Neiman Marcus 2014 Annual Report Download - page 70

Download and view the complete annual report

Please find page 70 of the 2014 Neiman Marcus annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Table of Contents

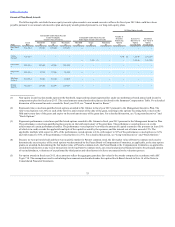

Predecessor Stock Options. At the time of the Acquisition, we had outstanding vested and unvested stock options (referred to as Predecessor stock

options). In connection with the Acquisition, all unvested stock options became fully vested on October 25, 2013 and, along with all outstanding vested

stock options, all such Predecessor stock options (other than the Co-Invest Stock Options described below) were settled and cancelled in exchange for an

amount equal to the excess of the per share merger consideration over the exercise prices of such stock options.

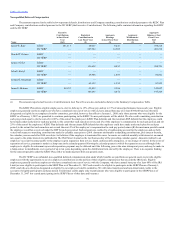

Co-Invest Stock Options. At the time of the Acquisition, certain management employees including the named executive officers (other than Mr.

Grimes) elected to exchange a portion of their Predecessor stock options for stock options to purchase shares of Parent (the Co-Invest Stock Options). The Co-

Invest Stock Options are fully vested. The number of stock options and exercise prices were adjusted pursuant to an exchange ratio in connection with the

Acquisition. The Co-Invest Stock Options are exercisable at any time prior to the applicable expiration dates related to the original grant of the Predecessor

stock options. The Co-Invest Options contain sale and repurchase provisions that expire upon an initial public offering.

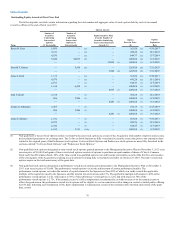

Company Stock Options. On November 5, 2013, the Parent Board granted 72,206 time-vested non-qualified stock options and 72,206 performance-

vested non-qualified stock options to the named executive officers (other than Mr. Grimes) and 17 other executive officers pursuant to the Management

Incentive Plan. Each grant of non-qualified stock options consists of options to purchase an equal number of shares of Class A Common Stock and Class B

Common Stock. The time-vested non-qualified stock options and the performance-vested non-qualified stock options contain sale and repurchase provisions

that expire upon an initial public offering. The size of stock option grants to such named executive officers in connection with the Acquisition was

determined by the Parent Board based on the experience of its members in establishing compensation for companies across multiple industries, as well as the

input of the Company’s chief executive officer, who has significant experience in the Company’s industry and a deep understanding of the respective duties

and responsibilities of such named executive officers. At the time of the Acquisition, the Parent Board determined the size of the grant of stock options to Ms.

Katz. The Parent Board also, in consultation with Ms. Katz, determined the sizes of the grants of stock options to our other senior executive officers,

including the named executive officers.

On July 21, 2015, the Compensation Committee granted 5,500 time-vested non-qualified stock options and 5,500 performance-vested non-qualified

stock options to Mr. Grimes pursuant to the Management Incentive Plan. 20% of the time-vested non-qualified stock options vest and become exercisable on

each of the first five anniversaries of the date of the grant, resulting in such options becoming fully vested and exercisable on the fifth anniversary date of the

grant. The performance-vested options vest on the achievement of certain performance hurdles. The performance-vested options vest when the amount of

capital returned to the sponsors with respect to their shares (at least 50% of which is in cash) exceeds the applicable multiple of the capital invested by the

sponsors, and the internal rate of return exceeds 15%. The applicable multiple with respect to 40% of the performance-vested options is 2.0x, with respect to

30% of the performance-vested options is 2.25x and with respect to 30% of the performance-vested options is 2.75x. These time-vested and performance-

vested non-qualified stock options were granted at an exercise price of $1,000 per share (other than those granted to Mr. Grimes, which were granted at an

exercise price of $1,205 per share) and such options will expire no later than the tenth anniversary of the grant date. The non-qualified stock options contain

repurchase provisions in the event of the participant’s termination of employment that expire upon an initial public offering.

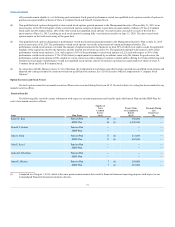

Mr. Skinner was previously awarded 5,827 time-vested non-qualified stock options and 5,827 performance-vested non-qualified stock options, in

each case, pursuant to the Management Incentive Plan. All 5,827 performance-vested non-qualified stock options, and 2,331 time-vested non-qualified stock

options, were cancelled by the Compensation Committee in connection with Mr. Skinner’s move to Vice Chairman. Additionally, the remaining unvested

2,331 time-vested non-qualified stock options will now vest on the earlier to occur of (i) February 1, 2016, subject to Mr. Skinner’s continued employment

through such date and (ii) Mr. Skinner’s termination of employment by us without “cause.” If Mr. Skinner's employment terminates as a result of his

retirement, he will be able to exercise the vested portion of his time-vested non-qualified stock options for one year following such termination of

employment.

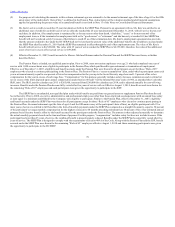

We maintain the following compensation components to provide a competitive total rewards package that supports retention of key executives.

Health and Welfare Benefits. Executive officers are eligible to participate under the same plans as all other eligible employees for medical, dental,

vision, disability and life insurance. These benefits are intended to be competitive with benefits offered in the retail industry.

69