Neiman Marcus 2014 Annual Report Download - page 54

Download and view the complete annual report

Please find page 54 of the 2014 Neiman Marcus annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Table of Contents

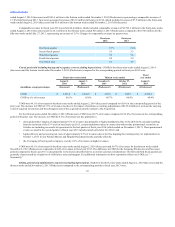

Revenues are reduced when customers return goods previously purchased. We maintain reserves for anticipated sales returns primarily based on our

historical trends related to returns by our customers. Our reserves for anticipated sales returns were $44.0 million at August 1, 2015 and $38.9 million at

August 2, 2014. As the vast majority of merchandise returns are made in less than 30 days after the sales transaction, we believe the risk that differences

between our estimated and actual returns is minimal and will not have a material impact on our Consolidated Financial Statements.

Between 2005 and 2014, we created and maintained e‑commerce websites pursuant to contractual arrangements with certain designers. Pursuant to

these arrangements, we purchased and maintained inventory from such designers that was showcased on their respective websites and bore all responsibilities

related to the fulfillment of goods purchased on such websites. All of these contractual arrangements expired by the end of the first quarter of fiscal year 2015

and were not renewed. Revenues generated from the operation of the designer websites were $4.7 million in fiscal year 2015, $70.0 million for the thirty-nine

weeks ended August 2, 2014, $13.5 million for the thirteen weeks ended November 2, 2013 and $66.5 million in fiscal year 2013.

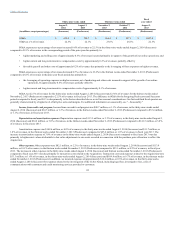

Merchandise Inventories and Cost of Goods Sold. We utilize the retail inventory method of accounting. Under the retail inventory method, the

valuation of inventories at cost and the resulting gross margins are determined by applying a calculated cost-to-retail ratio, for various groupings of similar

items, to the retail value of our inventories. The cost of the inventory reflected on the Consolidated Balance Sheets is decreased by charges to COGS at

average cost and the retail value of the inventory is lowered through the use of markdowns. Earnings are negatively impacted when merchandise is marked

down. As we adjust the retail value of our inventories through the use of markdowns to reflect market conditions, our merchandise inventories are stated at

the lower of cost or market.

The areas requiring significant management judgment related to the valuation of our inventories include (i) setting the original retail value for the

merchandise held for sale, (ii) recognizing merchandise for which the customer’s perception of value has declined and appropriately marking the retail value

of the merchandise down to the perceived value and (iii) estimating the shrinkage that has occurred between physical inventory counts. These judgments and

estimates, coupled with the averaging processes within the retail method can, under certain circumstances, produce varying financial results. Factors that can

lead to different financial results include (i) determination of original retail values for merchandise held for sale, (ii) identification of declines in perceived

value of inventories and processing the appropriate retail value markdowns and (iii) overly optimistic or conservative estimation of shrinkage. In prior years,

we have not made material changes to our estimates of shrinkage or markdown requirements on inventories held as of the end of our fiscal years. We do not

believe that changes in the assumptions and estimates, if any, used in the valuation of our inventories at August 1, 2015 will have a material effect on our

future operating performance.

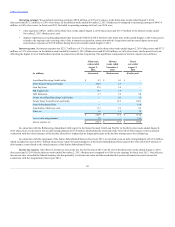

Consistent with industry business practice, we receive allowances from certain of our vendors in support of the merchandise we purchase for resale.

Certain allowances are received to reimburse us for markdowns taken or to support the gross margins that we earn in connection with the sales of the vendor’s

merchandise. These allowances result in an increase to gross margin when we earn the allowances and they are approved by the vendor. Other allowances we

receive represent reductions to the amounts we pay to acquire the merchandise. These allowances reduce the cost of the acquired merchandise and are

recognized at the time the goods are sold. We received vendor allowances of $94.8 million in fiscal year 2015, $88.5 million for the thirty-nine weeks ended

August 2, 2014, $5.0 million for the thirteen weeks ended November 2, 2013 and $90.2 million in fiscal year 2013. The amounts of vendor allowances we

receive fluctuate based on the level of markdowns taken and did not have a significant impact on the year-over-year change in gross margin during any of the

periods presented.

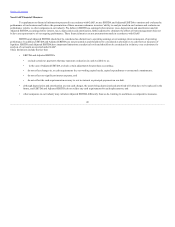

Long-lived Assets. Property and equipment are stated at cost less accumulated depreciation. In connection with the Acquisition, the cost basis of the

acquired property and equipment was adjusted to its estimated fair value. For financial reporting purposes, we compute depreciation principally using the

straight-line method over the estimated useful lives of the assets. Buildings and improvements are depreciated over five to 30 years while fixtures and

equipment are depreciated over three to 15 years. Leasehold improvements are amortized over the shorter of the asset life or the lease term (which may

include renewal periods when exercise of the renewal option is at our discretion and exercise of the renewal option is considered reasonably assured). Costs

incurred for the development of internal computer software are capitalized and amortized using the straight-line method over three to ten years.

We assess the recoverability of the carrying values of our store assets, consisting of property and equipment, customer lists and favorable lease

commitments, annually and upon the occurrence of certain events. The recoverability assessment requires judgment and estimates of future store generated

cash flows. The underlying estimates of cash flows include estimates for future revenues, gross margin rates and store expenses. To the extent our estimates for

revenue growth and gross margin improvement are not realized, future annual assessments could result in impairment charges.

53