Neiman Marcus 2014 Annual Report Download - page 49

Download and view the complete annual report

Please find page 49 of the 2014 Neiman Marcus annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Table of Contents

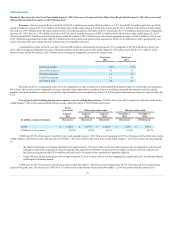

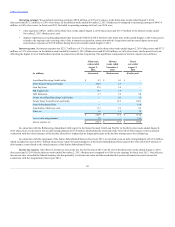

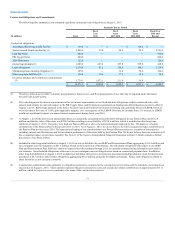

(h) Amounts represent direct expenses incurred in connection with strategic initiatives, primarily NMG One and Organizing for Growth.

(i) Amounts consist primarily of expenses incurred in connection with settlements of class action litigation claims.

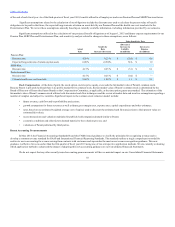

We believe changes in revenues and net earnings that have resulted from inflation or deflation have not been material during the past three fiscal

years. In recent years, we have experienced certain inflationary conditions in our cost base due primarily to changes in foreign currency exchange rates that

have reduced the purchasing power of the U.S. dollar and, to a lesser extent, to increases in selling, general and administrative expenses, particularly with

regard to employee benefits, and increases in fuel prices and costs impacted by increases in fuel prices, such as freight and transportation costs. For more

information regarding the effects of changes in foreign currency exchange rates, see Item 7A, "Quantitative and Qualitative Disclosures About Market Risk—

Foreign Currency Risk."

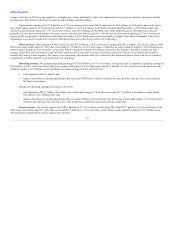

Our liquidity requirements consist principally of:

• the funding of our merchandise purchases;

• operating expense requirements;

• debt service requirements;

• capital expenditures for expansion and growth strategies, including new store construction, store remodels and upgrades of our management

information systems;

• income tax payments; and

• obligations related to our defined benefit pension plan (Pension Plan).

Our primary sources of short-term liquidity are comprised of cash on hand, availability under the Asset-Based Revolving Credit Facility and vendor

payment terms. The amounts of cash on hand and borrowings under the Asset-Based Revolving Credit Facility are influenced by a number of factors,

including revenues, working capital levels, vendor terms, the level of capital expenditures, cash requirements related to financing instruments and debt

service obligations, Pension Plan funding obligations and tax payment obligations, among others.

Our working capital requirements fluctuate during the fiscal year, increasing substantially during the first and second quarters of each fiscal year as a

result of higher seasonal levels of inventories. We have typically financed our cash requirements with available cash balances, cash flows from operations

and, if necessary, with cash provided from borrowings under the Asset-Based Revolving Credit Facility. We had $130.0 million of outstanding borrowings

under the Asset-Based Revolving Credit Facility as of August 1, 2015.

We believe that operating cash flows, cash balances, available vendor payment terms and amounts available pursuant to the Asset-Based Revolving

Credit Facility will be sufficient to fund our cash requirements through the end of fiscal year 2016, including merchandise purchases, anticipated capital

expenditure requirements, debt service requirements, income tax payments and obligations related to our Pension Plan.

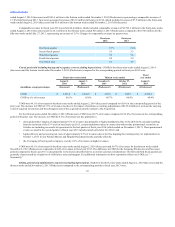

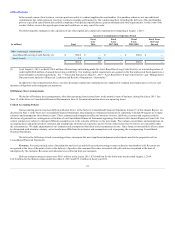

Cash and cash equivalents were $73.0 million at August 1, 2015 compared to $196.5 million at August 2, 2014, a decrease of $123.5 million. Net

cash provided by our operating activities was $228.4 million in fiscal year 2015 compared to $283.4 million in the Acquisition and thirty-nine weeks ended

August 2, 2014 (Successor) and $12.3 million in the thirteen weeks ended November 2, 2013 (Predecessor). Net cash used for our operating activities was

$99.2 million in the thirteen weeks ended November 1, 2014 (Successor) compared to net cash provided by our operating activities of $12.3 million in the

corresponding period of the prior year. The increase in net cash used for our operating activities in the thirteen weeks ended November 1, 2014 (Successor)

from the corresponding period of the prior year is due primarily to (i) a $57.0 million increase in cash interest requirements on incremental indebtedness

incurred in connection with the Acquisition and (ii) higher seasonal working capital requirements. Net cash provided by our operating activities was $327.6

million in the thirty-nine weeks ended August 1, 2015 (Successor) compared to $283.4 million in the Acquisition and thirty-nine weeks ended August 2,

2014 (Successor). The increase in cash provided by our operating activities from the Acquisition and thirty-nine weeks ended August 2, 2014 (Successor)

from the corresponding period of the prior year is due primarily to (i) non-recurring cash payments

48