Neiman Marcus 2014 Annual Report Download - page 118

Download and view the complete annual report

Please find page 118 of the 2014 Neiman Marcus annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Table of Contents

• economic conditions and other factors deemed material to the valuation process; and

• valuations of Parent performed by third parties.

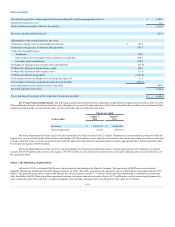

Income from Credit Card Program. We maintain a proprietary credit card program through which credit is extended to customers and have a related

marketing and servicing alliance with affiliates of Capital One Financial Corporation (Capital One). Pursuant to our agreement with Capital One (the

Program Agreement), Capital One currently offers credit cards and non-card payment plans under both the "Neiman Marcus" and "Bergdorf Goodman" brand

names. Effective July 1, 2013, we amended and extended the Program Agreement to July 2020 (renewable thereafter for three-year terms), subject to early

termination provisions.

We receive payments from Capital One based on sales transacted on our proprietary credit cards. We may receive additional payments based on the

profitability of the portfolio as determined under the Program Agreement depending on a number of factors including credit losses. In addition, we receive

payments from Capital One for marketing and servicing activities we provide to Capital One. We recognize income from our credit card program when

earned.

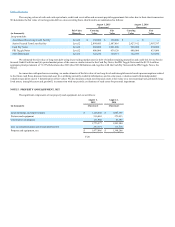

Gift Cards. The gift cards sold to our customers have no stated expiration dates and, in some cases, are subject to actual and/or potential

escheatment rights in various of the jurisdictions in which we operate. Unredeemed gift cards were $43.0 million at August 1, 2015 and $43.1 million at

August 2, 2014.

We recognized gift card breakage of $1.4 million in fiscal year 2015, $1.3 million for the thirty-nine weeks ended August 2, 2014, $0.3 million for

the thirteen weeks ended November 2, 2013 and $1.9 million in fiscal year 2013 as a component of revenues.

Loyalty Program. We maintain a customer loyalty program in which customers earn points for qualifying purchases. Upon reaching specified

levels, points are redeemed for awards, primarily gift cards. The estimates of the costs associated with the loyalty program require us to make assumptions

related to customer purchasing levels and redemption rates. At the time the qualifying sales giving rise to the loyalty program points are made, we defer the

portion of the revenues on the qualifying sales transactions equal to the estimated retail value of the gift cards to be redeemed upon conversion of the earned

points to gift cards. We record the deferral of revenues related to gift card awards under our loyalty program as a reduction of revenues.

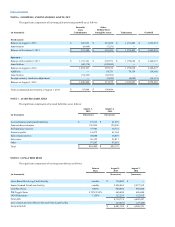

Income Taxes. We use the asset and liability method of accounting for income taxes. Under this method, deferred tax assets and liabilities are

determined based on differences between the financial reporting and tax bases of assets and liabilities and are measured using the enacted tax rates and laws

that will be in effect when the differences are expected to reverse. We are routinely under audit by federal, state or local authorities in the area of income

taxes. We regularly evaluate the likelihood of realization of tax benefits derived from positions we have taken in various federal and state filings after

consideration of all relevant facts, circumstances and available information. If we believe it is more likely than not that our position will be sustained, we

recognize the benefit we believe is cumulatively greater than 50% likely to be realized.

Foreign Currency. We translate the assets and liabilities denominated in a foreign currency into U.S. dollars using the exchange rate in effect at the

balance sheet date. Revenues and expenses are translated into U.S. dollars using weighted average exchange rates during the year. We record these translation

adjustments as a component of accumulated other comprehensive loss on the Consolidated Balance Sheets.

Segments. We believe that our customers have allocated a higher portion of their luxury spending to online retailing in recent years and that our

customers increasingly expect a seamless shopping experience across our in-store and online channels, and we expect these trends to continue for the

foreseeable future. As a result, we have made investments and redesigned processes to integrate our shopping experience across channels so that it is

consistent with our customers' shopping preferences and expectations. In particular, we have invested and continue to invest in technology and systems that

further our omni-channel retailing capabilities, and in fiscal year 2014, we realigned the management and merchandising responsibilities for our Neiman

Marcus brand on an omni-channel basis. With the acceleration of omni-channel retailing and our past and ongoing investments in our omni-channel retail

model, we believe the growth in our total comparable revenues and results of operations are the best measures of our ongoing performance. As a result,

effective August 3, 2014, we began viewing and reporting our specialty retail stores and online operations as a single, omni-channel reporting segment.

Recent Accounting Pronouncements. In May 2014, the Financial Accounting Standards Board (the FASB) issued guidance to clarify the principles

for recognizing revenue and to develop a common revenue standard for GAAP and International Financial Reporting Standards. The standard outlines a

single comprehensive model for entities to use in accounting for revenue arising from contracts with customers and supersedes the most recent revenue

recognition guidance.

F-16