Neiman Marcus 2014 Annual Report Download - page 42

Download and view the complete annual report

Please find page 42 of the 2014 Neiman Marcus annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Table of Contents

expense in fiscal year 2015 was due primarily to (i) higher asset values attributable to fair value adjustments to our assets recorded in connection with the

purchase price allocation to reflect the Acquisition and (ii) higher capital spending.

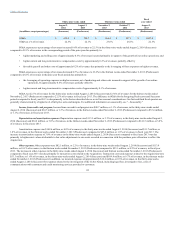

Amortization expense was $137.3 million, or 2.7% of revenues, in fiscal year 2015 compared to $148.6 million, or 4.0% of revenues, in the thirty-

nine weeks ended August 2, 2014 (Successor) and $11.7 million, or 1.0% of revenues, in the thirteen weeks ended November 2, 2013 (Predecessor). The

decrease in amortization expense of 1.3% of revenues in fiscal year 2015 compared to the thirty-nine weeks ended August 2, 2014 (Successor) was due

primarily to lower amortization charges with respect to our customer lists in fiscal year 2015. The increase in amortization expense of 1.7% of revenues in

fiscal year 2015 compared to the thirteen weeks ended November 2, 2013 (Predecessor) was due primarily to higher asset values attributable to fair value

adjustments to our assets recorded in connection with the purchase price allocation to reflect the Acquisition.

Other expenses. Other expenses in fiscal year 2015 were $39.5 million, or 0.8% of revenues, compared to $82.1 million, or 2.2% of revenues, in the

thirty-nine weeks ended August 2, 2014 (Successor) and $113.9 million, or 10.1% of revenues, in the thirteen weeks ended November 2, 2013 (Predecessor).

Other expenses include (i) costs incurred in connection with the Acquisition and the MyTheresa acquisition, (ii) expenses incurred in connection with

strategic initiatives, (iii) investigative, legal and other expenses, net of insurance recovery, incurred in connection with the Cyber-Attack discovered in

January 2014 and (iv) other expenses. We expect to incur ongoing costs related to the Cyber-Attack for the foreseeable future. Such costs are not currently

estimable but could be material to our future results of operations.

Operating earnings. We generated operating earnings of $318.0 million, or 6.2% of revenues, in fiscal year 2015 compared to operating earnings of

$8.8 million, or 0.2% of revenues, in the thirty-nine weeks ended August 2, 2014 (Successor) and $32.1 million, or 2.8% of revenues, in the thirteen weeks

ended November 2, 2013 (Predecessor). Included in operating earnings in fiscal year 2015 were:

• other expenses of $39.5 million; and

• impact of purchase accounting adjustments that increased COGS by $6.8 million related to the step-up in the carrying value of the acquired

MyTheresa inventories.

Included in operating earnings in fiscal year 2014 were:

• other expenses of $82.1 million in the thirty-nine weeks ended August 2, 2014 (Successor) and $113.9 million in the thirteen weeks ended

November 2, 2013 (Predecessor); and

• impact of purchase accounting adjustments that increased COGS by $129.6 million in the thirty-nine weeks ended August 2, 2014 (Successor)

related to the step-up in the carrying value of the inventories acquired in connection with the Acquisition.

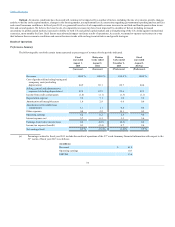

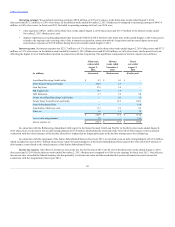

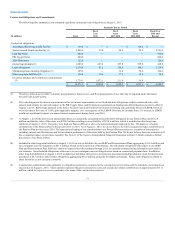

Interest expense. Net interest expense was $289.9 million, or 5.7% of revenues, in fiscal year 2015 and $232.7 million, or 6.3% of revenues, in the

thirty-nine weeks ended August 2, 2014 (Successor) and $37.3 million, or 3.3% of revenues, in the thirteen weeks ended November 2, 2013 (Predecessor).

The significant components of interest expense are as follows:

41