Neiman Marcus 2014 Annual Report Download - page 78

Download and view the complete annual report

Please find page 78 of the 2014 Neiman Marcus annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Table of Contents

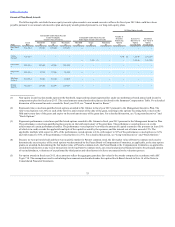

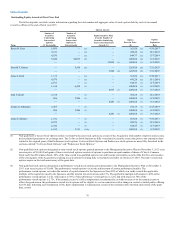

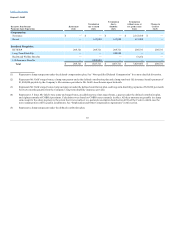

of her awards remain eligible to vest following such retirement. Each grant of performance‑vested non‑qualified stock options consists of options to

purchase an equal number of shares of Class A Common Stock and Class B Common Stock.

(4) Non‑qualified stock options designated as time‑vested stock options granted pursuant to the Management Incentive Plan on July 21, 2015 at an

exercise price of $1,205. Each grant of time‑vested stock options consists of options to purchase an equal number of shares of Class A Common

Stock and Class B Common Stock. 20% of the time‑vested non‑qualified stock options vest and become exercisable on each of the first five

anniversaries of June 15, 2015, resulting in such stock options becoming fully vested and exercisable on June 15, 2020. The time‑vested stock

options expire on the tenth anniversary of the grant date.

(5) Non‑qualified stock options designated as performance‑vested stock options granted pursuant to the Management Incentive Plan on July 21, 2015

at an exercise price of $1,205. The performance‑vested stock options vest on the achievement of certain performance hurdles. The

performance‑vested stock options vest when the amount of capital returned to the Sponsors (at least 50% of which is in cash) exceeds the applicable

multiple of the capital invested by the Sponsors, and the internal rate of return exceeds 15%. The applicable multiple with respect to 40% of the

performance‑vested stock options is 2.0x, with respect to 30% of the performance‑vested stock options is 2.25x and with respect to 30% of the

performance‑vested stock options is 2.75x. If Mr. Grimes’s employment is terminated by us without cause or by Mr. Grimes for good reason, the

performance-vested stock options will be eligible to vest in connection with a change in control or initial public offering for 30 days following such

termination. Each grant of performance‑vested non‑qualified stock options consists of options to purchase an equal number of shares of Class A

Common Stock and Class B Common Stock.

(6) In connection with Mr. Skinner’s move to Vice Chairman, the Compensation Committee cancelled certain unvested non‑qualified stock options and

adjusted the vesting schedule for certain unvested non‑qualified stock options. See “2015 Executive Officer Compensation - Company Stock

Options.”

No stock options issued to our named executive officers were exercised during fiscal year 2015. No stock subject to vesting has been awarded to any

named executive officer.

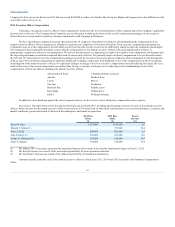

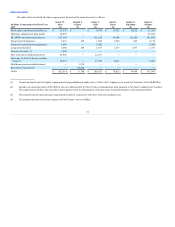

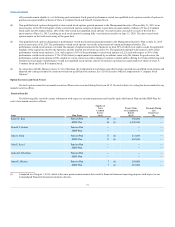

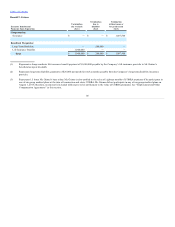

The following table sets forth certain information with respect to retirement payments and benefits under the Pension Plan and the SERP Plan for

each of our named executive officers.

Karen W. Katz

Pension Plan

25

(3)

542,000

—

SERP Plan

26

(3)

4,549,000

—

Donald T. Grimes

Pension Plan

—

—

—

SERP Plan

—

—

—

James J. Gold

Pension Plan

17

(4)

231,000

—

SERP Plan

17

(4)

655,000

—

John E. Koryl

Pension Plan

—

—

—

SERP Plan

—

—

—

Joshua G. Schulman

Pension Plan

—

—

—

SERP Plan

—

—

—

James E. Skinner

Pension Plan

7

(4)

208,000

—

SERP Plan

7

(4)

667,000

—

(1) Computed as of August 1, 2015, which is the same pension measurement date used for financial statement reporting purposes with respect to our

Consolidated Financial Statements and notes thereto.

77