Neiman Marcus 2014 Annual Report Download - page 22

Download and view the complete annual report

Please find page 22 of the 2014 Neiman Marcus annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

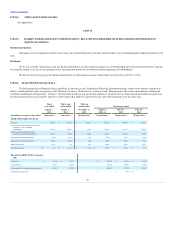

Table of Contents

Our substantial indebtedness could adversely affect our business, financial condition and results of operations and our ability to fulfill our obligations

with respect to such indebtedness.

As of August 1, 2015, the principal amount of our total indebtedness was approximately $4.7 billion, and we had unused commitments under our

senior secured asset-based revolving credit facility (as amended, the Asset-Based Revolving Credit Facility) available to us of $680.0 million, subject to a

borrowing base.

The existence and terms of our substantial indebtedness could adversely affect our business, financial condition and results of operations by:

• making it more difficult for us to satisfy our obligations with respect to our indebtedness;

• limiting our ability to incur, or guarantee, additional indebtedness or obtain additional financing to fund future working capital, capital

expenditures, acquisitions, execution of our business and growth strategies or other general corporate requirements;

• requiring a substantial portion of our cash flows to be dedicated to debt service payments instead of other purposes, thereby reducing the

amount of cash flows available for working capital, capital expenditures, acquisitions and other general corporate purposes and future growth;

• limiting our ability to pay dividends or make other distributions in respect of, or repurchase or redeem, capital stock;

• increasing our vulnerability to general adverse economic, industry and competitive conditions and government regulations;

• exposing us to the risk of increased interest rates as certain of our borrowings, including borrowings under our Senior Secured Credit Facilities

(as defined below), are at variable rates of interest;

• limiting our flexibility in planning for and reacting to changes in the industry in which we compete and our ability to take advantage of new

business opportunities;

• placing us at a disadvantage compared to other, less leveraged competitors and affecting our ability to compete;

• increasing our cost of borrowing; and

• causing our suppliers or other parties with which we maintain business relationships to experience uncertainty about our future and seek

alternative relationships with third parties or seek to alter their business relationships with us.

We may also incur substantial indebtedness in the future, subject to the restrictions contained in the indentures governing the Notes (as defined

below) and the credit agreements governing our Senior Secured Credit Facilities. If such new indebtedness is in an amount greater than our current

indebtedness levels, the related risks that we now face could intensify. However, we cannot assure you that any such additional financing will be available to

us on acceptable terms or at all. See “—Our ability to obtain adequate financing or raise capital in the future may be limited.”

We may not be able to generate sufficient cash to service all of our indebtedness and may be forced to take other actions to satisfy our obligations

under our indebtedness, which may not be successful.

Our ability to make scheduled payments on or refinance our debt obligations depends on our financial condition and results of operations, which are

subject to prevailing economic and competitive conditions and to financial, business, legislative, regulatory and other factors beyond our control. As a result,

we cannot assure you that our business will generate a level of cash flows from operating activities sufficient to permit us to make payments on our

indebtedness.

If our cash flows and capital resources are insufficient to fund our debt service obligations, we could face substantial liquidity problems and may

have to undertake alternative financing plans, such as refinancing or restructuring our indebtedness, selling our assets, reducing or delaying capital

investments or seeking to raise additional capital. Our ability to restructure or refinance our indebtedness will depend on the conditions of the capital markets

and our financial condition at such time. Any refinancing of our indebtedness could be at higher interest rates and may require us to comply with more

onerous covenants, which could further restrict our business operations. The terms of existing or future debt instruments may also restrict us from adopting

some of these alternatives.

21