Neiman Marcus 2014 Annual Report Download - page 151

Download and view the complete annual report

Please find page 151 of the 2014 Neiman Marcus annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.-

1

1 -

2

2 -

3

3 -

4

4 -

5

5 -

6

6 -

7

7 -

8

8 -

9

9 -

10

10 -

11

11 -

12

12 -

13

13 -

14

14 -

15

15 -

16

16 -

17

17 -

18

18 -

19

19 -

20

20 -

21

21 -

22

22 -

23

23 -

24

24 -

25

25 -

26

26 -

27

27 -

28

28 -

29

29 -

30

30 -

31

31 -

32

32 -

33

33 -

34

34 -

35

35 -

36

36 -

37

37 -

38

38 -

39

39 -

40

40 -

41

41 -

42

42 -

43

43 -

44

44 -

45

45 -

46

46 -

47

47 -

48

48 -

49

49 -

50

50 -

51

51 -

52

52 -

53

53 -

54

54 -

55

55 -

56

56 -

57

57 -

58

58 -

59

59 -

60

60 -

61

61 -

62

62 -

63

63 -

64

64 -

65

65 -

66

66 -

67

67 -

68

68 -

69

69 -

70

70 -

71

71 -

72

72 -

73

73 -

74

74 -

75

75 -

76

76 -

77

77 -

78

78 -

79

79 -

80

80 -

81

81 -

82

82 -

83

83 -

84

84 -

85

85 -

86

86 -

87

87 -

88

88 -

89

89 -

90

90 -

91

91 -

92

92 -

93

93 -

94

94 -

95

95 -

96

96 -

97

97 -

98

98 -

99

99 -

100

100 -

101

101 -

102

102 -

103

103 -

104

104 -

105

105 -

106

106 -

107

107 -

108

108 -

109

109 -

110

110 -

111

111 -

112

112 -

113

113 -

114

114 -

115

115 -

116

116 -

117

117 -

118

118 -

119

119 -

120

120 -

121

121 -

122

122 -

123

123 -

124

124 -

125

125 -

126

126 -

127

127 -

128

128 -

129

129 -

130

130 -

131

131 -

132

132 -

133

133 -

134

134 -

135

135 -

136

136 -

137

137 -

138

138 -

139

139 -

140

140 -

141

141 -

142

142 -

143

143 -

144

144 -

145

145 -

146

146 -

147

147 -

148

148 -

149

149 -

150

150 -

151

151 -

152

152 -

153

153 -

154

154 -

155

155 -

156

156 -

157

157 -

158

158 -

159

159 -

160

160 -

161

161

|

|

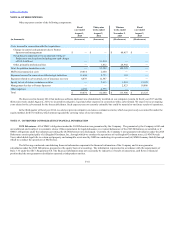

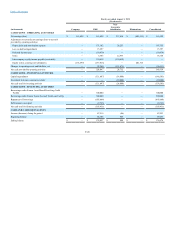

Table of Contents

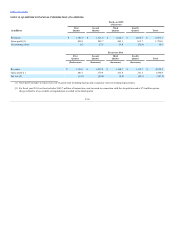

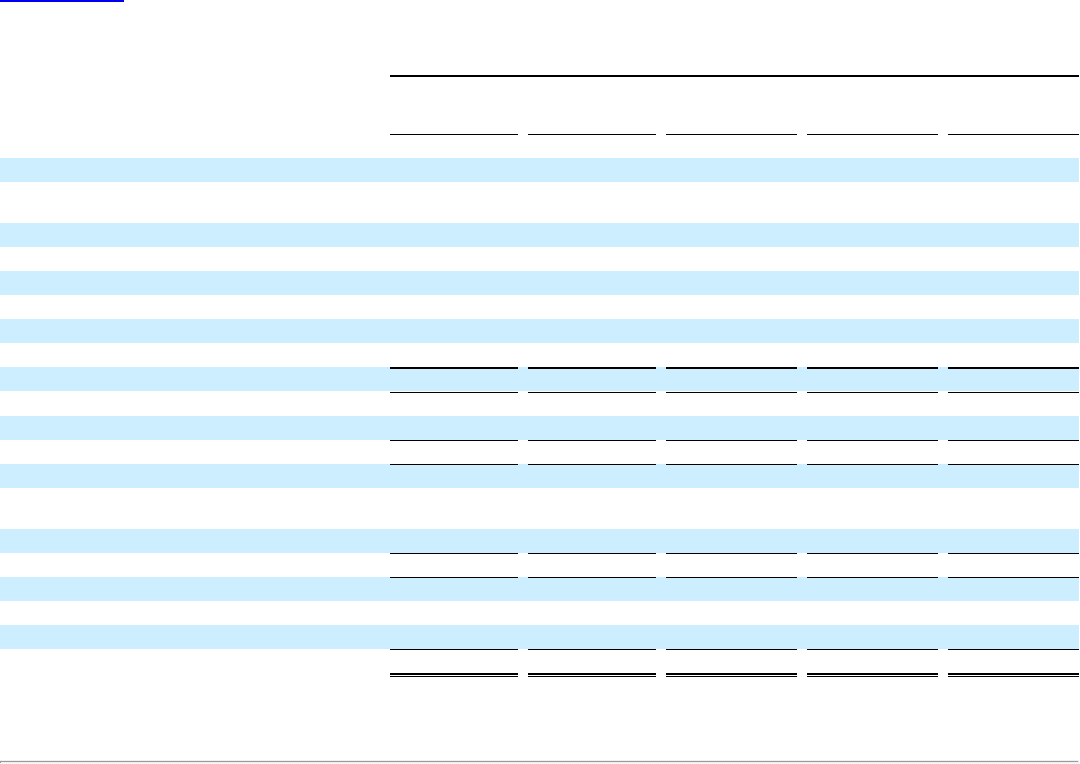

Net earnings (loss)

$ (13,098)

$ (13,098)

$ 76,143

$ (63,045)

$ (13,098)

Adjustments to reconcile net earnings (loss) to net cash

provided by operating activities:

Depreciation and amortization expense

—

42,296

6,129

—

48,425

Deferred income taxes

—

(6,326)

—

—

(6,326)

Other

—

5,068

1,457

—

6,525

Intercompany royalty income payable (receivable)

—

32,907

(32,907)

—

—

Equity in loss (earnings) of subsidiaries

13,098

(76,143)

—

63,045

—

Changes in operating assets and liabilities, net

—

21,469

(44,684)

—

(23,215)

Net cash provided by operating activities

—

6,173

6,138

—

12,311

Capital expenditures

—

(30,051)

(5,908)

—

(35,959)

Net cash used for investing activities

—

(30,051)

(5,908)

—

(35,959)

Borrowings under Former Asset-Based Revolving Credit

Facility

—

130,000

—

—

130,000

Repayment of borrowings

—

(126,904)

—

—

(126,904)

Net cash provided by financing activities

—

3,096

—

—

3,096

Increase (decrease) during the period

—

(20,782)

230

—

(20,552)

Beginning balance

—

135,827

849

—

136,676

Ending balance

$ —

$ 115,045

$ 1,079

$ —

$ 116,124

F-48