Neiman Marcus 2014 Annual Report Download - page 140

Download and view the complete annual report

Please find page 140 of the 2014 Neiman Marcus annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Table of Contents

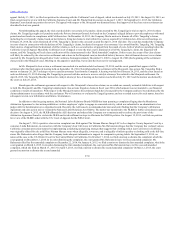

complaint in its entirety, without leave to amend, and on June 9, 2015, Ms. Rubenstein filed a notice to appeal the court's ruling.

On February 2, 2015, a putative class action complaint was filed against Bergdorf Goodman, Inc. in the Supreme Court of the State of New York,

County of New York, by Marney Zaslav. Ms. Zaslav seeks monetary relief and alleges that she and other similarly situated individuals were misclassified as

interns exempt from minimum wage requirements instead of as employees and, therefore, were not provided with proper compensation under the New York

Labor Law. The Company is vigorously defending this matter.

In addition, we are currently involved in various other legal actions and proceedings that arose in the ordinary course of business. With respect to

the matters described above as well as all other current outstanding litigation involving us, we believe that any liability arising as a result of such litigation

will not have a material adverse effect on our financial position, results of operations or cash flows.

Cyber-Attack Class Actions Litigation. Three class actions relating to a cyber-attack on our computer systems in 2013 (the Cyber-Attack) were filed

in January 2014 and later voluntarily dismissed by the plaintiffs between February and April 2014. The plaintiffs had alleged negligence and other claims in

connection with their purchases by payment cards and sought monetary and injunctive relief. Melissa Frank v. The Neiman Marcus Group, LLC, et al., was

filed in the U.S. District Court for the Eastern District of New York on January 13, 2014 but was voluntarily dismissed by the plaintiff on April 15, 2014,

without prejudice to her right to re-file a complaint. Donna Clark v. Neiman Marcus Group LTD LLC was filed in the U.S. District Court for the Northern

District of Georgia on January 27, 2014 but was voluntarily dismissed by the plaintiff on March 11, 2014, without prejudice to her right to re-file a

complaint. Christina Wong v. The Neiman Marcus Group, LLC, et al., was filed in the U.S. District Court for the Central District of California on January 29,

2014, but was voluntarily dismissed by the plaintiff on February 10, 2014, without prejudice to her right to re-file a complaint. Three additional putative

class actions relating to the Cyber-Attack were filed in March and April 2014, also alleging negligence and other claims in connection with plaintiffs’

purchases by payment cards. Two of the cases, Katerina Chau v. Neiman Marcus Group LTD Inc., filed in the U.S. District Court for the Southern District of

California on March 14, 2014, and Michael Shields v. The Neiman Marcus Group, LLC, filed in the U.S. District Court for the Southern District of California

on April 1, 2014, were voluntarily dismissed, with prejudice as to Chau and without prejudice as to Shields. The third case, Hilary Remijas v. The Neiman

Marcus Group, LLC, was filed on March 12, 2014 in the U.S. District Court for the Northern District of Illinois. On June 2, 2014, an amended complaint in the

Remijas case was filed, which added three plaintiffs (Debbie Farnoush and Joanne Kao, California residents; and Melissa Frank, a New York resident) and

asserted claims for negligence, implied contract, unjust enrichment, violation of various consumer protection statutes, invasion of privacy and violation of

state data breach laws. The Company moved to dismiss the Remijas amended complaint on July 2, 2014. On September 16, 2014, the court granted the

Company's motion to dismiss the Remijas case on the grounds that the plaintiffs lacked standing due to their failure to demonstrate an actionable injury. On

September 25, 2014, plaintiffs appealed the district court's order dismissing the case to the Seventh Circuit Court of Appeals. Oral argument was held on

January 23, 2015. On July 20, 2015, the Seventh Circuit Court of Appeals reversed the district court's ruling and remanded the case to the district court for

further proceedings. On August 3, 2015, we filed a petition for rehearing en banc. On September 17, 2015, the Seventh Circuit Court of Appeals denied our

petition for rehearing. Andrew McClease v. The Neiman Marcus Group, LLC was filed in the U.S. District Court for the Eastern District of North Carolina on

December 30, 2014, alleging negligence and other claims in connection with Mr. McClease's purchase by payment card. On March 9, 2015, the McClease

case was voluntarily dismissed without prejudice by stipulation of the parties.

In addition to class actions litigation, payment card companies and associations may require us to reimburse them for unauthorized card charges and

costs to replace cards and may also impose fines or penalties in connection with the security incident, and enforcement authorities may also impose fines or

other remedies against us. We have also incurred other costs associated with this security incident, including legal fees, investigative fees, costs of

communications with customers and credit monitoring services provided to our customers. At this point, we are unable to predict the developments in,

outcome of, and economic and other consequences of pending or future litigation or regulatory investigations related to, and other costs associated with, this

matter. We will continue to evaluate these matters based on subsequent events, new information and future circumstances.

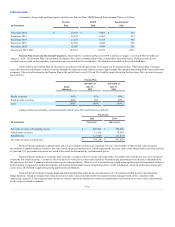

Other. We had no outstanding irrevocable letters of credit relating to purchase commitments and insurance and other liabilities at August 1, 2015.

We had approximately $3.0 million in surety bonds at August 1, 2015 relating primarily to merchandise imports and state sales tax and utility requirements.

F-37