Neiman Marcus 2014 Annual Report Download - page 113

Download and view the complete annual report

Please find page 113 of the 2014 Neiman Marcus annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Table of Contents

Neiman Marcus Group LTD LLC (the Company) is a luxury retailer conducting operations principally under the Neiman Marcus, Bergdorf

Goodman and MyTheresa brand names. References to “we,” “our” and “us” are used to refer to the Company or collectively to the Company and its

subsidiaries, as appropriate to the context.

On October 25, 2013, the Company merged with and into Mariposa Merger Sub LLC (Mariposa) pursuant to an Agreement and Plan of Merger,

dated September 9, 2013, by and among Neiman Marcus Group, Inc. (f/k/a NM Mariposa Holdings, Inc.) (Parent), Mariposa and the Company, with the

Company surviving the merger (the Acquisition). As a result of the Acquisition and the Conversion (as defined below), the Company is now a direct

subsidiary of Mariposa Intermediate Holdings LLC (Holdings), which in turn is a direct subsidiary of Parent. Parent is owned by entities affiliated with Ares

Management, L.P. and Canada Pension Plan Investment Board (together, the Sponsors) and certain co-investors. Previously, the Company was a subsidiary of

Newton Holding, LLC, which was controlled by investment funds affiliated with TPG Global, LLC (collectively with its affiliates, TPG) and Warburg Pincus

LLC (together with TPG, the Former Sponsors). On October 28, 2013, the Company and NMG (as defined below) each converted from a Delaware

corporation to a Delaware limited liability company (the Conversion).

The Company’s operations are conducted through its direct wholly owned subsidiary, The Neiman Marcus Group LLC (NMG).

In October 2014, we acquired MyTheresa, a luxury retailer headquartered in Munich, Germany. The operations of MyTheresa are conducted

primarily through the mytheresa.com global luxury website.

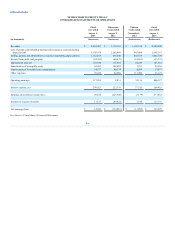

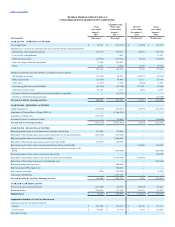

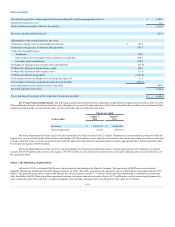

The accompanying Consolidated Financial Statements are presented as “Predecessor” or “Successor” to indicate whether they relate to the period

preceding the Acquisition or the period succeeding the Acquisition, respectively. All significant intercompany accounts and transactions have been

eliminated.

Our fiscal year ends on the Saturday closest to July 31. Like many other retailers, we follow a 4-5-4 reporting calendar, which means that each fiscal

quarter consists of thirteen weeks divided into periods of four weeks, five weeks and four weeks. This resulted in an extra week in fiscal year 2013 (the 53rd

week). All references to (i) fiscal year 2015 relate to the fifty-two weeks ended August 1, 2015 of the Successor, (ii) fiscal year 2014 relate to the fifty-two

weeks ended August 2, 2014 (consisting of the thirty-nine weeks ended August 2, 2014 of the Successor and the thirteen weeks ended November 2, 2013 of

the Predecessor) and (iii) fiscal year 2013 relate to the fifty-three weeks ended August 3, 2013 of the Predecessor.

Certain prior period balances have been reclassified to conform to the current period presentation.

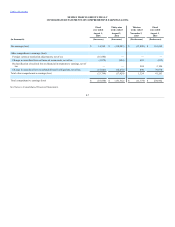

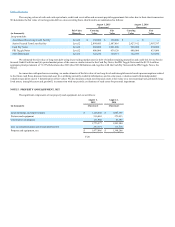

We are required to make estimates and assumptions about future events in preparing our financial statements in conformity with generally accepted

accounting principles. These estimates and assumptions affect the amounts of assets, liabilities, revenues and expenses and the disclosure of gain and loss

contingencies at the date of the accompanying Consolidated Financial Statements.

While we believe that our past estimates and assumptions have been materially accurate, the amounts currently estimated are subject to change if

different assumptions as to the outcome of future events were made. We evaluate our estimates and assumptions on an ongoing basis and predicate those

estimates and assumptions on historical experience and on various other factors that we believe are reasonable under the circumstances. We make

adjustments to our estimates and assumptions when facts and circumstances dictate. Since future events and their effects cannot be determined with absolute

certainty, actual results may differ from the estimates and assumptions used in preparing the accompanying Consolidated Financial Statements.

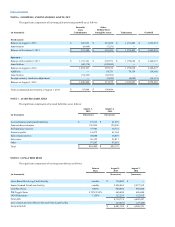

Purchase Accounting. We account for acquisitions in accordance with the provisions of Accounting Standards Codification Topic 805, Business

Combinations, whereby the purchase price paid to effect the acquisitions was allocated to state the acquired assets and liabilities at fair value. The

Acquisition and the allocation of the purchase price were recorded for

F-11