Neiman Marcus 2014 Annual Report Download - page 48

Download and view the complete annual report

Please find page 48 of the 2014 Neiman Marcus annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Table of Contents

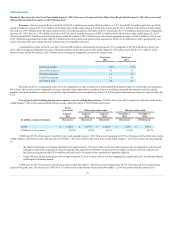

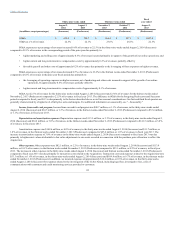

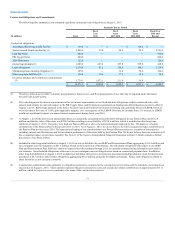

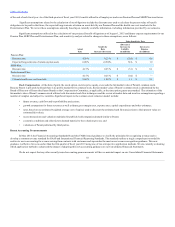

In calculating these financial measures, we make certain adjustments that are based on assumptions and estimates that may prove inaccurate. In

addition, in the future we may incur expenses similar to those eliminated in this presentation. The following table reconciles net earnings (loss) as reflected in

our Consolidated Statements of Operations prepared in accordance with GAAP to EBITDA and Adjusted EBITDA:

Net earnings (loss) $ 14.9

$ (134.1)

$ (13.1)

$ 163.7

$ 140.1

$ 31.6

Income tax expense (benefit) 13.1

(89.8)

7.9

113.7

88.3

17.6

Interest expense, net 289.9

232.7

37.3

169.0

175.2

280.5

Depreciation expense 185.6

113.3

34.2

141.5

130.1

132.4

Amortization of intangible assets and favorable lease

commitments 137.3

148.6

11.7

47.4

50.1

62.5

EBITDA $ 640.8 $ 270.8

$ 78.1

$ 635.3

$ 583.8

$ 524.7

EBITDA as a percentage of revenues 12.6%

7.3%

6.9%

13.7%

13.4%

13.1%

Amortization of inventory step-up (a) 6.8

129.6

—

—

—

—

Incremental rent expense (b) 11.0

8.5

0.8

4.0

4.5

4.3

Transaction and other costs (c) 19.4

55.4

109.4

—

—

—

Non-cash stock-based compensation 0.1

6.2

2.5

9.7

6.9

3.9

Equity in loss of Asian e-commerce retailer /

professional fees (d) —

3.6

1.5

14.2

7.7

—

Expenses related to cyber-attack (e) 4.1

12.6

—

—

—

—

Management fee due to Former Sponsors (f) —

—

2.8

10.0

10.0

10.0

Expenses incurred in connection with openings of

new stores / remodels of existing stores (g) 12.3

4.0

1.8

5.1

6.6

1.7

Expenses incurred in connection with strategic

initiatives (h) 11.6

5.7

0.2

—

—

—

Other expenses (i) 4.3

4.8

—

4.3

—

—

Adjusted EBITDA $ 710.6

$ 501.3

$ 197.2

$ 682.7

$ 619.5

$ 544.6

Adjusted EBITDA as a percentage of revenues 13.9%

13.5%

17.5%

14.7%

14.3%

13.6%

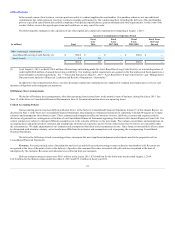

(a) The carrying values of inventories acquired in connection with the Acquisition and the acquisition of MyTheresa were stepped up to estimated

fair value as of the respective acquisition dates and amortized into cost of goods sold as the acquired inventories were sold.

(b) Rental obligations and deferred real estate credits were revalued at fair value in connection with the Acquisition. These fair value adjustments

increase post‑acquisition rent expense.

(c) Amounts relate to costs and expenses incurred in connection with the Acquisition and the acquisition of MyTheresa.

(d) Amounts relate to our equity in losses and professional fees incurred in connection with our prior non‑controlling investment in an Asian

e‑commerce retailer. See Note 16 of the Notes to Consolidated Financial Statements.

(e) For a further description of the cyber‑attack, see Item 1A, “Risk Factors—Risks Related to Our Business and Industry—A breach in information

privacy could negatively impact our operations” and Note 12 of the Notes to Consolidated Financial Statements.

(f) Amounts represent management fees paid to the Former Sponsors prior to the Acquisition.

(g) Amounts represent direct and incremental expenses incurred in connection with the openings of new stores as well as remodels to our existing

stores.

47