Neiman Marcus 2014 Annual Report Download - page 144

Download and view the complete annual report

Please find page 144 of the 2014 Neiman Marcus annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Table of Contents

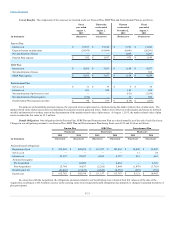

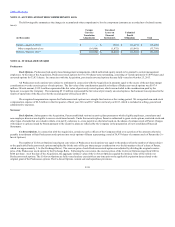

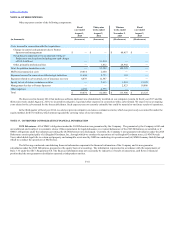

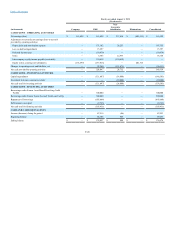

Other expenses consists of the following components:

Costs incurred in connection with the Acquisition:

Change-in-control cash payments due to Former

Sponsors and management

$ —

$ —

$ 80,457

$ —

Stock-based compensation for accelerated vesting of

Predecessor stock options (including non-cash charges

of $15.4 million)

—

51,510

—

—

Other, primarily professional fees

—

1,812

28,942

—

Total Acquisition transaction costs

—

53,322

109,399

—

MyTheresa transaction costs

19,414

2,050

—

—

Expenses incurred in connection with strategic initiatives

11,644

5,733

155

—

Expenses related to cyber-attack, net of insurance recovery

4,078

12,587

—

—

Equity in loss of Asian e-commerce retailer

—

3,613

1,523

13,125

Management fee due to Former Sponsors

—

—

2,823

10,000

Other expenses

4,338

4,775

—

—

Total

$ 39,474

$ 82,080

$ 113,900

$ 23,125

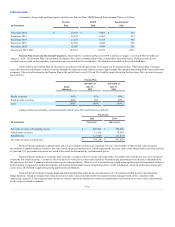

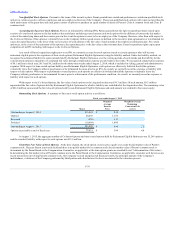

We discovered in January 2014 that malicious software (malware) was clandestinely installed on our computer systems. In fiscal year 2015 and the

thirty-nine weeks ended August 2, 2014, we incurred investigative, legal and other expenses in connection with a cyber-attack. We expect to incur ongoing

costs related to the cyber-attack for the foreseeable future. Such expenses are not currently estimable but could be material to our future results of operations.

In the third quarter of fiscal year 2014, we sold our prior investment in an Asian e-commerce retailer, which was previously accounted for under the

equity method, for $35.0 million, which amount equaled the carrying value of our investment.

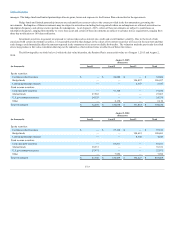

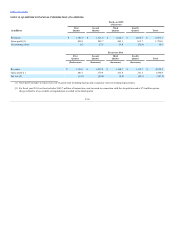

2028 Debentures. All of NMG’s obligations under the 2028 Debentures are guaranteed by the Company. The guarantee by the Company is full and

unconditional and is subject to automatic release if the requirements for legal defeasance or covenant defeasance of the 2028 Debentures are satisfied, or if

NMG’s obligations under the indenture governing the 2028 Debentures are discharged. Currently, the Company’s non-guarantor subsidiaries under the 2028

Debentures consist principally of (i) Bergdorf Goodman, Inc., through which we conduct the operations of our Bergdorf Goodman stores, (ii) NM Nevada

Trust, which holds legal title to certain real property and intangible assets used by NMG in conducting its operations and (iii) NMG Germany GmbH, through

which we conduct the operations of MyTheresa.

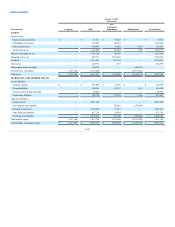

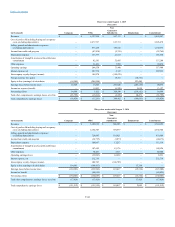

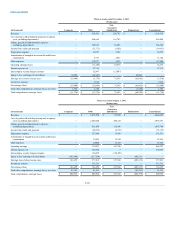

The following condensed consolidating financial information represents the financial information of the Company and its non-guarantor

subsidiaries under the 2028 Debentures, prepared on the equity basis of accounting. The information is presented in accordance with the requirements of

Rule 3-10 under the SEC’s Regulation S-X. The financial information may not necessarily be indicative of results of operations, cash flows or financial

position had the non-guarantor subsidiaries operated as independent entities.

F-41