Neiman Marcus 2014 Annual Report Download - page 53

Download and view the complete annual report

Please find page 53 of the 2014 Neiman Marcus annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Table of Contents

In the normal course of our business, we issue purchase orders to vendors/suppliers for merchandise. Our purchase orders are not unconditional

commitments but, rather represent executory contracts requiring performance by the vendors/suppliers, including the delivery of the merchandise

prior to a specified cancellation date and the compliance with product specifications, quality standards and other requirements. In the event of the

vendor’s failure to meet the agreed upon terms and conditions, we may cancel the order.

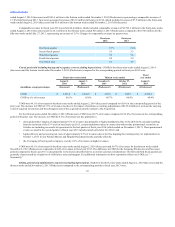

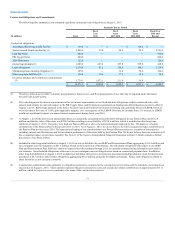

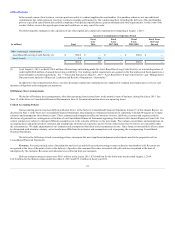

The following table summarizes the expiration of our other significant commercial commitments outstanding at August 1, 2015:

Other commercial commitments:

Asset-Based Revolving Credit Facility (1)

$ 900.0

$ —

$ —

$ 900.0

$ —

Surety bonds

3.0

3.0

—

—

—

$ 903.0

$ 3.0

$ —

$ 900.0

$ —

(1) As of August 1, 2015, we had $130.0 million of borrowings outstanding under the Asset-Based Revolving Credit Facility, no outstanding letters of

credit and $680.0 million of unused borrowing availability. Our working capital requirements are greatest in the first and second fiscal quarters as a

result of higher seasonal requirements. See “—Financing Structure at August 1, 2015—Asset-Based Revolving Credit Facility” and “Management’s

Discussion and Analysis of Financial Condition and Results of Operations—Seasonality.”

In addition to the items presented above, our other principal commercial commitments are comprised of common area maintenance costs, tax and

insurance obligations and contingent rent payments.

We had no off-balance sheet arrangements, other than operating leases entered into in the normal course of business, during fiscal year 2015. See

Note 12 of the Notes to Consolidated Financial Statements in Item 15 for more information about our operating leases.

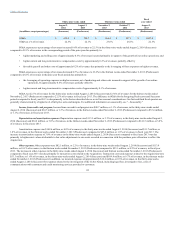

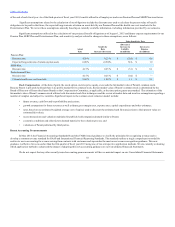

Our accounting policies are more fully described in Note 1 of the Notes to Consolidated Financial Statements in Item 15 of this Annual Report. As

disclosed in Note 1 of the Notes to Consolidated Financial Statements, the preparation of financial statements in conformity with GAAP requires us to make

estimates and assumptions about future events. These estimates and assumptions affect the amounts of assets, liabilities, revenues and expenses and the

disclosure of gain and loss contingencies at the date of our Consolidated Financial Statements appearing elsewhere in this Annual Report on Form 10-K. Our

current estimates are subject to change if different assumptions as to the outcome of future events were made. We evaluate our estimates and assumptions on

an ongoing basis and predicate those estimates and assumptions on historical experience and on various other factors that we believe are reasonable under

the circumstances. We make adjustments to our estimates and assumptions when facts and circumstances dictate. Since future events and their effects cannot

be determined with absolute certainty, actual results may differ from the estimates and assumptions used in preparing the accompanying Consolidated

Financial Statements.

We believe the following critical accounting policies encompass the more significant judgments and estimates used in the preparation of our

Consolidated Financial Statements.

Revenues. Revenues include sales of merchandise and services and delivery and processing revenues related to merchandise sold. Revenues are

recognized at the later of the point of sale or the delivery of goods to the customer. Revenues associated with gift cards are recognized at the time of

redemption by the customer. Revenues exclude sales taxes collected from our customers.

Delivery and processing revenues were $50.1 million in fiscal year 2015, $38.0 million for the thirty‑nine weeks ended August 2, 2014,

$14.8 million for the thirteen weeks ended November 2, 2013 and $75.1 million in fiscal year 2013.

52