Neiman Marcus 2014 Annual Report Download - page 131

Download and view the complete annual report

Please find page 131 of the 2014 Neiman Marcus annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Table of Contents

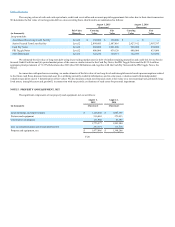

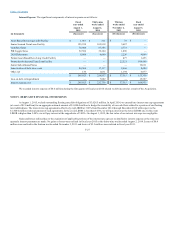

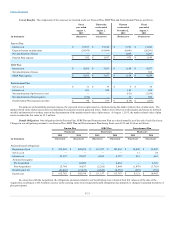

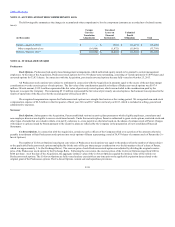

The significant components of income tax expense (benefit) are as follows:

Current:

Federal

$ 73,928

$ 23,432

$ 12,100

$ 114,632

State

7,955

4,617

2,145

18,540

Foreign

980

—

—

—

82,863

28,049

14,245

133,172

Deferred:

Federal

(60,780)

(98,443)

(5,291)

(18,648)

State

(6,080)

(19,431)

(1,035)

(791)

Foreign

(2,876)

—

—

—

(69,736)

(117,874)

(6,326)

(19,439)

Income tax expense (benefit)

$ 13,127

$ (89,825)

$ 7,919

$ 113,733

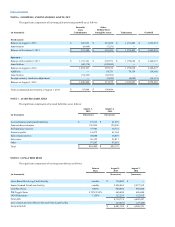

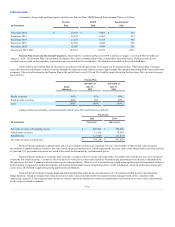

The significant components of earnings (loss) before income taxes are as follows:

United States

$ 38,399

$ (223,908)

$ (5,179)

$ 277,432

Foreign

(10,323)

—

—

—

Earnings (loss) before income taxes

$ 28,076

$ (223,908)

$ (5,179)

$ 277,432

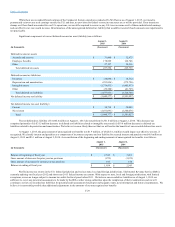

A reconciliation of income tax expense (benefit) to the amount calculated based on the federal and state statutory rates is as follows:

Income tax expense (benefit) at statutory rate

$ 9,827

$ (78,365)

$ (1,814)

$ 97,101

State income taxes, net of federal income tax benefit

1,235

(9,256)

635

11,672

Impact of non-deductible expenses

3,330

(2,354)

8,514

683

Tax (benefit) expense related to tax settlements and other

changes in tax liabilities

(555)

(1,101)

133

525

Impact of non-taxable income

(3)

(4)

(10)

(13)

Impact of foreign tax differential

(706)

—

—

—

Unbenefitted losses of foreign subsidiary

—

1,265

533

4,594

Other

(1)

(10)

(72)

(829)

Total

$ 13,127

$ (89,825)

$ 7,919

$ 113,733

Effective tax rate

46.8%

40.1%

(152.9)%

41.0%

Our effective income tax rate on the earnings for fiscal year 2015, the thirty-nine weeks ended August 2, 2014 and fiscal year 2013 exceeded the

federal statutory tax rate due primarily to the non-deductible portion of transaction and other costs incurred in connection with acquisitions and state income

taxes. Our effective income tax rate on the loss for the thirteen weeks ended November 2, 2013 exceeded the federal statutory tax rate due primarily to the

non-deductible portion of transaction costs incurred in connection with the Acquisition and state income taxes.

F-28