Neiman Marcus 2014 Annual Report Download - page 57

Download and view the complete annual report

Please find page 57 of the 2014 Neiman Marcus annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Table of Contents

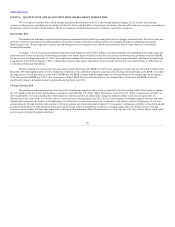

We are exposed to market risks, which include significant deterioration of the U.S. and foreign markets, changes in U.S. interest rates, foreign

currency exchange rates, including the devaluation of the U.S. dollar, and the effects of economic uncertainty that may affect the prices we pay our vendors in

the foreign countries in which we do business. We do not engage in financial transactions for trading or speculative purposes.

Interest Rate Risk

The market risk inherent in our financial instruments represents the potential loss arising from adverse changes in interest rates. We do not enter into

derivative financial instruments for trading purposes. We seek to manage exposure to adverse interest rate changes through our normal operating and

financing activities. We are exposed to interest rate risk through our borrowing activities, which are described in Note 8 of the Notes to Consolidated

Financial Statements.

At August 1, 2015, we had outstanding floating rate debt obligations of $3,028.5 million consisting primarily of outstanding borrowings under our

Senior Secured Term Loan Facility. Borrowings pursuant to the Senior Secured Term Loan Facility bear interest at floating rates, primarily based on LIBOR,

but in no event less than a floor rate of 1.00%, plus applicable margins. The interest rate on the outstanding borrowings pursuant to the Senior Secured Term

Loan Facility was 4.25% at August 1, 2015. A further description of the terms of the Senior Secured Term Loan Facility is set forth in Note 8 of the Notes to

Consolidated Financial Statements.

We have entered into interest rate cap agreements which effectively cap LIBOR at 3.00% for an aggregate notional amount of $1,400.0 million from

December 2014 through December 2016 to hedge the variability of our cash flows related to a portion of our floating rate indebtedness. If LIBOR is less than

the capped rate, we will pay interest at the lower LIBOR rate. If LIBOR is higher than the capped rate, we will pay interest at the capped rate. As of August 1,

2015, three-month LIBOR was 0.29%. As a consequence of the LIBOR floor rate described above, we estimate that a 1% increase in LIBOR would not

significantly impact our annual interest requirements during fiscal year 2016.

Foreign Currency Risk

We purchase a substantial portion of our inventory from foreign suppliers whose costs are affected by the fluctuation of their local currency against

the U.S. dollar or who price their merchandise in currencies other than the U.S. dollar. While fluctuations in the Euro-U.S. dollar exchange rate can affect us

most significantly, we source merchandise from numerous countries and thus are affected by changes in numerous other currencies and, generally, by

fluctuations in the value of the U.S. dollar relative to such currencies. During fiscal year 2015, the U.S. dollar began to strengthen against the Euro and other

international currencies. We believe a strengthening U.S. dollar may (i) create disincentives to, or changes in the pattern, practice or frequency of, travel to

and spending by foreign tourists in the regions in which we operate our retail stores and (ii) impact U.S. consumers’ willingness or ability to travel abroad and

purchase merchandise we offer for sale at lower prices from foreign retailers. In addition, we believe a strengthening of the U.S. dollar relative to foreign

currencies, most notably the Euro, may impact the retail prices of merchandise offered for sale and/or our cost of goods sold. Any of these effects could cause

our revenues or product margins to decrease.

56