Standards. The standard outlines a single comprehensive model for

entities to use in accounting for revenue arising from contracts with customers and supersedes the most recent revenue recognition guidance. This new

guidance is effective for us no earlier than the first quarter of fiscal year 2019 using one of two retrospective application methods. We are currently evaluating

which application method to adopt and the impact of adopting this new accounting guidance on our Consolidated Financial Statements.

We do not expect that any other recently issued accounting pronouncements will have a material impact on our Consolidated Financial Statements.

55